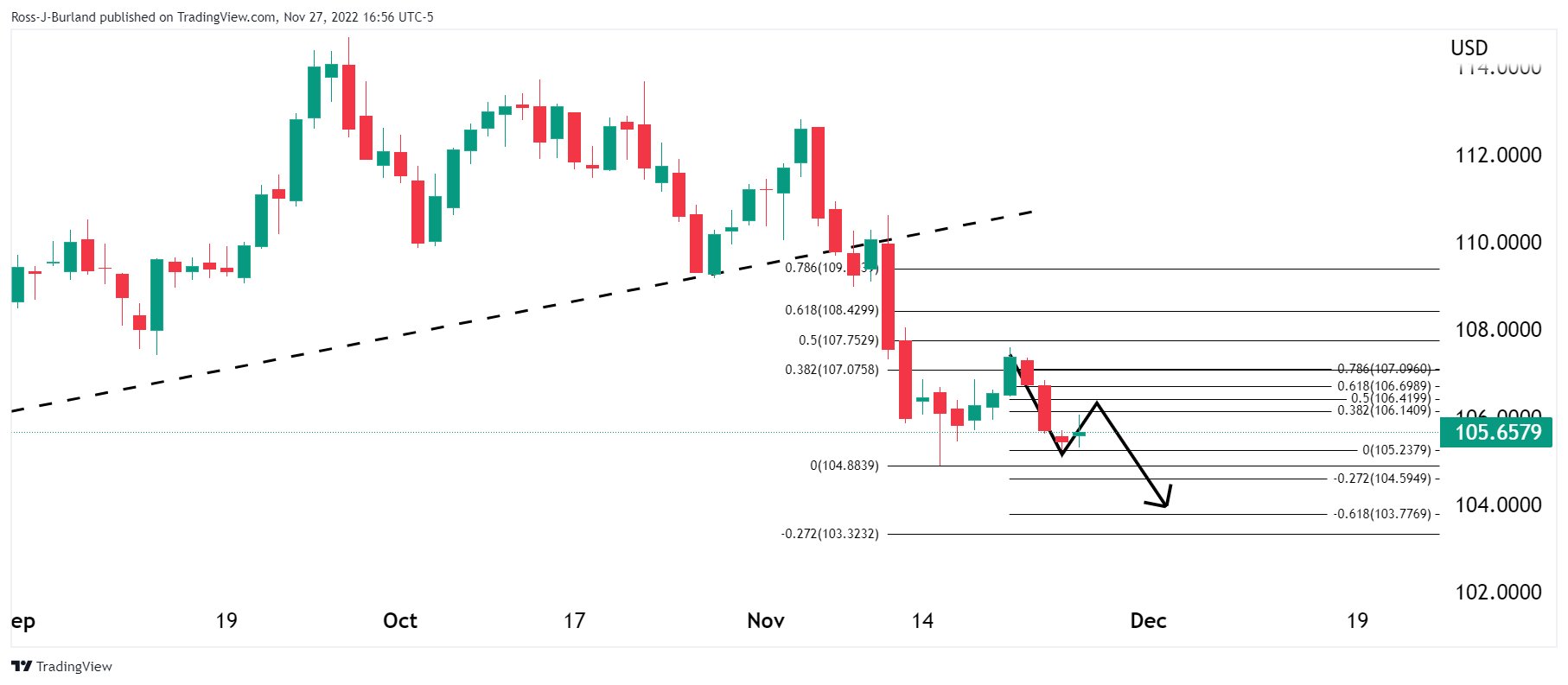

- Dollar bears are heading towards the mid range at the 104 area which awaits a drop towards 103 and 101.

- Are investors putting the cart before the horse?

The dollar is falling to test a 16 week low. The low of August 11 occurred at 104.64 and today’s reached 104.66 so far. The index has fallen from a high of 105.89 and has come under pressure from dovish remarks on Wednesday from Federal Reserve Chairman Jerome Powell.

Powell gave a speech on Wednesday in which he strongly indicated that the Fed would soften the historically high pace of interest rate hikes at its next policy meeting in December. “The time to ease the pace of rate hikes could come as soon as the December meeting,” Powell said in his remarks at the Brookings Institution, his last public appearance before the central bank enters a suspension period. of activities before their monetary policy meeting on December 13 and 14. As a result, the dollar fell, US yields fell and stocks rose. The S&P500 ended its three-day losing streak Y closed up 2.7% as the Dow officially entered a bull market.

Meanwhile, on Thursday, easing inflation supported the Fed chair’s indication that rate hikes could slow. Data has shown that in the 12 months to October, the Personal Consumption Expenditures (PCE) price index rose 6.0%, after advancing 6.3% in September, compared to the 2% target set by the fed.

In current trade, 10-year bond yields are down 1.5% to 3.5565, and 2-year bond yields, more sensitive to Fed sentiment, are down 0.6% to 4.287%. Fed funds futures forecast the Fed benchmark rate to peak at 4.91% in May, up from 3.83% today. Traders had expected a high of more than 5% before Powell’s remarks on Wednesday.

However, investors hoping for a complete turnaround may be putting the cart before the horse. Before Powell’s speech, the president of the St. Louise Federal Reserve Bank, James Bullard, warned that the stock market is underpricing the risk of a continuously aggressive Fed. Powell’s admission that “the path to inflation remains highly uncertain” leaves the possibility of a prolonged period of rate hikes on the table. In addition, the dollar tends to behave around sentiment of a US Recession. Powell said on Wednesday that there is still a chance that the economy will avoid recession, but that the chances are slim: “To the extent that we need to keep rates higher for longer, that’s going to narrow the path to a soft landing,” Powell warned. The US PMIs on Thursday were testimony to this rhetoric.

The bottom line is that “by any standard, inflation is still too high,” and “much more evidence will be needed for inflation to really come down,” according to Powell’s comments on Wednesday. For now though, despite these hawkish words, and signs that the Fed will keep raising inflation through 2023, investors don’t care for now and that is weighing on the dollar.

Technical analysis of the dollar and yields

The 2-year yield has created a head-shoulder pattern and is about to break the long-term trend line, as seen on the weekly chart and the 4-hour chart.

US dollar daily chart

Based on the analysis above, the USD is firm in a start of the week without riskso it was expected to correct to the upside before the next drop and is following a bearish trajectory below the previous uptrend.”

Previous analysis:

Update:

Price is heading for a mid-range test at the 104 zone that guards the decline towards 103 and 101.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.