- DXY alternates profit and loss around 92.00 on Tuesday.

- US 10-year yields rebound from Monday’s lows near 1.15%.

- Factory orders, Clarida statement and API report in focus.

The dollar looks for direction in the neighborhood of 92.00 tracked by the US Dollar Index (DXY) at the change of course on Tuesday.

US dollar index focuses on data

The index adds losses to the negative start of the week, although it manages to maintain the business around the key zone of 92.00 for the moment.

The recent dollar weakness comes amid another jolt in yields on the US 10-year note to just 1.12% on Monday, where some initial containment appears to have appeared. Additionally, the 2-10 year yield curve flattened by about 2 basis points on Monday (from Friday).

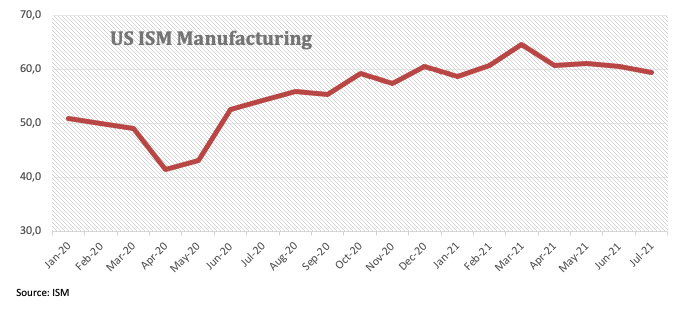

In addition, the lower than expected reading of the Manufacturing ISM for July (published on Monday) contributed to the bearish note surrounding the dollar.

In the US data space, June factory orders will be in the spotlight, seconded by the IBD / TIPP Economic Optimism Index and the API’s weekly report on US crude inventories. Additionally, Richard Clarida (permanent voter, moderate) from the FOMC will also speak today.

What to look for around USD

DXY managed to put some distance from the recent lows near 91.80, although it still finds it difficult to muster any serious upside traction above 92.00. The dollar remains under pressure after the Committee spoke to the downside of the likelihood of QE tightening in the near term despite optimistic, albeit insufficient, progress in the US economy. A clearer direction in price action around the dollar is now expected to emerge after the post-FOMC dust settles. Meanwhile, episodes of risk aversion in response to coronavirus concerns, the strong pace of the economic recovery, high inflation, and the prospects for rate hikes and rate cuts earlier than expected should remain key factors that support the dollar.

Relevant levels of the US Dollar Index

Now, the index is down 0.07% at 92.00 and faces the next support at 91.78 (July 30 monthly low), followed by 91.51 (June 23 weekly low) and then 91.33 (200-day SMA). On the upside, a break above 92.50 (20-day SMA) would open the door to 93.19 (July 21 monthly high) and finally 93.43 (March 21, 2021 high).

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.