- The 20 -year bond auction shows a weak demand, the yield jumps to 5,047%, the highest since November 2023.

- The moody’s reduction and the imminent fiscal invoice flush the fears on the fiscal credibility of the United States.

- The wide performance curve goes up while investors prepare for inflationary policies that increase the deficit.

The US treasure yields shot Wednesday after a 20 -year weed bond auction than expected, before the vote on the US budget in Congress. At the time of writing, the 10 -year reference note of the US Treasury rises 11 basic points to 4,601%.

Treasury yields jump after a weak demand for bonds and deficit fears linked to Trump’s high indebted fiscal plan

Reuters reported that a sale of 16,000 million dollars of 20 years saw a soft demand, with a yield of 5,047%, which exceeded the yield of the anterior auction of 4,810%.

The yields of the US government debt throughout the curve increased at the beginning of the week, after the news that Moody’s reduced the Credit Solvency of the United States from AAA to AA1, citing more than a decade of inaction by successive administrations and the US Congress to address the deteriorated fiscal position of the country.

Sources cited by Reuters revealed that “the interest rates environment reflects concerns about US budget deficits, with some estimates on the new fiscal bill that shows that you would add billions to the deficit.”

The yield of the USA in 20 years of the US rose to 5.125% after the auction, its highest level since November 2023.

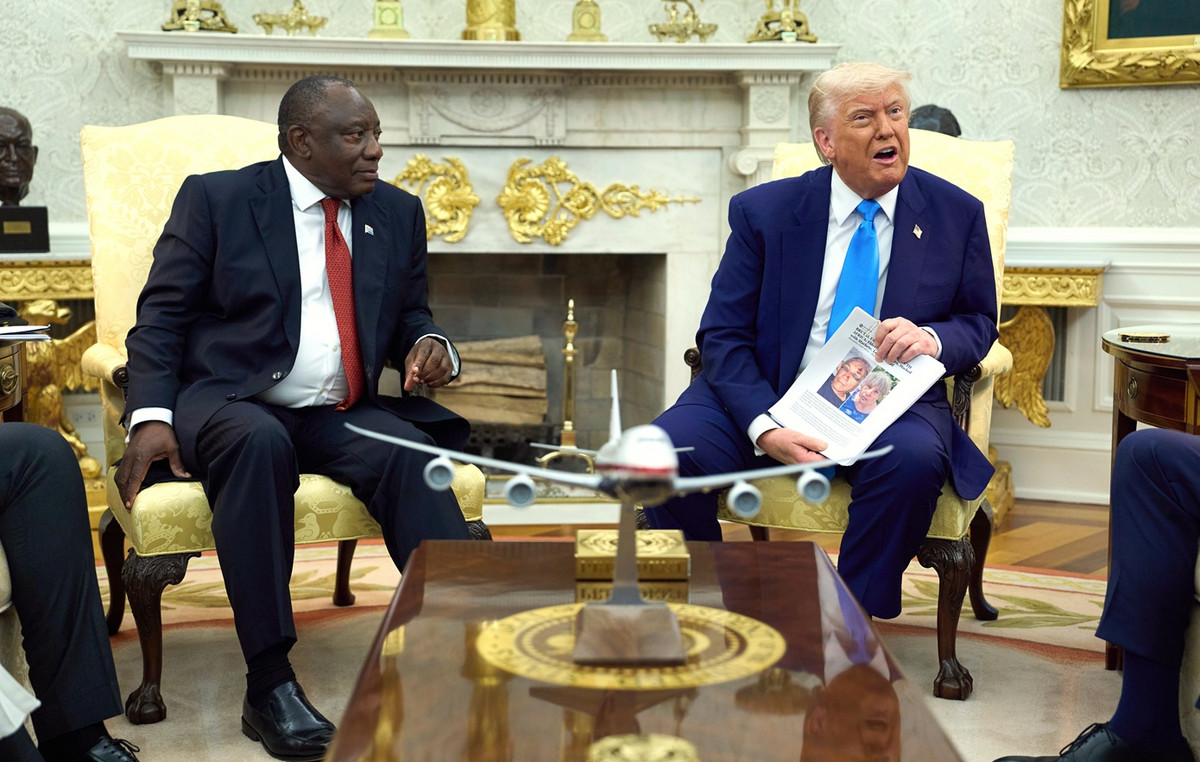

The unpredictable economic policies of US President Donald Trump caused an increase in treasure yields throughout the curve. Tariffs are considered inflation prone, and the increase in the US fiscal deficit continues to press the bond market.

The US House of Representatives will vote on Trump’s budget on Wednesday.

Meanwhile, the federal reserve position is to keep stable interest rates. Consequently, the performance of the 2 -year treasure note, the most sensitive to changes in monetary policy, rises five basic points to 4,022% at the time of writing,

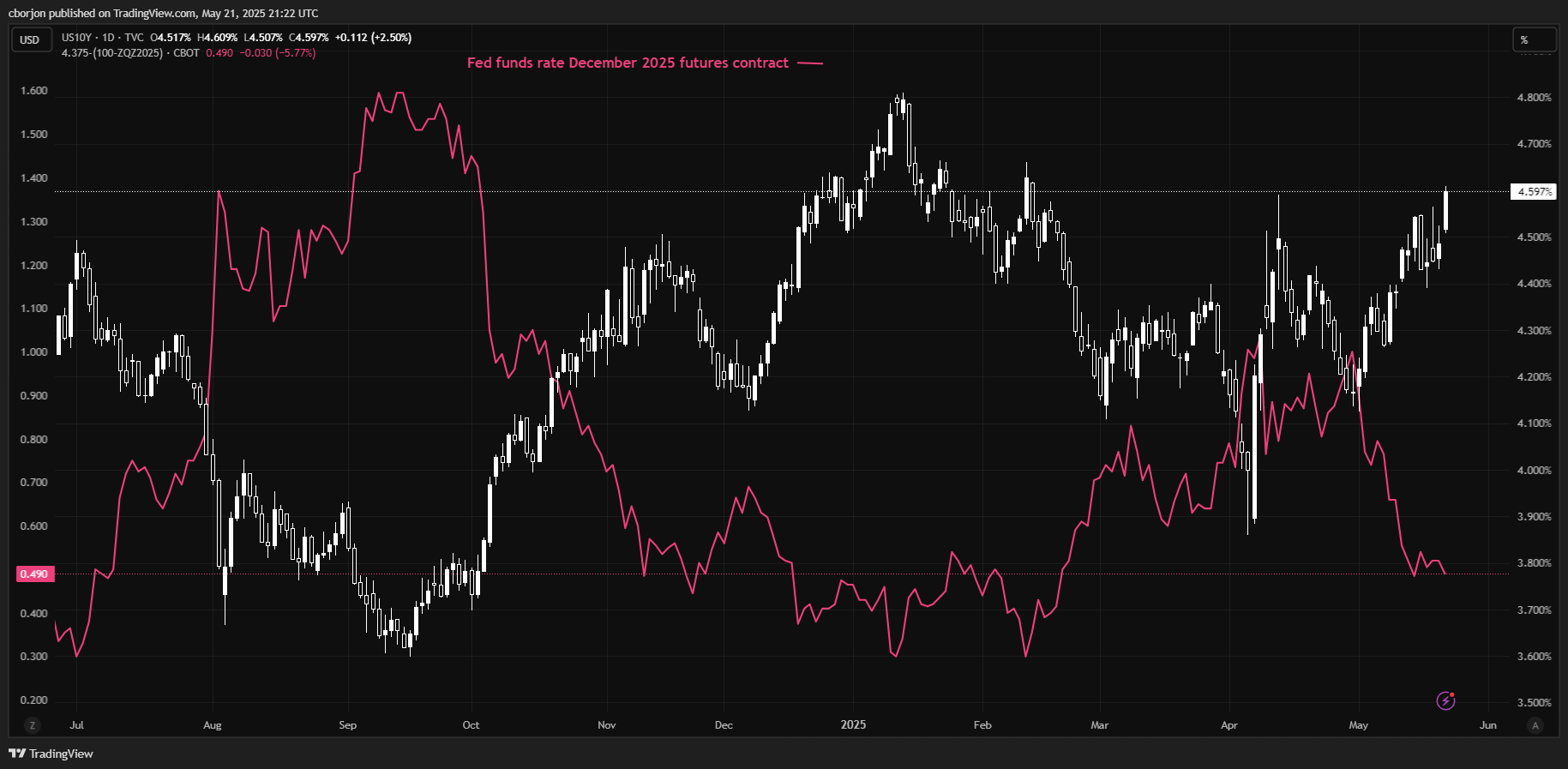

10 -year performance of the US vs. Fed fund rate relaxation expectations for December 2025

US interest rates

Financial institutions charge interest rates on loans to borrowers and pay them as interest to savers and depositors. They influence the basic types of interest, which are set by central banks based on the evolution of the economy. Normally, central banks have the mandate to guarantee the stability of prices, which in most cases means setting as an objective an underlying inflation rate around 2%.

If inflation falls below the objective, the Central Bank can cut the basic types of interest, in order to stimulate credit and boost the economy. If inflation increases substantially above 2%, the Central Bank usually rises the interest rates of basic loans to try to reduce inflation.

In general, higher interest rates contribute to reinforce the currency of a country, since they make it a more attractive place for world investors to park their money.

The highest interest rates influence the price of gold because they increase the opportunity cost of maintaining gold instead of investing in an asset that accrues interest or depositing effective in the bank.

If interest rates are high, the price of the US dollar (USD) usually rises and, as gold quotes in dollars, the price of low gold.

The federal funds rate is the type to a day that US banks lend each other. It is the official interest rate that the Federal Reserve usually sets at its FOMC meetings. It is set at a fork, for example 4.75%-5.00%, although the upper limit (in this case 5.00%) is the aforementioned figure.

Market expectations on the interest rate of the Federal Reserve funds are followed by the Fedwatch of the CME tool, which determines the behavior of many financial markets in the forecast of future monetary policy decisions of the Federal Reserve.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.