- A combination of factors gave support to USD/CAD, which hit the highest in more than a week on Monday.

- Fall in stock markets, stronger dollar and correction of oil play against the CAD.

- Low yields on Treasury bonds limit the rise in the dollar.

USD/CAD climbed to 1.2783, the highest level in a week before retreating a few pips and is trading around 1.2775, after finding support above 1.2755.

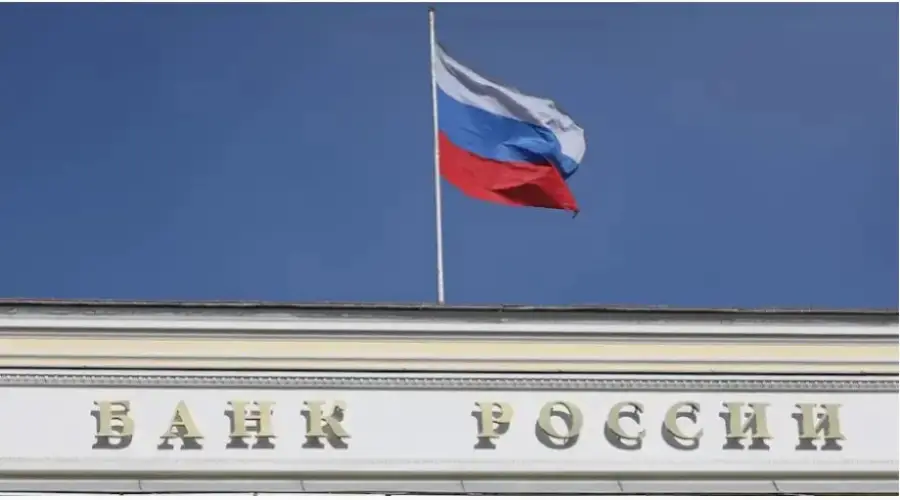

The pair rises for the third day in a row. Monday’s advance comes in the face of a new escalation in the conflict between Russia and the West over Ukraine and a retreat in oil prices from a maximum of more than seven years. It is also added that the dollar, which had been rising due to the expectation of a monetary tightening by the Federal Reserve, did so at the beginning of the week due to risk aversion.

Warnings of an armed conflict starting as soon as this week by US national security adviser Jake Sullivan added to concerns. In Europe, stock markets are down sharply and Wall Street futures are in the red.

The USD/CAD rallies are facing a key resistance zone around 1.2790, which contained the rises in the previous two weeks. Should it assert itself above 1.2800, the pair would be poised for further rally. On the contrary, if it cannot break in the short term, the positive tone will lose strength.

Without relevant data for Monday, the focus will continue to be on what happens in the equity and bond markets, mainly affected at this time by the situation in Ukraine and expectations about the Fed.

Technical levels

Source: Fx Street

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.