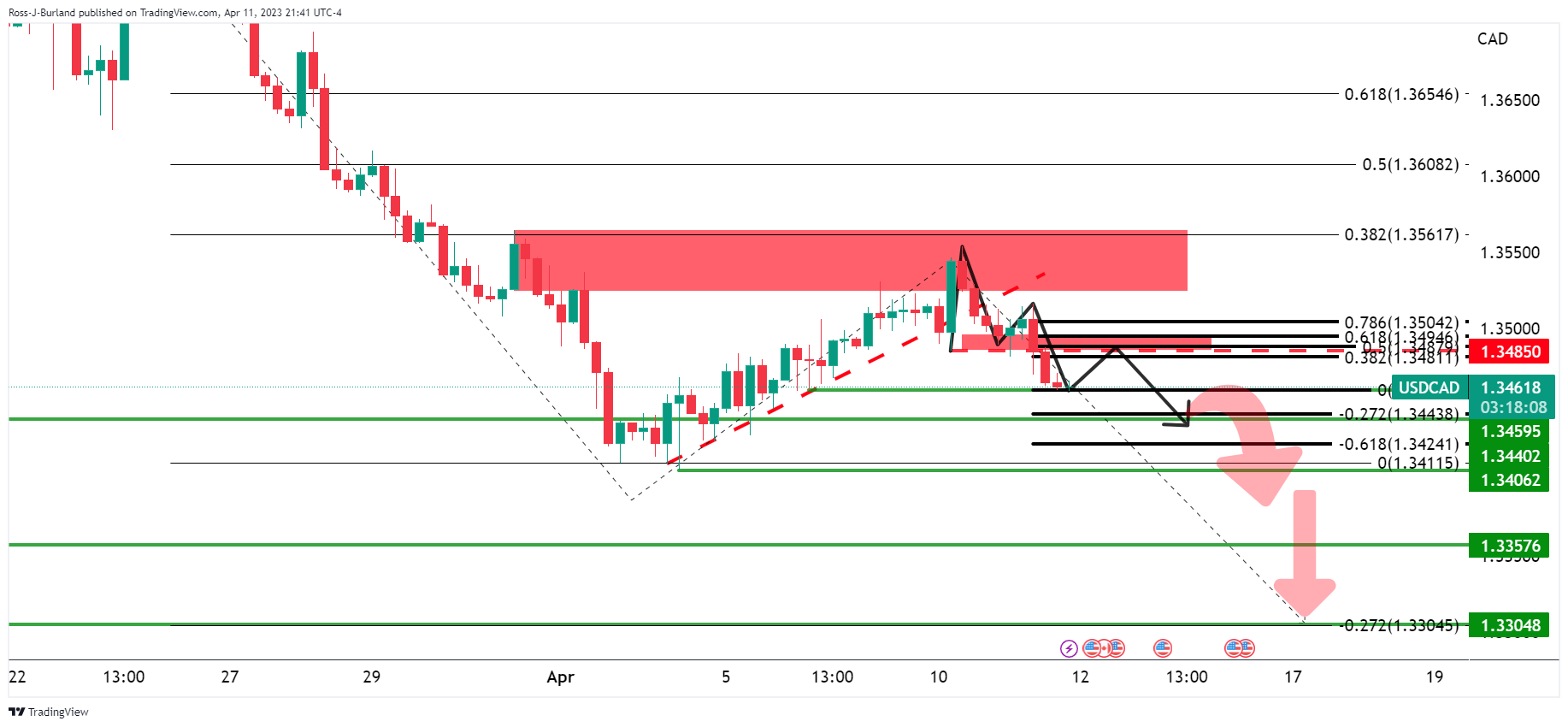

- USD/CAD bears lurk below the 38.2% Fibonacci retracement zone.

- The bears look at the target area of 1.3400.

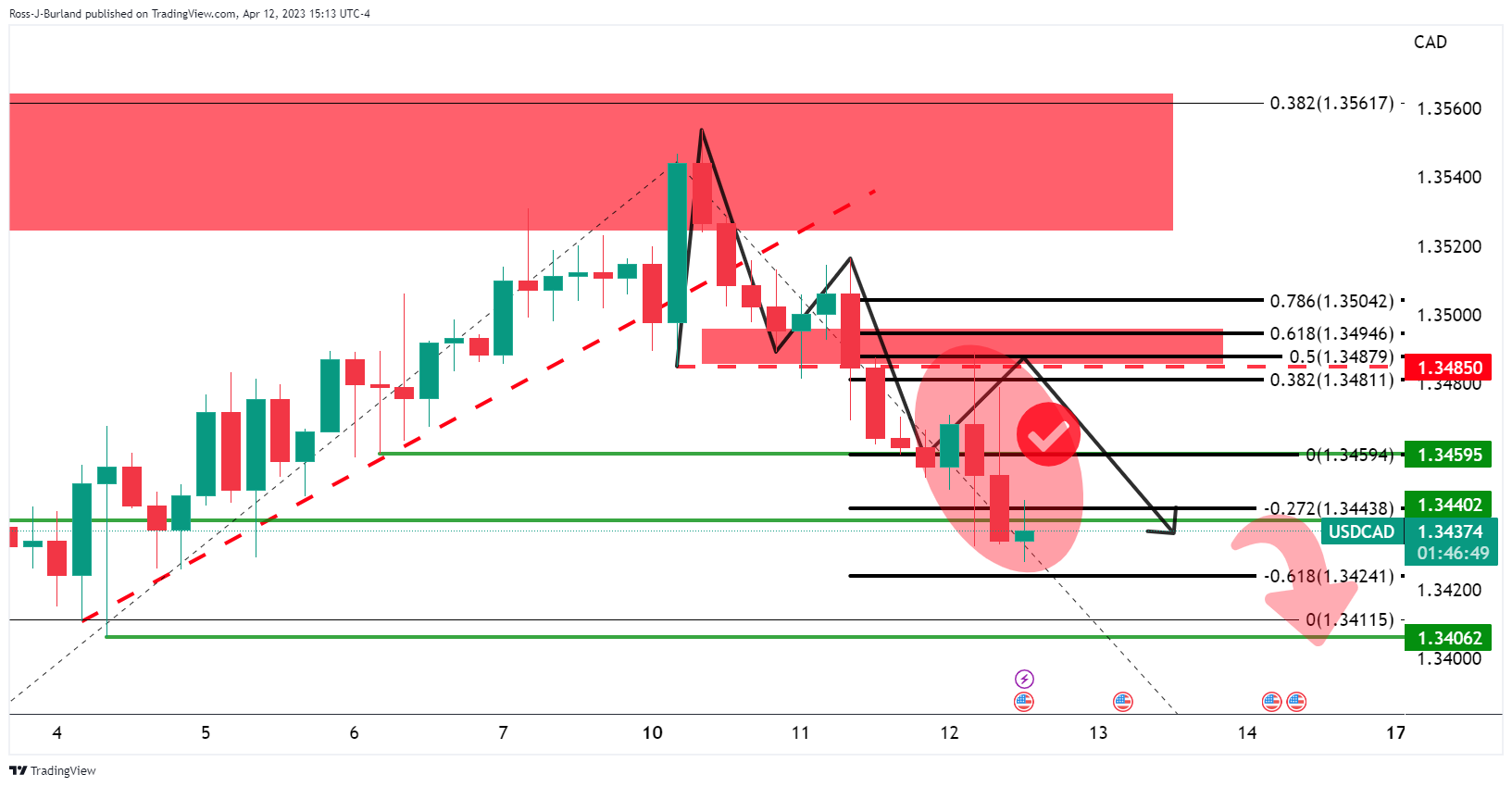

Based on the above USD/CAD analysis, USD/CAD Price Analysis: The Bears They are in control and aim for a breaking off of the minimum daily, the price fell accordingly and the bears are in the clear for a run to test 1.3400.

USD/CAD Prior Analysis

It was argued that “the bears will stay the course and break below the recent lows for a bearish extension.”

Moving down to the 4-hour chart, it stated that “price was finding resistance very close to the 38.2% Fibonacci level…breaking the 4-hour structure to the downside, as illustrated below”:

Price is on the back of the previous 4-hour uptrend/correction, and the M formation can be considered a topping pattern. The neckline of the pattern could act as resistance on a pullback and lead to a further lower low with a target of 1.3440-50″.

It was also argued that a break below 1.3440 opened up the risk of testing previous lows of 1.3400 and bearish extensions based on the weekly chart, as illustrated at the beginning of the above downward analysis.

USD/CAD update, live charts

The price has approached 1.3400, reaching a low of 1.3428 so far for the day. However, it is likely that we will see consolidation at this juncture.

1 hour chart

On the hourly chart, we can see that the price is being rejected at the previous support again. A 38.2% Fibonacci retracement lines up with previous support that would be expected to act as resistance on a break, while bears commit behind the downtrend. This in turn could lead to further momentum to the downside and the 1.3400 target zone.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.