- The dollar under pressure, raw materials up.

- USD/CAD bears point to 1.3320 for the next few sessions and lower for the next few days.

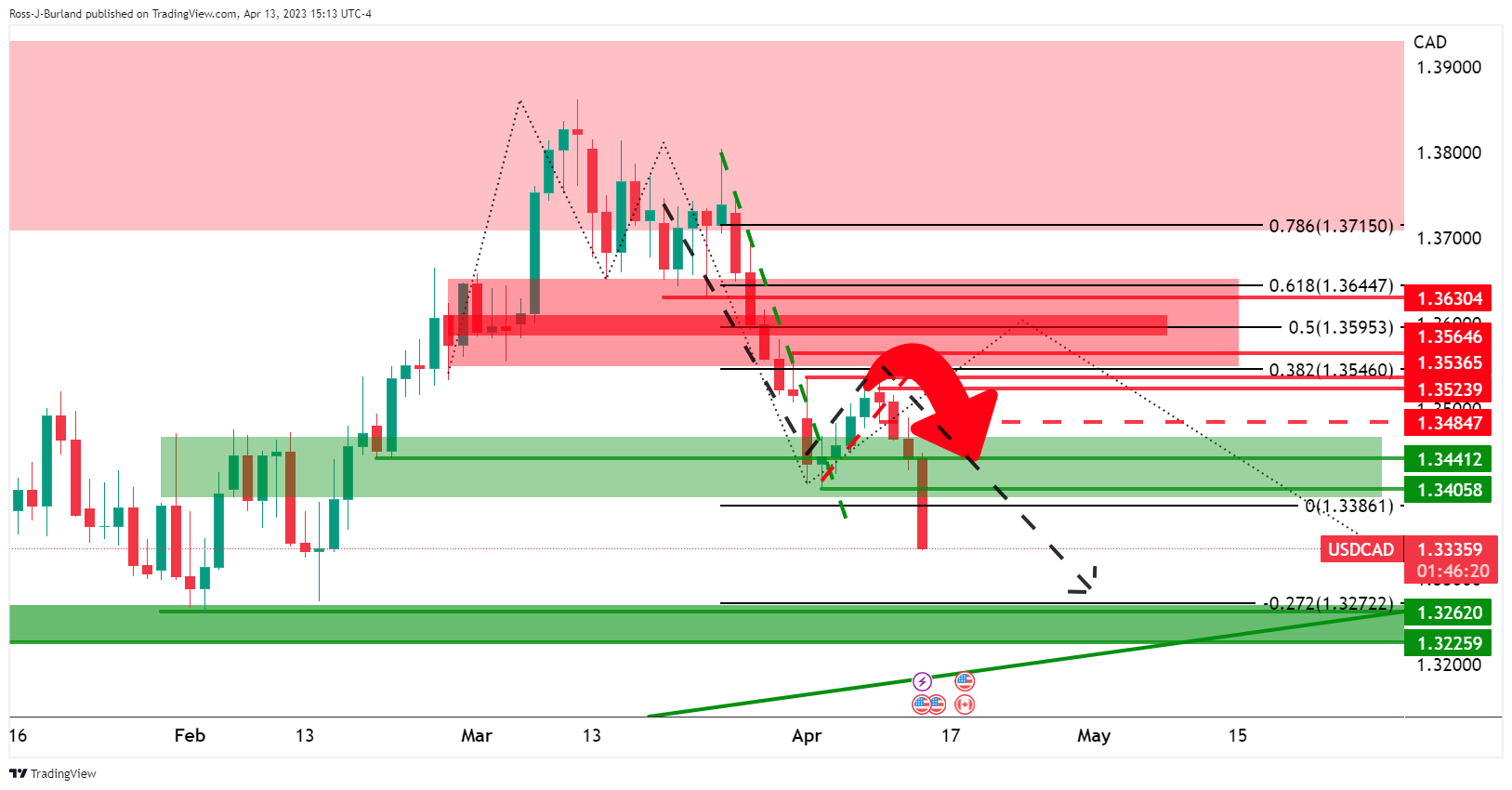

In the above analysis, USD/CAD Price Analysis: The Bears They are in the market and are watching the 1.3400 level, which reached a bearish bias, noted that on the hourly chart, ”we can see that the price is being rejected at the old support again. A 38.2% retracement of the Fibonacci level aligns with previous support that would be expected to act as resistance on a retest, as bears commit to the front end of the downtrend. This, in turn, could lead to further momentum to the downside and the 1.3450 target zone.”

USD/CAD Prior Analysis

USD/CAD 1 hour chart

USD/CAD, live updates

As illustrated, the price fell at the 38.2% Fibonacci retracement target.

Meanwhile, the US dollar came under more pressure on Thursday and markets have taken the opportunity to go long on commodities, as the following CRB chart shows:

Thus, the Canadian dollar has found support, sending USD/CAD falling like a stone and in line with previous analysis:

Before:

After:

The forecasts point to 1.3270 in the next few days if it breaks 1.3320:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.

.jpg)