- The USD/CAD is under pressure around 1,3835 in the first Asian session on Tuesday.

- The concerns about the independence of the Fed and the economic slowdown of the US drags the US dollar down.

- The lowest prices of crude oil could weigh on the CAD and limit the fall of the torque.

The USD/CAD torque loses land about 1,3835 during the first Asian session on Tuesday. The US dollar (USD) weakens against the Canadian dollar (CAD) amid fears of a deceleration in the US and concerns about the independence of the Federal Reserve (Fed).

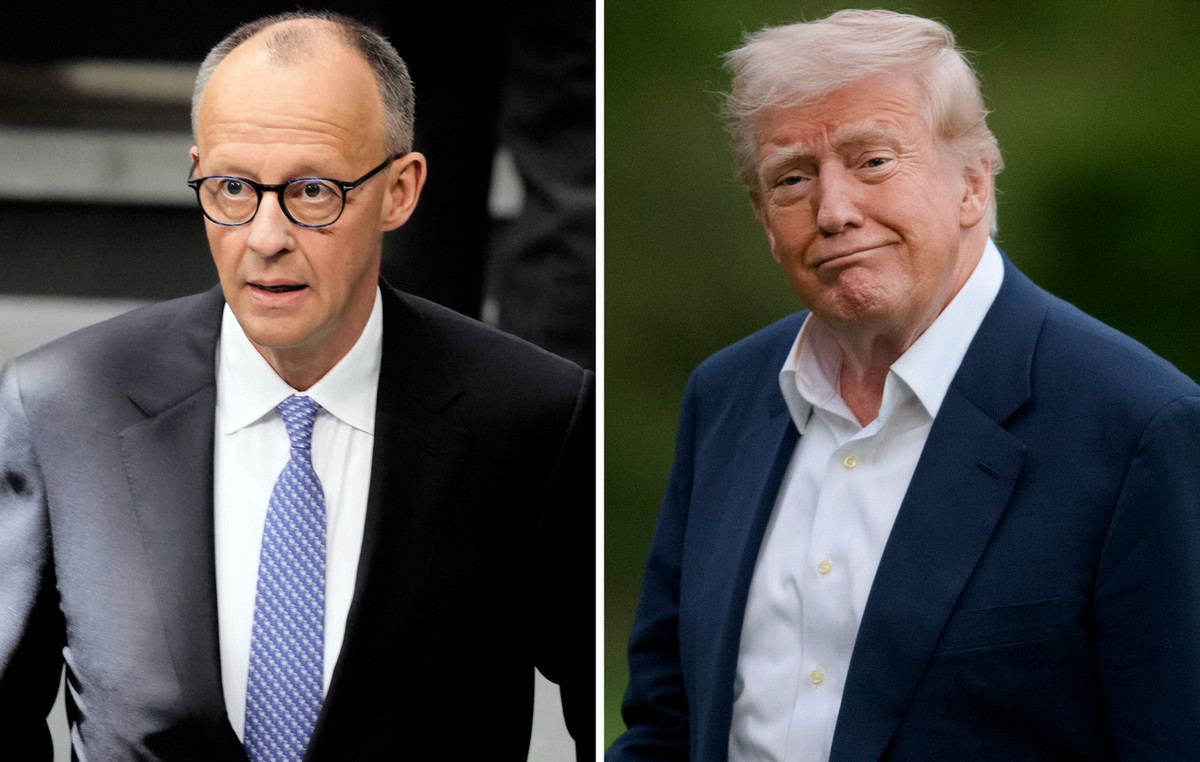

The Economic Advisor of the White House, Kevin Hassett, said Friday that US president Donald Trump is considering whether he can say goodbye to the president of the Fed, Jerome Powell. Trump pointed out in a social truth publication that the economy would slower unless Powell lowered interest rates immediately. The dollar faces some sale pressure, reaching a minimum of three years while operators raise questions about the independence of the Fed.

In addition, lack of progress in global trade affects investor confidence. Commercial tensions seemed to increase after China warned other nations that did not reach any agreement with the US to harm Beijing. “If the uncertainty continues for a prolonged period of time – that is, several quarters – I think that becomes more challenging for corporate profits and decision making, and we have seen some of that in the profit season until now,” said Robert Haworth, senior investment strategist in US Bank.

Meanwhile, a fall in crude oil prices by signs of progress in conversations between the US and Iran could undermine the CAD linked to raw materials. It is worth noting that Canada is the largest oil exporter to the US, and the lowest prices of crude oil tend to have a negative impact on the value of the CAD.

Canadian dollar faqs

The key factors that determine the contribution of the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BOC), the price of oil, the main export product of Canada, the health of its economy, inflation and commercial balance, which is the difference between the value of Canadian exports and that of its imports. Other factors are market confidence, that is, if investors bet on riskier assets (Risk-on) or seek safe assets (Risk-Off), being the positive risk-on CAD. As its largest commercial partner, the health of the US economy is also a key factor that influences the Canadian dollar.

The Canada Bank (BOC) exerts a significant influence on the Canadian dollar by setting the level of interest rates that banks can provide with each other. This influences the level of interest rates for everyone. The main objective of the BOC is to maintain inflation between 1% and 3% by adjusting interest rates to the loss. Relatively high interest rates are usually positive for CAD. The Bank of Canada can also use quantitative relaxation and hardening to influence credit conditions, being the first refusal for CAD and the second positive for CAD.

The price of oil is a key factor that influences the value of the Canadian dollar. Oil is the largest export in Canada, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD also rises, since the aggregate demand of the currency increases. The opposite occurs if the price of oil drops. The highest prices of oil also tend to give rise to a greater probability of a positive commercial balance, which also supports the CAD.

Although traditionally it has always been considered that inflation is a negative factor for a currency, since it reduces the value of money, the opposite has actually happened in modern times, with the relaxation of cross -border capital controls. Higher inflation usually leads to central banks to raise interest rates, which attracts more capital of world investors who are looking for a lucrative place to save their money. This increases the demand for the local currency, which in the case of Canada is the Canadian dollar.

The published macroeconomic data measure the health of the economy and can have an impact on the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the CAD direction. A strong economy is good for the Canadian dollar. Not only attracts more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.