- USD/CAD falls as the Dollar weakens following a late return by Kamala Harris in the safe Republican state of Iowa.

- A Harris victory would be negative for the USD, while a Trump victory would strengthen the Dollar, analysts say.

- The Canadian dollar is under a dark cloud of fundamentals, including a weak economy and falling oil prices.

USD/CAD is trading down around three tenths of a percentage point at 1.3860 on the day of the US presidential election. This comes as the US Dollar (USD) weakens after a late rally in the polls for Democratic candidate Kamala Harris, putting the election at a critical point. Last week, former President Donald Trump was ahead, albeit by a small margin.

Previous expectation that Trump would win helped push USD/CAD to a new year’s high of 1.3959 on November 1, however, Harris’ late appearance in the usually safe Republican state of Iowa – according to the reputable and accurate poll by Ann Selzer – has led to a sell-off in the USD and the CAD pair on Monday and Tuesday.

USD/CAD Daily Chart

Markets predict that a Harris victory will be negative for the US Dollar, while a Donald Trump victory will have the opposite effect. Trump’s threats to impose tariffs on foreign imports and his inflationary tax cuts are the two main reasons; under Harris there would be no risk of tariffs.

The prediction model from highly rated election website 538.com shows a 50% chance of Vice President Harris winning, while former President Donald Trump has a 49% chance of victory. The model gives a 1% probability that there will be no overall winner.

Election uncertainty combined with the proximity of the Federal Reserve (Fed) meeting on November 6-7 is putting more pressure on USD/CAD. Some analysts speculate that the Fed could choose to make an interest rate cut of 50 basis points (bp) (0.50%) simply to calm markets, if it is not clear who has won the election.

“If markets go haywire, the FOMC could opt for a 50bp cut as a circuit breaker,” says Philip Marey, senior US strategist at Rabobank.

However, his views are not supported by market-based Fed policy indicators, with swap rates showing zero chance of a 50bp cut but about a 95% chance of a 25bp cut instead. , and a 5% probability of no cut, according to the CME FedWatch tool.

Nor does the major miss in October’s US Nonfarm Payrolls (NFP) report, which showed just 12,000 new employees for the month, compared to 223,000 in September and well below expectations of 113,000, increase the chances of a 50 bp cut, according to some analysts. The weak employment gains were attributed to the temporary effect of hurricanes Helene and Milton.

“The distorted October payrolls figure probably won’t change the outlook for the Fed, which we expect to cut by 25 bps next week,” said Joe Maher, assistant economist at Capital Economics in a note on Friday.

Operating under a cloud

Meanwhile, the Canadian Dollar continues to trade under a cloud of negative fundamentals that may limit the decline of USD/CAD.

The Bank of Canada (BoC) has been one of the most aggressive central banks when it comes to interest rate cuts this year, having reduced the bank’s cash rate from 5.00% in May 2024 to 3.75% currently . This includes a 50 bp (0.50%) cut in October. Lower interest rates are typically negative for a currency as they reduce foreign capital inflows.

Markets are also betting that the BoC could cut another 50 bps at its December meeting due to weak overall fundamentals, particularly if employment data continues to show a decline.

“We think Friday’s Canadian jobs report should tell a familiar story: that the labor market has continued to weaken in October amid slowing hiring demand,” says Nathan Janzen, assistant chief economist at RBC in a recent note.

Another source of weakness for the CAD is the sharp sell-off in crude oil, which is just bouncing from $60 per barrel (WTI Crude) and entering the $70 region. Oil is Canada’s largest export, so oil prices can impact gross demand for its currency.

Green shoots through the ice

It’s not all doom and gloom, however, and there are signs of green shoots in the Canadian economy that the most optimistic argue could lead the BoC to relax its stance on future cuts.

More recently, the S&P Global Canada Manufacturing PMI rose to 51.1 in October from 50.4 in the previous month, “the second consecutive expansion in Canadian manufacturing activity after 17 straight months of contractions,” according to Trading Economics.

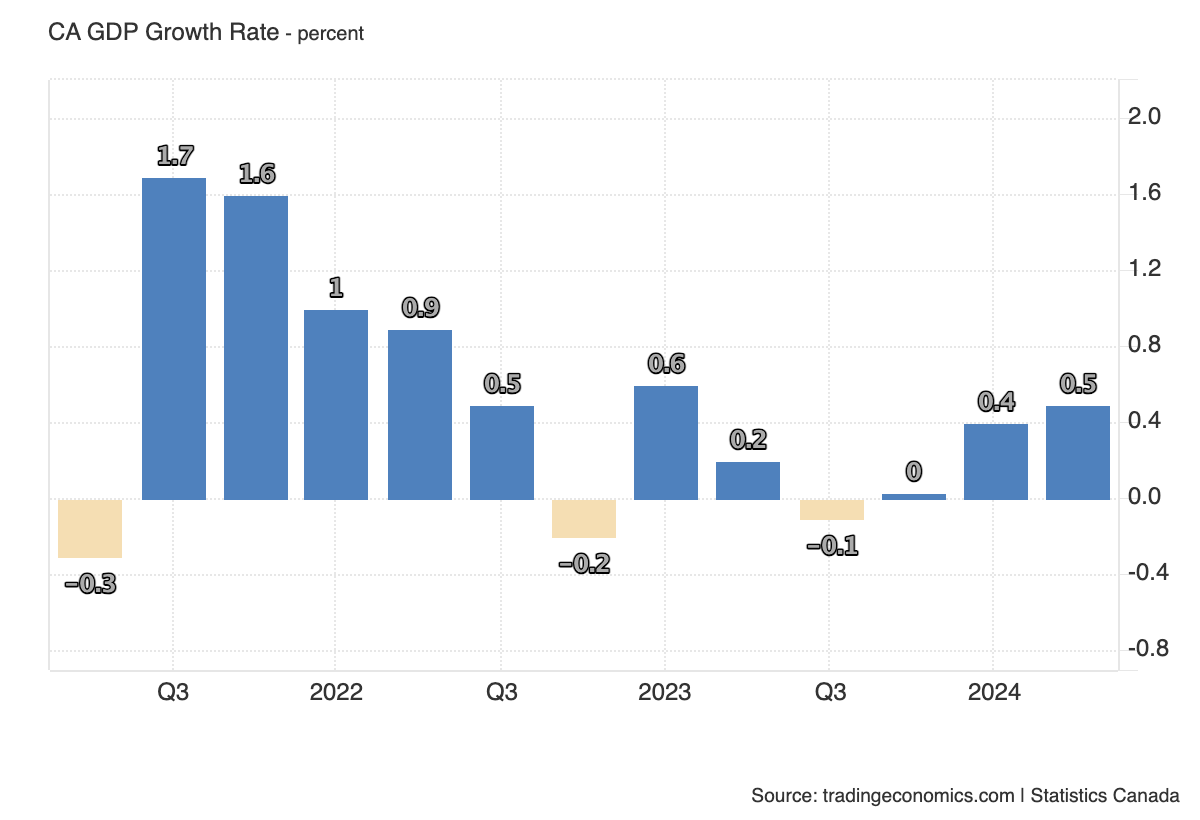

Additionally, Canadian GDP appears to have risen from its lowest point in late 2023, when Canada nearly fell into recession. In the second quarter of 2024, the Canadian economy grew by 0.5% compared to the previous quarter, up from 0.4% in the first quarter.

That said, not all analysts are optimistic about the economy’s prospects. The National Bank of Canada forecasts even more weakness for the Canadian dollar as GDP slows due to a marked decline in Canadian population growth.

“Under the latest targets, population growth is projected to decline for two consecutive years, something unprecedented in modern history. If this unprecedented change is implemented quickly, it will likely slow GDP growth in the coming quarters,” it says the strategist of the National Bank, Stéfane Marion.

Furthermore, lower GDP growth compared to the US will likely lead to a divergence in monetary policy between the two nations. While the Fed could take a more cautious approach to cutting interest rates, the BoC could be forced to continue cutting them. Such a scenario would push USD/CAD higher, with Marion revising his target for the pair from 1.41 in November 2024 to 1.45.

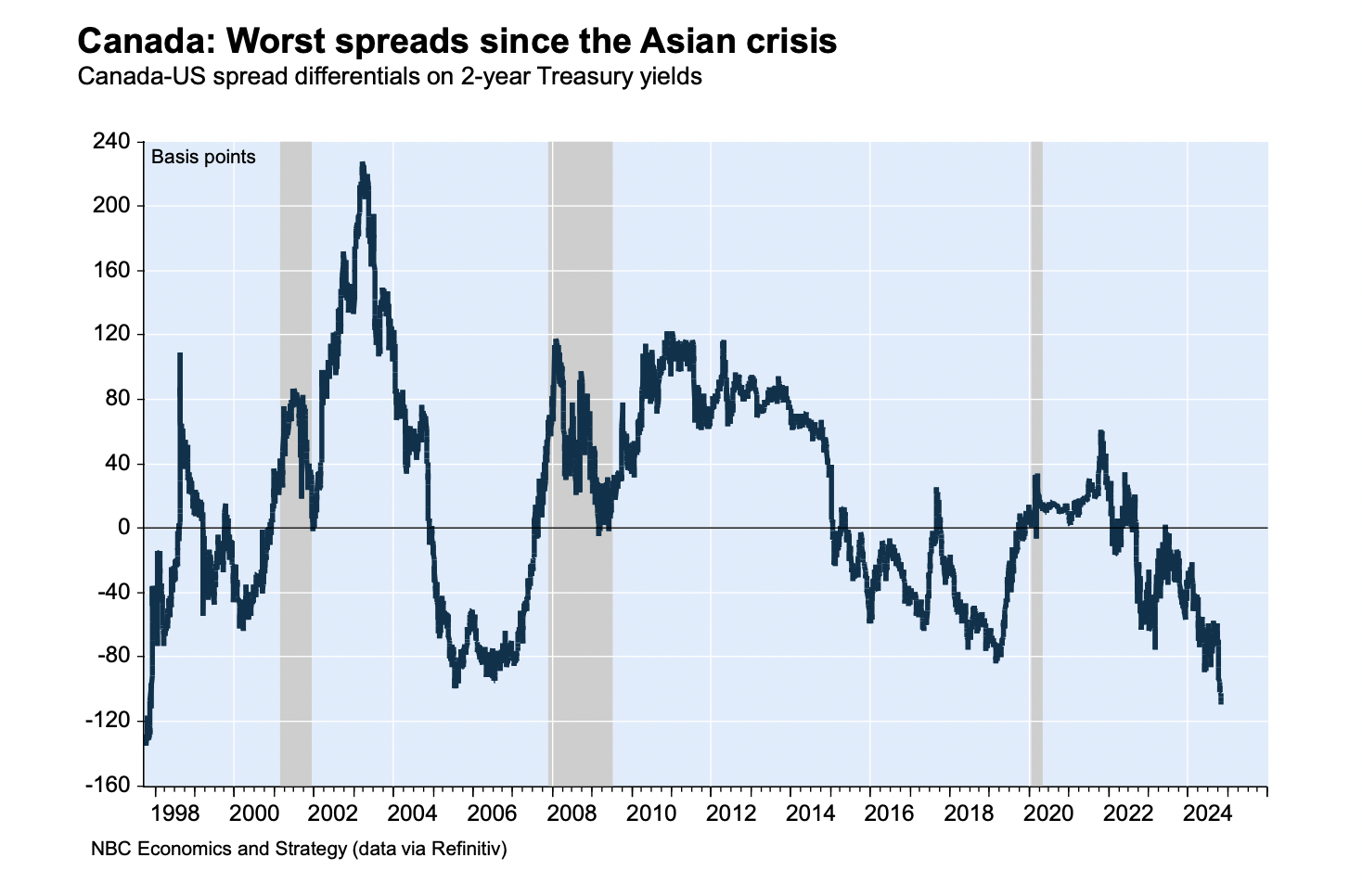

Swap spreads between US and Canadian government bonds, often seen as a proxy for the exchange rate, are already at a low level not seen since the Asian financial crisis in the 1990s, says the strategist.

“While the US economy operates in a state of excess demand, Canada is grappling with excess capacity,” Marion notes. “As today’s chart shows, this unusual development supports a significant divergence in monetary policy, now reflected in the widest spreads in 2-year Treasury yields between Canada and the US since the 1997-98 Asian crisis. , a key factor of the exchange rate.”

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.