- USD / CAD gains strong positive traction and recovers to week-long highs on Thursday.

- Bearish market sentiment benefits the USD as a safe haven and supports the pair’s upward move.

- A sharp drop in crude oil prices weighs on the CAD and provides additional momentum.

The pair USD / CAD continues to move higher at the start of the American session on Thursday and has soared to new one-week highs, around the 1.3240 region.

A combination of support factors triggered an aggressive short-hedging move on Thursday and helped the USD / CAD pair to move away from the more than one-month lows around the 1.3100 level reached earlier this week.

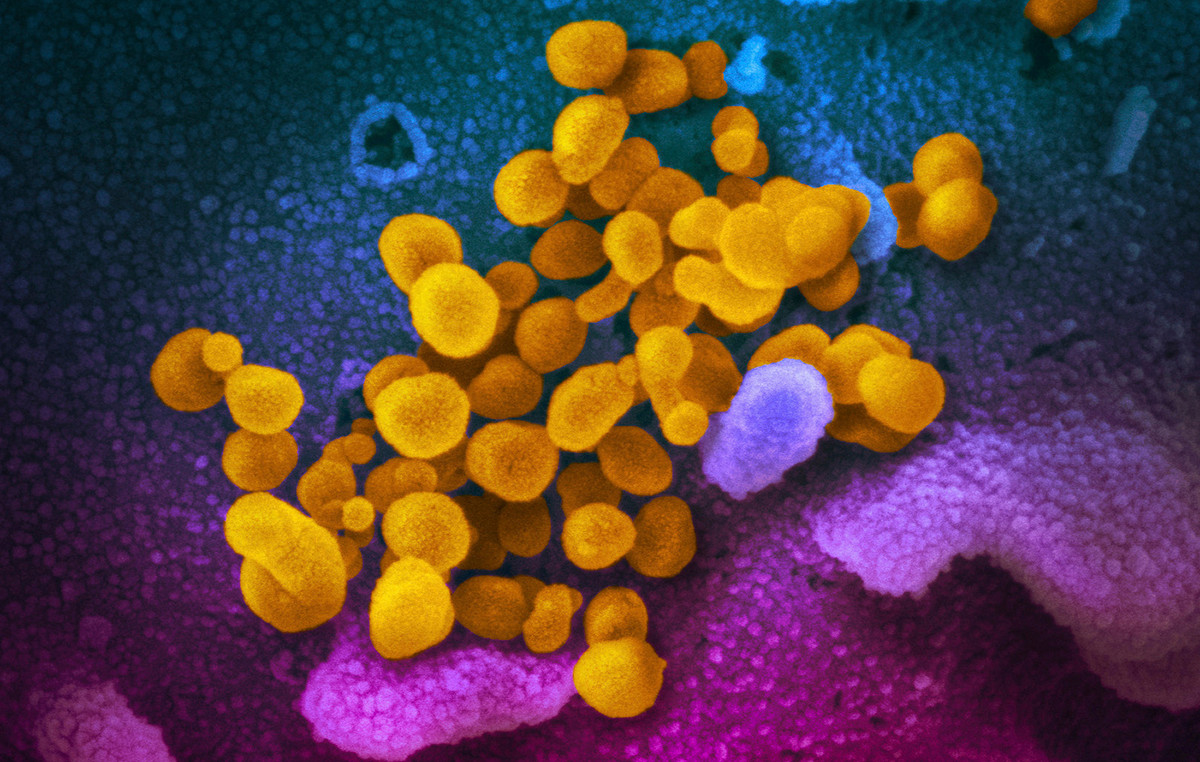

In the context of a rapid rise in new coronavirus cases, stagnation of the next round of US fiscal stimulus measures it has taken a toll on global risk sentiment. This, in turn, has benefited the safe-haven US dollar.

USD bulls do not appear to be affected by the disappointing release of the Empire State Manufacturing Index and initial weekly jobless claims, instead following the signs of the optimistic release of the Philadelphia Fed Manufacturing Index.

On the other hand, a sharp drop in crude oil prices, now falling more than 3.5% on the day, has weighed on the Canadian dollar, a currency linked to commodity prices, providing an additional boost to the USD / CAD pair.

The strong positive intraday movement has executed some short-term stop orders located near the horizontal level of 1.3165. A subsequent move above the round 1.3200 level has further contributed to the latest sudden upward move for the last hour or so.

New news about the US fiscal stimulus measures will influence USD price dynamics and generate some trading opportunities. So it remains to be seen if the USD / CAD pair can capitalize on the move or if it meets some new resistance at higher levels.

Credits: Forex Street

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.