- USD/CAD is up 0.05% to 1.3551, buoyed by investor concerns over the shadow bank crisis and China’s real estate crisis.

- US retail sales beat expectations, supporting the Fed’s stance to maintain a tight monetary policy.

- Canadian producer prices for July rebounded with a 0.4% rise, led by rebounds in oil and lumber prices.

He USD/CAD is preparing to end the week higher, with gains of 0.84%, extending its recovery to five consecutive days, but still unable to conquer 1.3600. Risk aversion continues to weigh on global stocks, prompting flows into safe-haven assets. Hence, USD/CAD is almost flat, trading at 1.3545.

Evergrande Bankruptcy and Economic Downturn in China Support Dollar as Canadian Producer Prices Show Recovery

The pair extended its gains on risk aversion as investors weighed in on China’s economic woes. The latest data revealed that the second largest economy is deteriorating. At the same time, the shadow banking crisis and real estate turmoil intensified after news broke Thursday that Evergrande filed for Chapter 15 bankruptcy in New York.

The US economic agenda was light, but the latest data showed that retail sales are pushing above estimates and a robust labor market justifies the need for the Federal Reserve (Fed) to keep monetary policy at restrictive levels. The minutes of the last monetary policy meeting emphasized the Fed’s commitment to drive inflation towards its 2% target, although some officials began to appear cautious ahead of the next meetings.

Meanwhile, the Canadian economic calendar revealed that July producer prices rose 0.4%, surpassing June’s -0.6% drop, supported by oil and lumber prices. Commodity prices rose 3.5% in July but are still down 11.1% for the year.

USD/CAD held higher but a late rally in oil prices turned it negative. The Dollar Index (DXY), an indicator of the value of the USD against a basket of six currencies, hovered around two-month highs, but fell back to 103,389, almost sideways. US Treasury yields pared some of their losses, with the 10-year US Treasury yield yielding 4.239%, down four basis points.

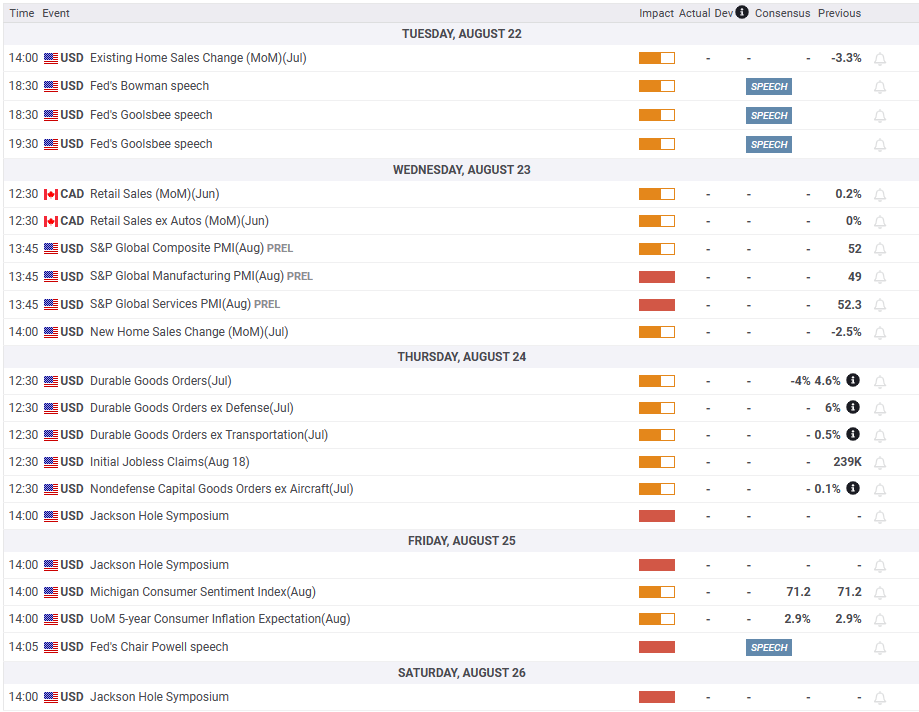

What is there to watch out for?

USD/CAD Price Analysis: Technical Perspective

The trend for USD/CAD remains bullish as price action broke above the 200-day moving average (DMA) at 1.3451, though it failed to break the May 30 daily low which became resistance at 1.3567, which a Once recovered, the USD/CAD pair would rally towards the May 26 swing high at 1.3654. If this level is exceeded, the maximum so far this year would be at 1.3862.

USD/CAD

| Overview | |

|---|---|

| Last price today | 1.3541 |

| today’s daily change | -0.0004 |

| today’s daily variation | -0.03 |

| today’s daily opening | 1.3545 |

| Trends | |

|---|---|

| daily SMA20 | 1.3347 |

| daily SMA50 | 1.3278 |

| daily SMA100 | 1.3384 |

| daily SMA200 | 1.3452 |

| levels | |

|---|---|

| previous daily high | 1.3553 |

| previous daily low | 1.3496 |

| Previous Weekly High | 1.3502 |

| previous weekly low | 1.3356 |

| Previous Monthly High | 1.3387 |

| Previous monthly minimum | 1.3093 |

| Fibonacci daily 38.2 | 1.3531 |

| Fibonacci 61.8% daily | 1.3518 |

| Daily Pivot Point S1 | 1,351 |

| Daily Pivot Point S2 | 1.3475 |

| Daily Pivot Point S3 | 1.3454 |

| Daily Pivot Point R1 | 1.3567 |

| Daily Pivot Point R2 | 1.3588 |

| Daily Pivot Point R3 | 1.3623 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.