- USD/CHF is correcting after peaking while extending its uptrend.

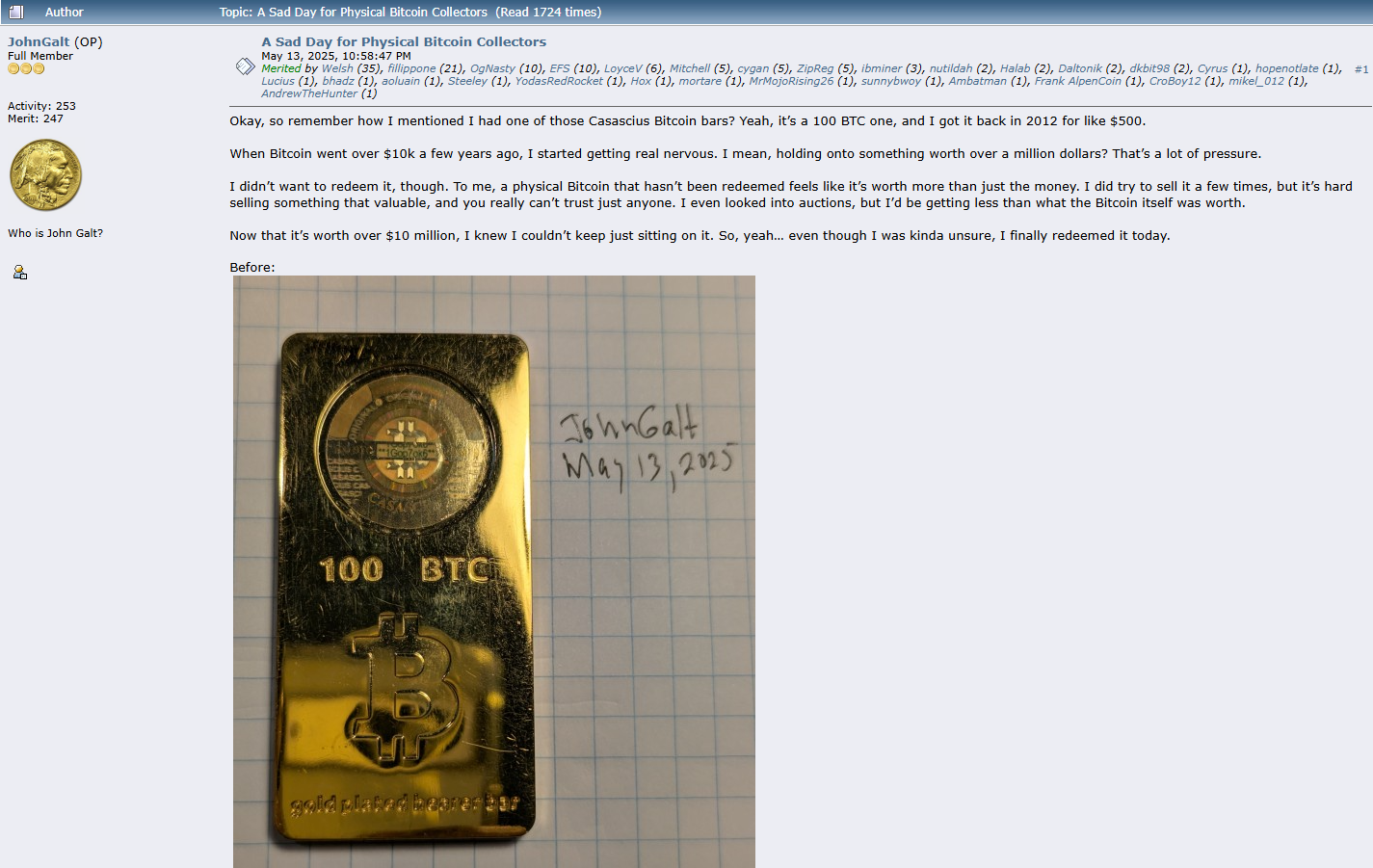

- The pair will likely resume its bullish bias after the pullback is complete.

USD/CHF is retreating within its short-term uptrend after hitting a high of 0.8642 on Monday. However, the move is likely to be just a temporary correction before the pair resumes its uptrend and extends its sequence of higher highs and higher lows.

USD/CHF 4-hour chart

USD/CHF will likely reach the target generated after breaking the range, at 0.8680, the 100% Fibonacci (Fib) extrapolation of the upward range height. It has already reached the conservative target at 0.8627, the 61.8% Fib level.

The Relative Strength Index (RSI) has broken out of the overbought region, giving traders a signal to liquidate their long positions and sell short.

A gap opened on the chart on Monday morning and there is a risk that the market could pull back completely to fill this gap. If so, it could correct up to 0.8574. A break below the previous range highs at 0.8541 would be required to confirm a likely trend reversal.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.