He US Dollar Index (DXY) has suffered a sharp sell-off from a high of 107 to a low of 102.5 in October and November. The economists of ANZ Bank They analyze the prospects of the Dollar.

Declining fiscal support in the US, combined with the impact of interest rate hikes, will weigh on US growth

We believe the DXY will continue its decline and expect it to reach 98.00 in Q4 2024; but it will be a hectic, non-linear and gradual movement, given the dynamics of the late cycle.

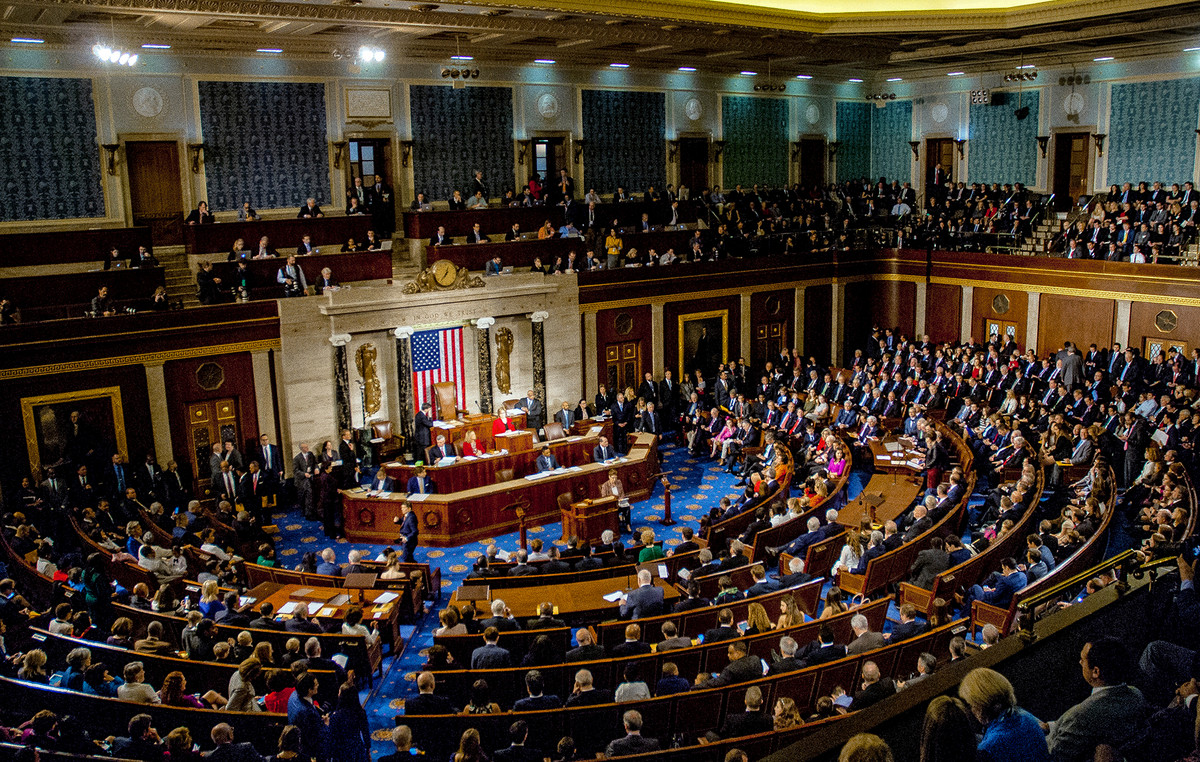

Fading fiscal support in the US combined with the impact of rising interest rates will weigh on US growth. If the deficit continues to rise, investors are likely to demand a higher risk premium for US assets again. Credit rating agencies have placed the US sovereign credit rating on a negative outlook following partisan disagreements over the national budget. These developments are long-term issues and will not be resolved in the short term. This reinforces our bearish view of the dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.