- The Indian Rupee loses momentum in the Asian session on Tuesday.

- Renewed demand for USD could weigh on INR, but routine RBI intervention and lower crude oil prices could limit its decline.

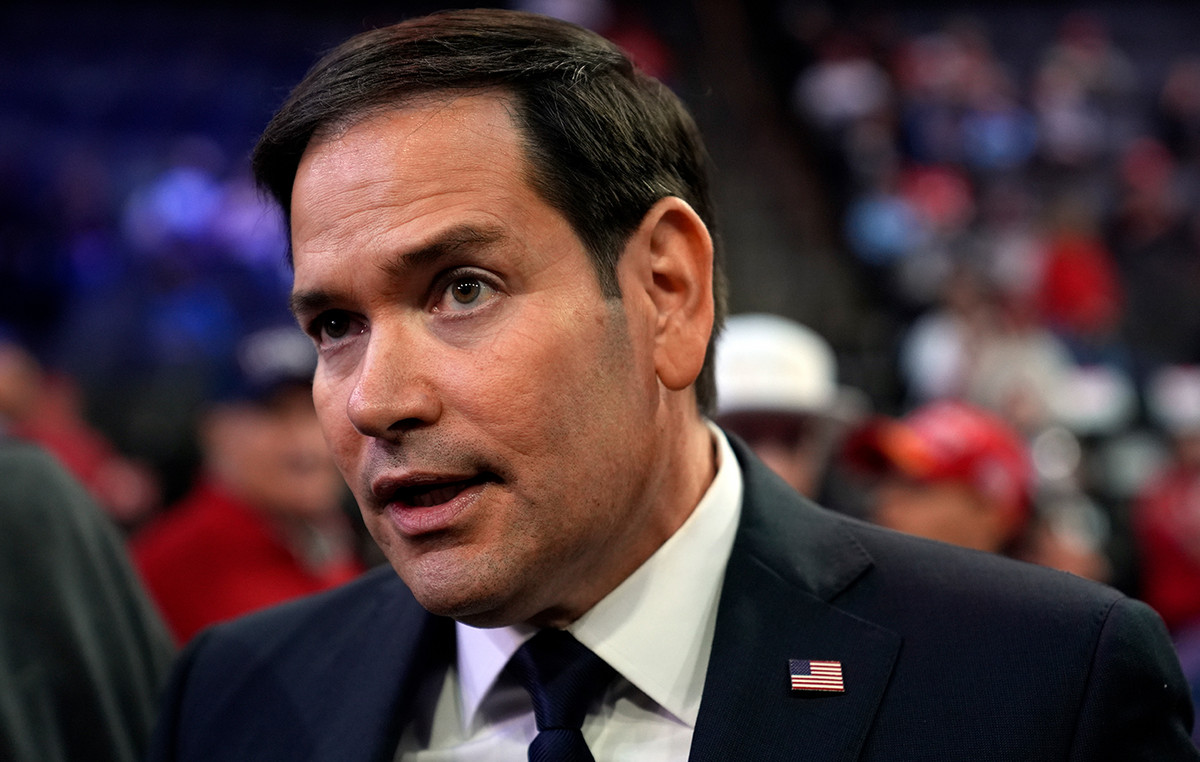

- Investors will take more cues from Trump’s policy announcements this week.

The Indian Rupee (INR) falls on Tuesday after hitting a one-week high in the previous session. The US Dollar (USD) could continue its upward trajectory due to demand from importers and a reversal of global financial flows to the United States. However, the Reserve Bank of India (RBI) could prevent the local currency from depreciating significantly through active interventions in the currency markets. Furthermore, falling crude oil prices support the INR as India is the third largest oil consumer in the world.

Investors will be closely watching the development of policy announcements this week, which could offer new catalysts for the pair. On Friday, HSBC India’s preliminary Purchasing Managers’ Index (PMI) reading for January will be in the spotlight. On the US agenda, the preliminary estimate of S&P PMI data will be published.

Indian Rupee Remains Weak Amid Multiple Global Signals

- The Indian rupee is likely to make a strong comeback once the euphoria over Donald Trump’s assumption of the US presidency dies down, according to the State Bank of India (SBI) on Monday.

- “There will be a risk of a correction in the dollar if it looks like Trump will be more selective with tariffs after all, but that will probably come at a later stage,” ING Bank said.

- Foreign investors have sold a net total of about $6.5 billion in local stocks and bonds in January so far, the largest monthly outflow since October 2023.

- Trump declared Monday that he is considering imposing 25% tariffs on Canada and Mexico as soon as early February, according to CNBC.

- Trump said Monday he would immediately declare a national energy emergency, vowing to fill strategic reserves and use authority to quickly approve new oil, gas and electricity projects that would normally take years to obtain permits.

USD/INR maintains long-term bullish trend

The Indian Rupee is trading on a stronger note on the day. The USD/INR pair is maintaining the bullish vibe on the daily time frame as the price has formed higher highs and higher lows while holding above the 100-day EMA. The bullish momentum is supported by the 14-day Relative Strength Index (RSI), which is above the midline near 65.40, suggesting that further upside looks favorable.

The key upside barrier for USD/INR emerges at an all-time high of 86.69. A sustained move above this level could see a rally towards the psychological level of 87.00.

On the downside, the January 20 low at 86.18 acts as initial support level for the pair. Extended losses could expose 85.85, the Jan. 10 low. Further south, the next containment level to watch is 85.65, the January 7 low.

Indian Rupee FAQs

The Indian Rupee (INR) is one of the currencies most sensitive to external factors. The price of crude oil (the country relies heavily on imported oil), the value of the US Dollar (most trade is done in US dollars), and the level of foreign investment are all influential factors. The direct intervention of the Reserve Bank of India (RBI) in the foreign exchange markets to keep the exchange rate stable as well as the level of interest rates set by the RBI are other important factors influencing the Rupee. .

The Reserve Bank of India (RBI) actively intervenes in foreign exchange markets to maintain a stable exchange rate and help facilitate trade. Furthermore, the RBI tries to keep the inflation rate at its target of 4% by adjusting interest rates. Higher interest rates tend to strengthen the Rupee. This is due to the role of the “carry trade”, in which investors borrow in countries with lower interest rates to park their money in countries that offer relatively higher interest rates and profit from the difference.

Macroeconomic factors that influence the value of the Rupee include inflation, interest rates, economic growth rate (GDP), trade balance and foreign investment inflows. A higher growth rate can lead to more investment abroad, increasing demand for the Rupee. A less negative trade balance will eventually lead to a stronger Rupee. Higher interest rates, especially real rates (interest rates minus inflation) are also positive for the Rupee. A risk environment can lead to higher inflows of foreign direct and indirect investment (FDI and FII), which also benefit the Rupee.

Higher inflation, particularly if it is comparatively higher than other countries, is generally negative for the currency as it reflects a devaluation through excess supply. Inflation also increases the cost of exports, leading to more rupees being sold to buy foreign imports, which is negative for the Indian Rupee. At the same time, higher inflation usually leads the Reserve Bank of India (RBI) to raise interest rates and this can be positive for the Rupee, due to increased demand from international investors. The opposite effect applies to lower inflation.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.