- USD/JPY traders await US CPI data for the next major catalyst.

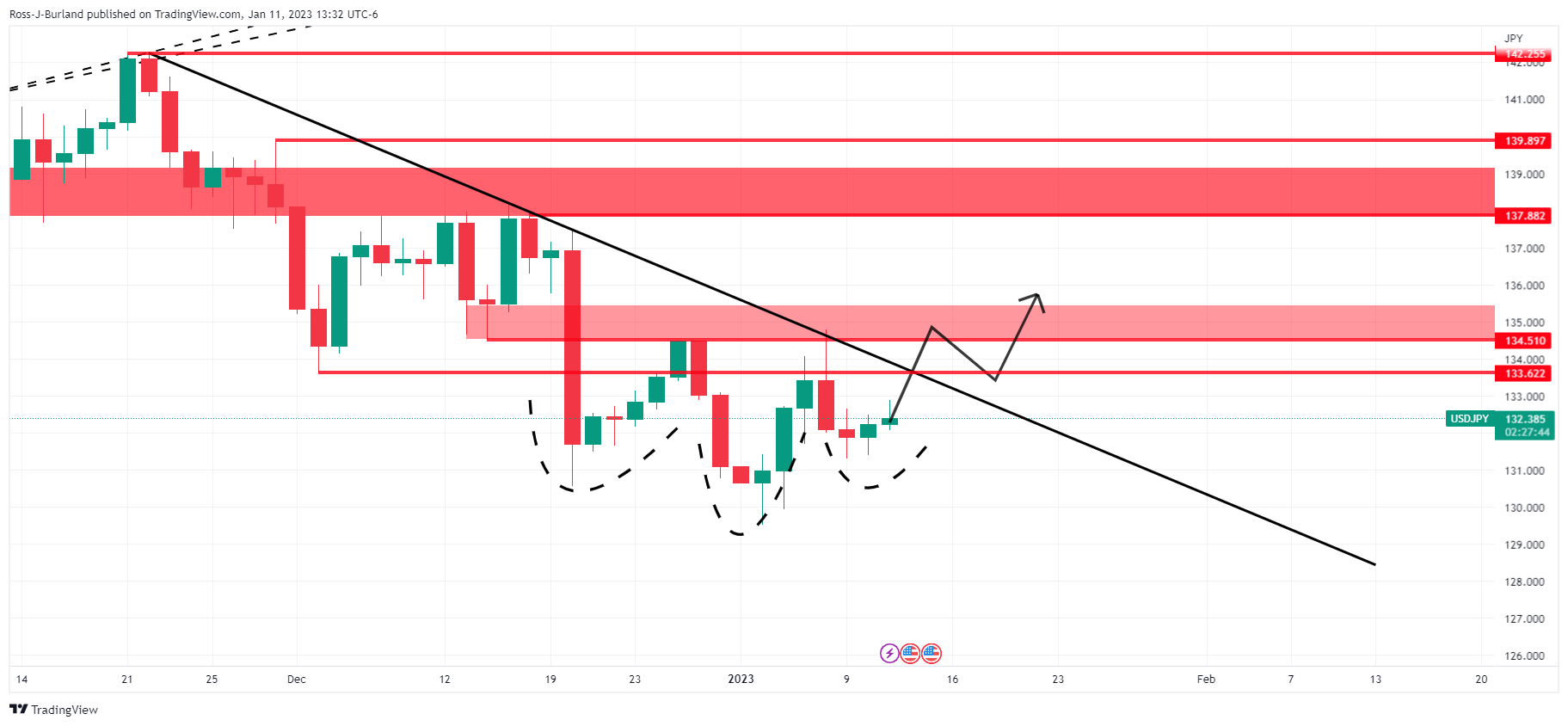

- Price is spiraling and could be forming an inverted head-shoulder pattern on the daily chart.

At the time of writing, USD/JPY is trading flat again at 132.35but it has oscillated between a low of 132.06 and a daily high of 132.87, weekly highs for now.

Main Wall Street indices are trading higheras investors await the release of the US CPI consumer price index, what seems to have weighed on the dollar and US Treasury yields in the closing hours of the session. The 10-year yield is down 1.66% and finds an hourly support structure near 3.563%. If this holds, the dollar would also receive some support and move away from the USD/JPY bears, leaving the cross afloat until Thursday’s CPI data, where traders hope to get more clarity on the path of the upside. of Federal Reserve rates.

In this sense, TD Securities analysts explained that they expect underlying prices to have risen on a monthly basis in December“closing the year on a relatively stronger footing.”

“Indeed, we anticipate a strong 0.3% m/m rise as services inflation is likely to have gained momentum. As for headline inflation, we expect CPI to decline slightly without rounding in December, but to round to flat mom growth as energy prices once again offered big relief. Our forecasts for month-on-month inflation imply that headline and core CPI inflation likely slowed year-on-year in December”.

As for the dollar, analysts say that “Unless the underlying index surprises significantly to the upside, dollar rallies should be sold. We think the bar is high to force a reversal even though the USD is tactically stretched.”

USD/JPY Technical Analysis

Bulls on the prowl, with price setting up a inverted head-shoulder pattern on the daily chart:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.