- USD/JPY extends its bearish trend as markets digest Fed Chair Jerome Powell’s speech and its implications.

- Major US interest rate cuts are expected over the next year and a half as the US economy contracts.

- Japanese Yen benefits from increased carry trade liquidation.

USD/JPY is down 144.10 on Monday, continuing its recent downtrend from August 15 highs of 149.40. This means that one US Dollar (USD) buys five fewer Japanese Yen (JPY) than it did 11 days ago.

The recent depreciation of the USD is due to rising expectations that US interest rates are about to fall. The expectation of lower interest rates is negative for the Dollar because it reduces foreign capital inflows.

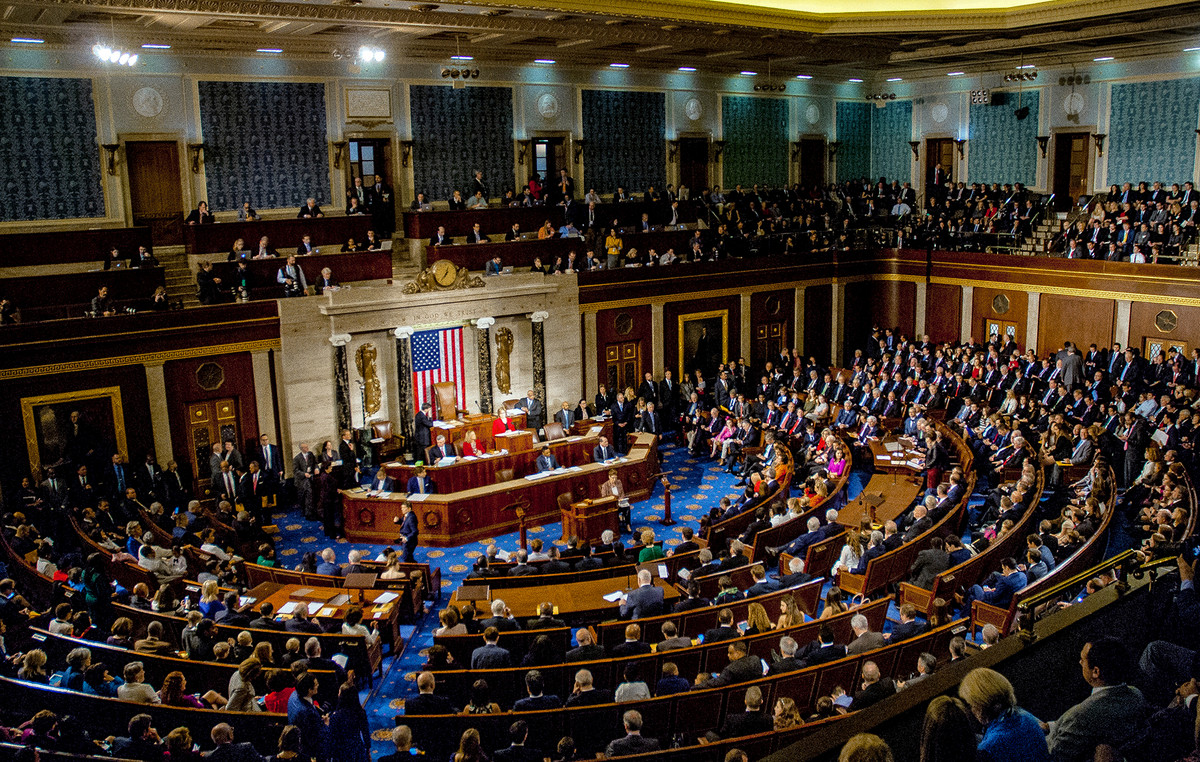

On Friday, in a speech given at Jackson Hole, where global central bankers gathered for their annual roundtable, Federal Reserve (Fed) Chairman Jerome Powell gave his clearest signal yet that the Fed was about to cut interest rates. High interest rates were bad for employment, he said, and with inflation now coming down more sustainably, the time was right to start cutting. “Upside risks to inflation have diminished, downside risks to employment have increased,” Powell said. USD/JPY fell more than 1.3% as a result.

In Japan, deflation rather than inflation has been a problem, leading the Bank of Japan (BoJ) to keep interest rates ultra-low – now at 0.25% – and the Yen historically weak.

Despite the government’s efforts to encourage higher wages, inflation remains stubbornly low. Recent inflation data showed headline inflation at 2.8% in July year-on-year, the same level as in June, and inflation excluding fresh food at 2.7% – up from 2.6% in the previous month, an increase that was in line with forecasts. Meanwhile, inflation excluding both fresh food and energy fell to 1.9% from 2.2% in the previous month, which is below the BoJ’s 2.0% target for core inflation.

This suggests that the BoJ will not have a strong mandate to raise interest rates further and, as a consequence, the Yen will remain under pressure. Even headline and non-food inflation figures, which are relatively high, it has been argued, were only high because of government energy subsidies that will be cancelled in September. This suggests a risk that after September inflation will also fall.

That said, economists seem to be in general agreement that the BoJ will still make one more 0.25% rate hike, taking interest rates to 0.50%, before the end of the year. Advisory service Capital Economics thinks the hike will happen in October. After that, the view is that throughout 2025 inflation will remain subdued and the BoJ will not be able to raise interest rates any further.

In contrast, markets are now pricing in 100% rate cuts by 2024 and 1.30% by the Federal Reserve in 2025, which, if it were to happen, would take the Fed’s official interest rate from a range of 5.50-5.25% to 3.20-2.95%. This suggests that at the same time as US interest rates are falling by an aggregate of 2.3% over the next 16 months, Japanese interest rates would be rising by 0.25%, leading to a sharp convergence of the current spread between the two. This partly explains the sudden drop in USD/JPY.

Another factor is that now that the Yen has established a firmer upward trend, it is becoming less attractive as a funding currency in the carry trade. This is an investment strategy in which traders borrow in a currency where interest rates are low – such as the Japanese Yen (JPY) – and buy a currency where interest rates are high – such as the US Dollar, or the Mexican Peso.

Assuming there is no change in the exchange rate, traders pocket the difference between the interest they have to pay on the loan and the interest they earn from the investment. However, since the Japanese Yen (JPY) is now trending higher and most of its favorite carry trade counterparts are weakening, the carry trade is not as profitable as it used to be, and this “liquidation” of long carry trade positions is driving the USD/JPY even lower.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.