- USD/JPY rebounded after US durable goods fell more than expected.

- Japanese national inflation as measured by the CPI fell, but less than expected.

- US GDP and PCE inflation will be released in the second half of the week.

The USD/JPY pair fell in the early hours of Tuesday before finding a bottom near 150.20, with the US dollar (USD) paring short-term losses after US durable goods orders fell more than expected. expected in January. Markets will focus on US Gross Domestic Product (GDP) growth and the Personal Consumption Price Index (PCE) due to be released on Wednesday and Thursday, respectively.

Japan's national Consumer Price Index (CPI) moderated from previous figures, but still fell less than expected. The annualized national headline CPI fell to 2.2% from 2.6% in January. The national core CPI fell to 2.0% from 2.3% in the same period, but markets were expecting a figure of 1.8%.

Everything focuses on US GDP and PCE.

Durable goods orders in the United States fell to -6.1% in January, below forecasts of -4.5%. The previous data was also revised downwards, from 0.0% to -0.3%.

US GDP growth for the fourth quarter of 2023 will be released on Wednesday, with annualized GDP for the fourth quarter expected to remain stable at 3.3%. On Thursday, US CPI inflation is expected to see a slight pick-up at the near end of the curve, with core CPI forecast to rise 0.4% from 0.2% in January. The US annualized core CPI is expected to decline to 2.8% from 2.9% for the year ended January.

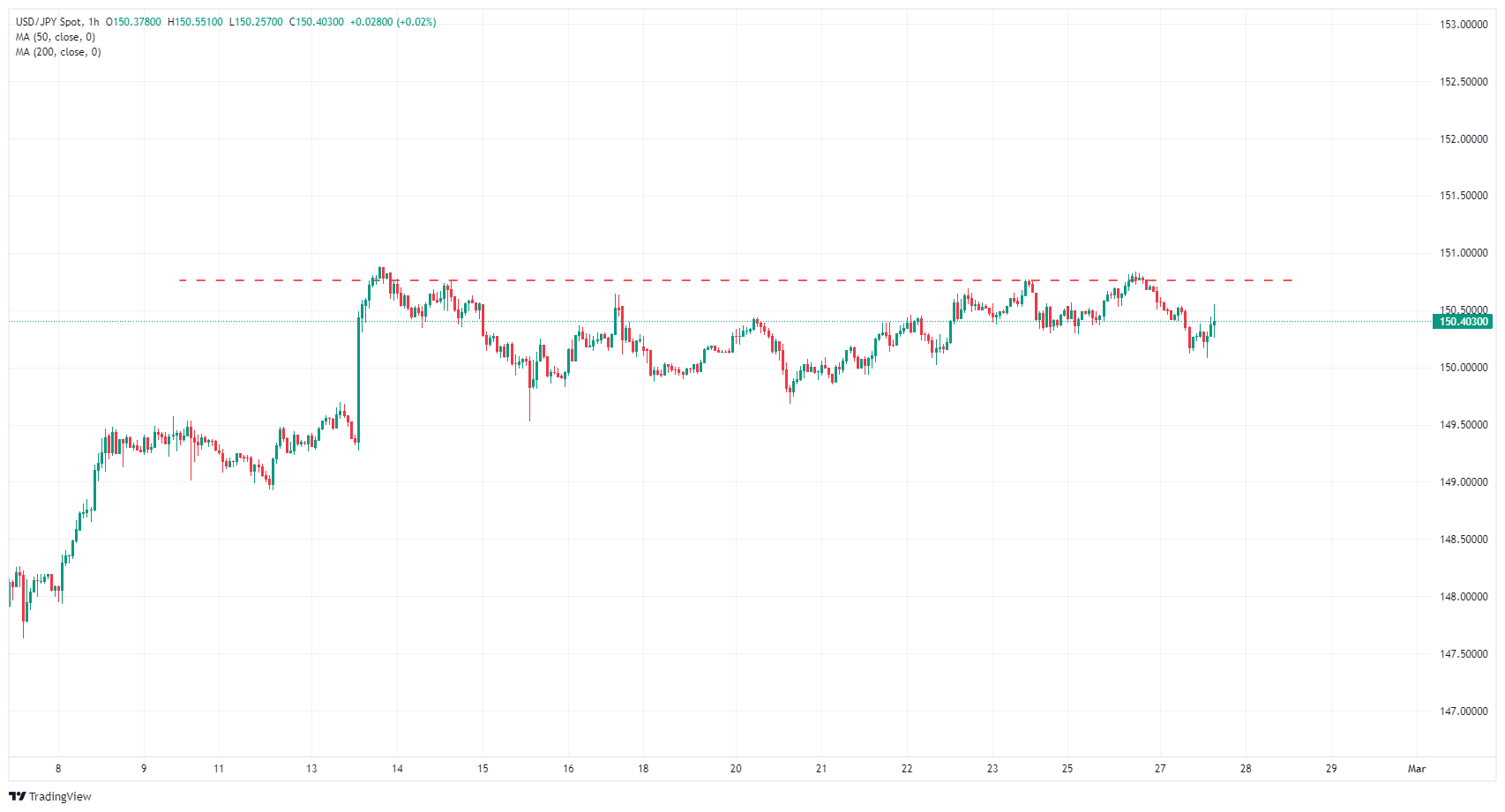

USD/JPY Technical Outlook

USD/JPY finds short-term technical resistance at 150.75, while the pair struggles to break above the 151.00 area. The pair remains capped in the mid-range as markets churn, and 150.50 remains a key cycle level for USD/JPY.

Longer-term, the pair remains firmly anchored in the bullish zone, with trading at technical resistance near the November 2023 highs around 152.00. USD/JPY has closed in bullish territory for six of the last seven consecutive weeks of trading.

USD/JPY hourly chart

USD/JPY daily chart

USD/JPY

| Overview | |

|---|---|

| Latest price today | 150.44 |

| Today Daily Change | -0.24 |

| Today's daily variation | -0.16 |

| Today's daily opening | 150.68 |

| Trends | |

|---|---|

| daily SMA20 | 149.28 |

| daily SMA50 | 146.64 |

| SMA100 daily | 147.64 |

| SMA200 Journal | 145.74 |

| Levels | |

|---|---|

| Previous daily high | 150.84 |

| Previous daily low | 150.29 |

| Previous weekly high | 150.77 |

| Previous weekly low | 149.68 |

| Previous Monthly High | 148.81 |

| Previous monthly low | 140.81 |

| Daily Fibonacci 38.2 | 150.63 |

| Fibonacci 61.8% daily | 150.5 |

| Daily Pivot Point S1 | 150.37 |

| Daily Pivot Point S2 | 150.06 |

| Daily Pivot Point S3 | 149.82 |

| Daily Pivot Point R1 | 150.92 |

| Daily Pivot Point R2 | 151.15 |

| Daily Pivot Point R3 | 151.47 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.