- USD/JPY is trading at 147.58, up 0.34%, after the US CPI for August rose to 3.7% year-on-year, beating estimates of 3.6%.

- The 10-year US Treasury yield remains stable at 4.28%, despite initial volatility following the inflation report.

- Market futures give the Fed a 97% chance of keeping rates; The focus is on upcoming economic data from both countries.

The Dollar extended its recovery against the Japanese Yen (JPY) on Wednesday after the inflation report in the United States (US) came in mixed, although suggesting there is a small chance of further tightening of monetary policy. The pair USD/JPY is trading at 147.58, gaining 0.34%.

Dollar rises against Yen as US CPI beats estimates, but market skeptical of imminent Fed tightening

The US Department of Labor revealed that the rebound in inflation in August was expected, but exceeded estimates. The Consumer Price Index (CPI) rose 3.7% year-on-year, above estimates of 3.6%, and surpassed July’s 3.2% reading, blamed on rising energy prices. The positive news was that the core CPI fell to 4.3% year-on-year, as expected, from 4.7% in July.

Following the data release, USD/JPY fluctuated around the 147.12/147.74 area before stabilizing around 147.40. Since then, the pair has continued to change hands at current price levels. The 10-year US Treasury yield is yielding 4.28%, unchanged, after swinging towards 4.35%.

Although the latest data, with a tight labor market and higher-than-expected inflation, should justify another interest rate hike, market participants believe otherwise. In money market futures, the probability that the Federal Reserve will keep the Federal Funds Rate (FFR) at its current level is 97%. However, the odds stand at 41% for the November meeting, unchanged from last week’s reading.

On the other hand, USD/JPY traders will be attentive to the publication of economic data to take clues about the direction of the pair. In Japan, machinery orders will be published. On the US side, Initial claims for unemployment benefits, the Producer Price Index (PPI) and Retail Sales would update the situation of the US economy.

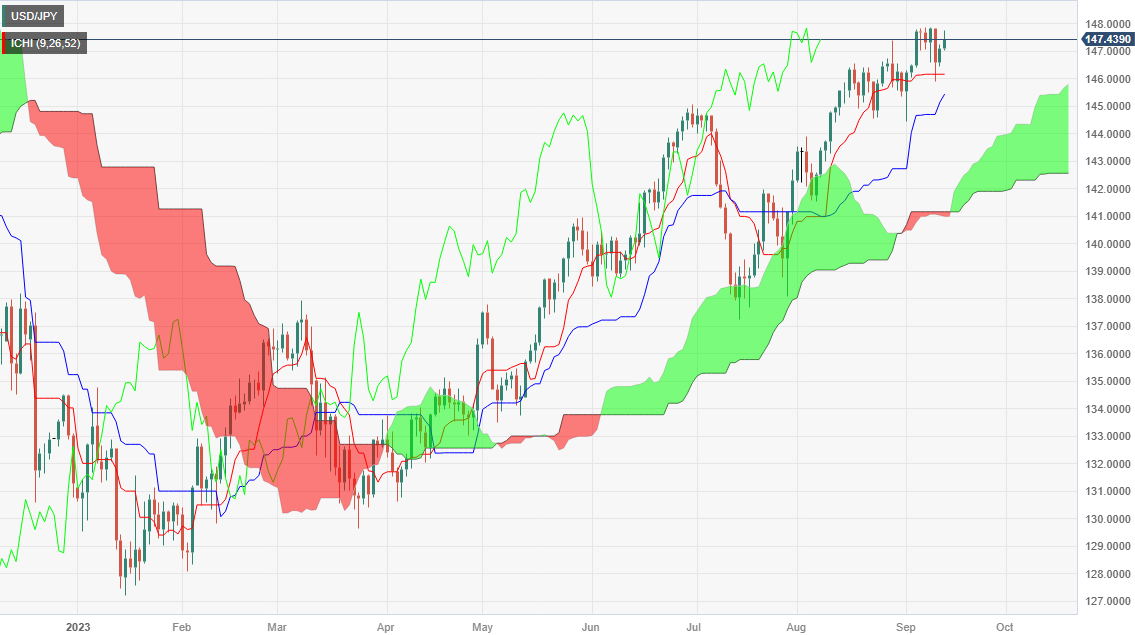

USD/JPY Price Analysis: Technical Outlook

The USD/JPY pair has been positive for two consecutive days, which opens the door to testing the maximum of 147.87 so far this year. If the Japanese authorities remain cautious, there is a possibility that the major currencies will challenge the psychological zone of 148.00 points. Once passed, the next stop would be the November 1 high at 148.82. On the other hand, if USD/JPY falls below 147.01, a bearish correction would occur.

USD/JPY

| Overview | |

|---|---|

| Last price today | 147.47 |

| Today Daily Change | 0.39 |

| today’s daily variation | 0.27 |

| today’s daily opening | 147.08 |

| Trends | |

|---|---|

| daily SMA20 | 146.4 |

| daily SMA50 | 143.64 |

| daily SMA100 | 141.43 |

| daily SMA200 | 137.19 |

| Levels | |

|---|---|

| previous daily high | 147.24 |

| Previous daily low | 146.44 |

| Previous Weekly High | 147.88 |

| previous weekly low | 146.02 |

| Previous Monthly High | 147.38 |

| Previous monthly minimum | 141.51 |

| Fibonacci daily 38.2 | 146.93 |

| Fibonacci 61.8% daily | 146.74 |

| Daily Pivot Point S1 | 146.6 |

| Daily Pivot Point S2 | 146.12 |

| Daily Pivot Point S3 | 145.81 |

| Daily Pivot Point R1 | 147.4 |

| Daily Pivot Point R2 | 147.72 |

| Daily Pivot Point R3 | 148.2 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.