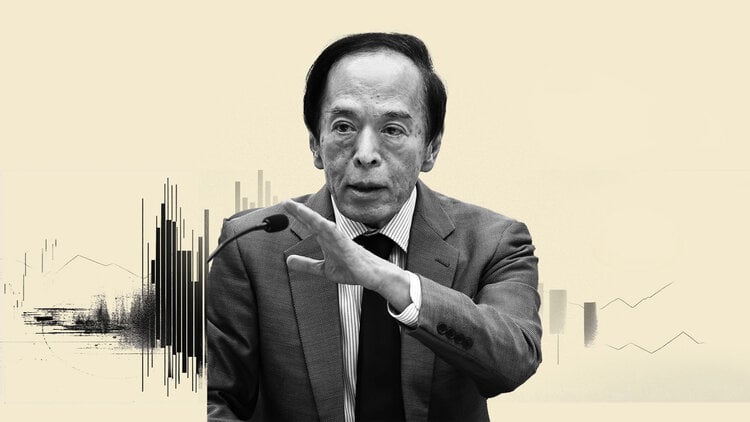

USD/JPY consolidated; last at 151.81 levels. The US elections are making noise, Governor Ueda’s press conference also had some influence, note OCBC FX analysts Frances Cheung and Christopher Wong.

Ueda paves the way for a BoJ hike in December

“Bullish momentum on the daily chart faded while the RSI remained flat. There will likely be two-way trading. Support at 151.60 (200-DMA), 150.60/70 levels (50% Fibonacci retracement of July high to September low, 100 DMA). Resistance at 153.30 (61.8% fibo), 155 and 156.50 (76.4% fibo).”

“Ueda talked about how the current political situation in Japan would not prevent it from raising rates if prices and the economy remain in line with the BoJ forecast. He also referenced that exchange rates are more likely to affect prices in Japan than before He also said that similar salary agreements next year like this year would be good, but there is not much information yet on next year’s shunto Overall, his comments were more aggressive than expected and have probably paved the way for. a BoJ hike in December, which remains our main view.”

“The recent labor market report also pointed to upward wage pressure in Japan with 1/ the unemployment rate declining, 2/ the job-applicant ratio rising to 1.24 and 3/ even the female labor participation rate rising to 1.2 percentage points (vs. a year ago). Wage growth remains intact, along with expanding services inflation and this supports the normalization of BoJ rates while the JPY should continue to regain strength.”

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.