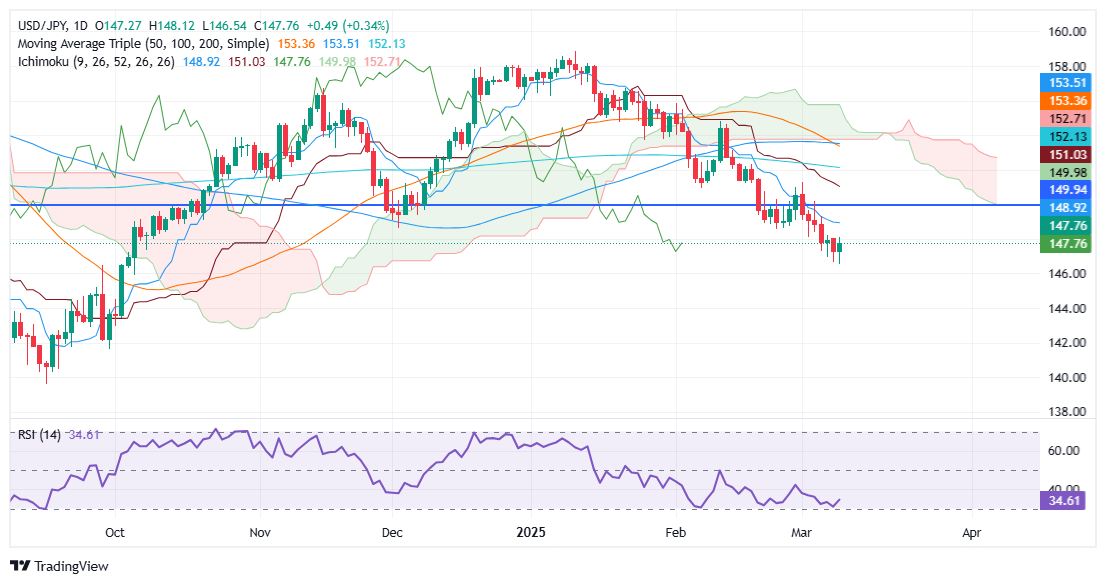

- The pattern of ‘minimums in tweezers’ formed in 146.54 indicates a possible reversal of short -term trend.

- The RSI is flattened, suggesting that the bearish impulse is losing strength.

- The key to the rise is observed in 148.00; A rupture opens the door to Senkou Span A at 149.79.

The USD/JPY goes up while commercial tensions loom due to the rhetoric of tariffs between Canada and the United States (USA), which initially weighed on the US dollar. However, as both countries agreed to lift tariffs, the PAR advanced and quoted in 147.77, with an increase of 0.34%.

USD/JPY price forecast: technical perspective

The USD/JPY formed a graphic pattern of ‘minimums in tweels of two candles near the minimum of the year to date (YTD) of 146.54, insinuating that the bearish trend seems to be overextended after falling from around 158.00 to the current exchange rates. Despite being bassist, the relative force index (RSI) is flat, indicating that the sale pressure is fading.

For a bearish continuation, the USD/JPY needs to overcome the minimum YTD of 146.54. If it is exceeded, the next stop would be the minimum oscillation of September 30, 141.64, followed by the minimum of September 16, 139.58.

On the contrary, if the USD/JPY rises above 148.00, a rebound towards the Senkou Span A test in 149.79 is in the cards.

USD/JPY price chart – Diario

And in Japanese price today

The lower table shows the rate of change of Japanese Yen (JPY) compared to the main currencies today. Yen Japanese was the strongest currency in front of the euro.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | 0.01% | 0.00% | -0.05% | 0.03% | 0.00% | -0.02% | |

| EUR | -0.02% | -0.01% | -0.06% | -0.06% | 0.00% | -0.02% | -0.04% | |

| GBP | -0.01% | 0.01% | -0.02% | -0.05% | 0.02% | -0.01% | -0.02% | |

| JPY | 0.00% | 0.06% | 0.02% | -0.03% | 0.05% | 0.00% | 0.01% | |

| CAD | 0.05% | 0.06% | 0.05% | 0.03% | 0.08% | 0.04% | 0.03% | |

| Aud | -0.03% | -0.01% | -0.02% | -0.05% | -0.08% | -0.03% | -0.04% | |

| NZD | 0.00% | 0.02% | 0.00% | -0.01% | -0.04% | 0.03% | -0.01% | |

| CHF | 0.02% | 0.04% | 0.02% | -0.01% | -0.03% | 0.04% | 0.00% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Japanese yen from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the JPY (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.