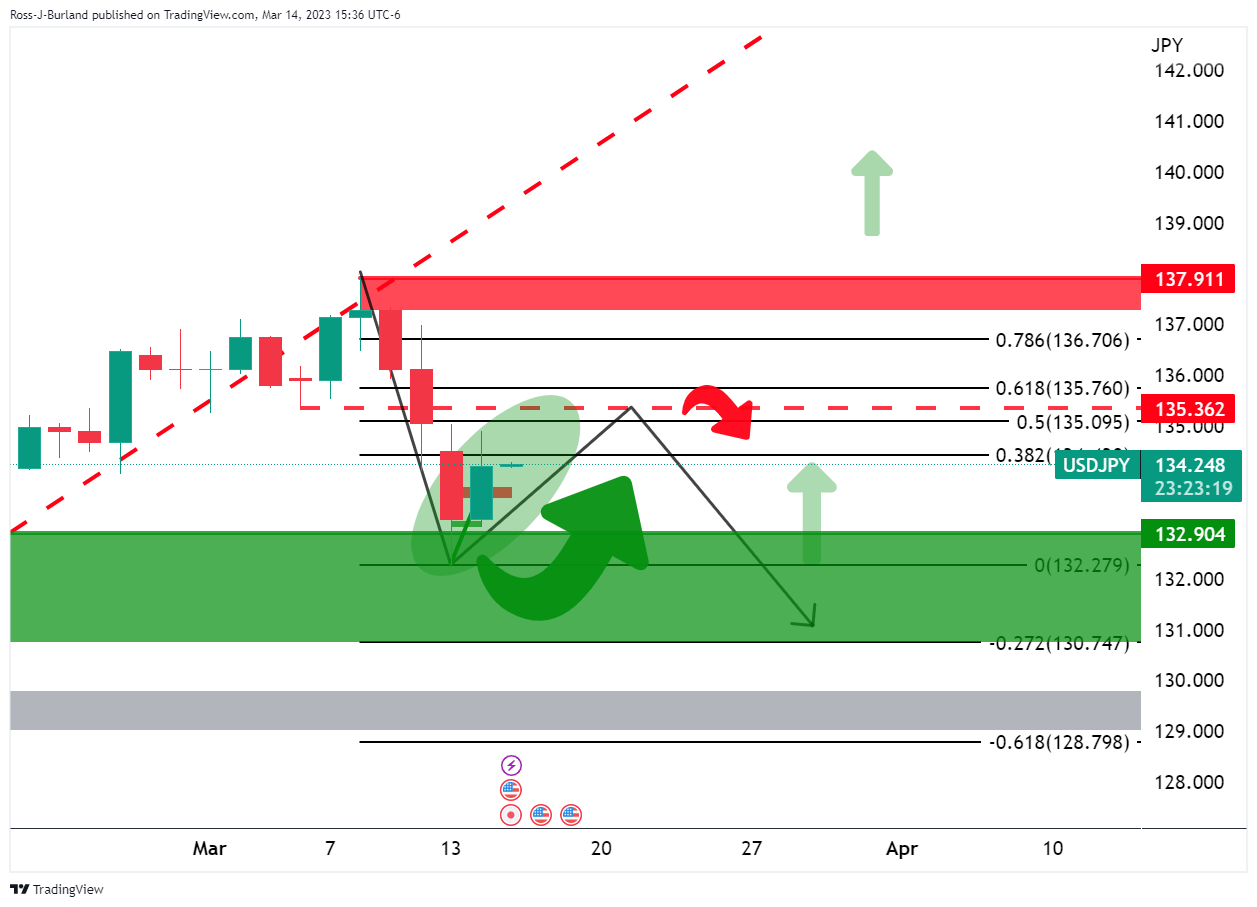

- USD/JPY bulls are in command and point to a deeper correction.

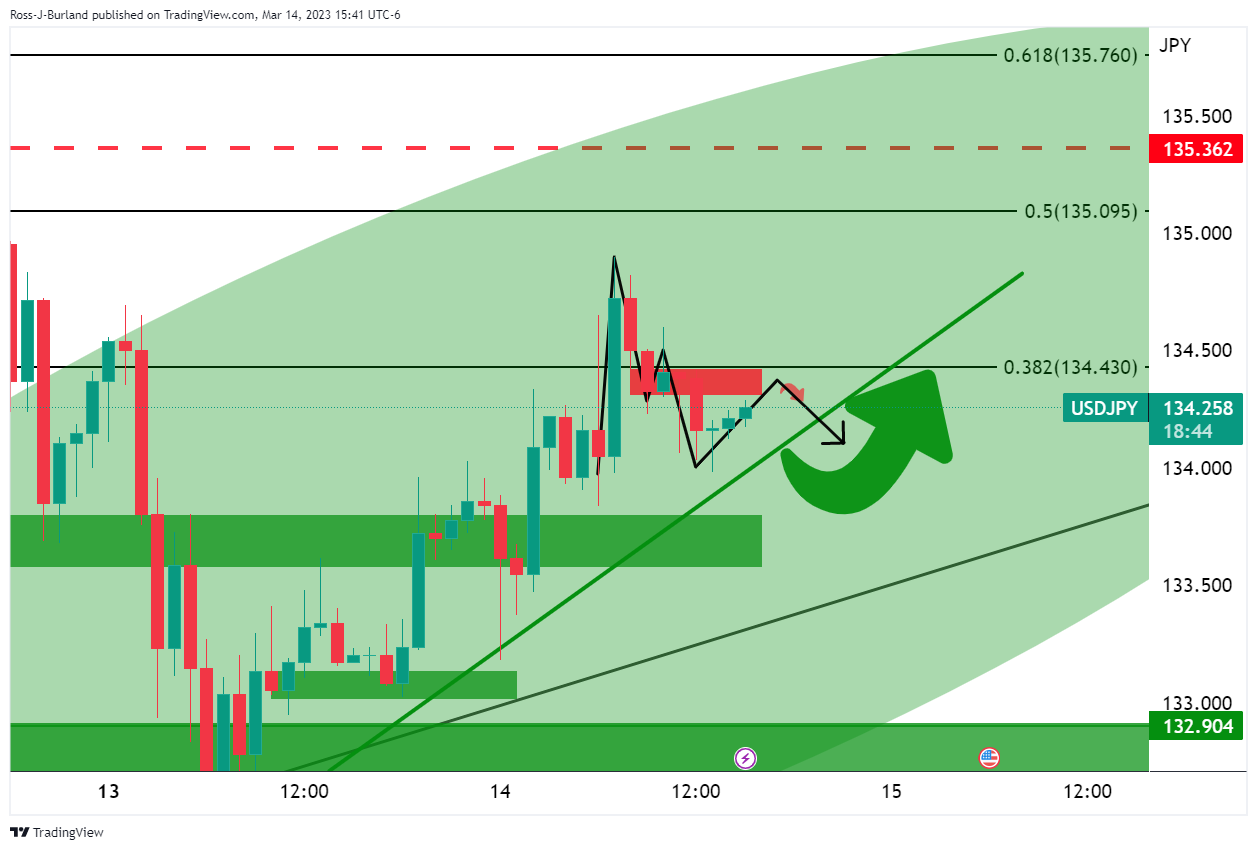

- The bulls need to overcome temporary hourly resistance.

USD/JPY is moving north after the US CPI According to he previous analysis, the bulls are making a firm correction and the bias is still in the hands of the bulls, as will be seen below.

USD/JPY Previous Technical Analysis

On the day, USD/JPY is moving towards a support zone which could lead to a correction ahead of US CPI data with 134.50-70 in sight on the daily Fibonacci scale. as illustrated above. However, in a lower time frame:”

”There is a lot of resistance between 133.70 and 134.00 that the bulls will have to flip first.”

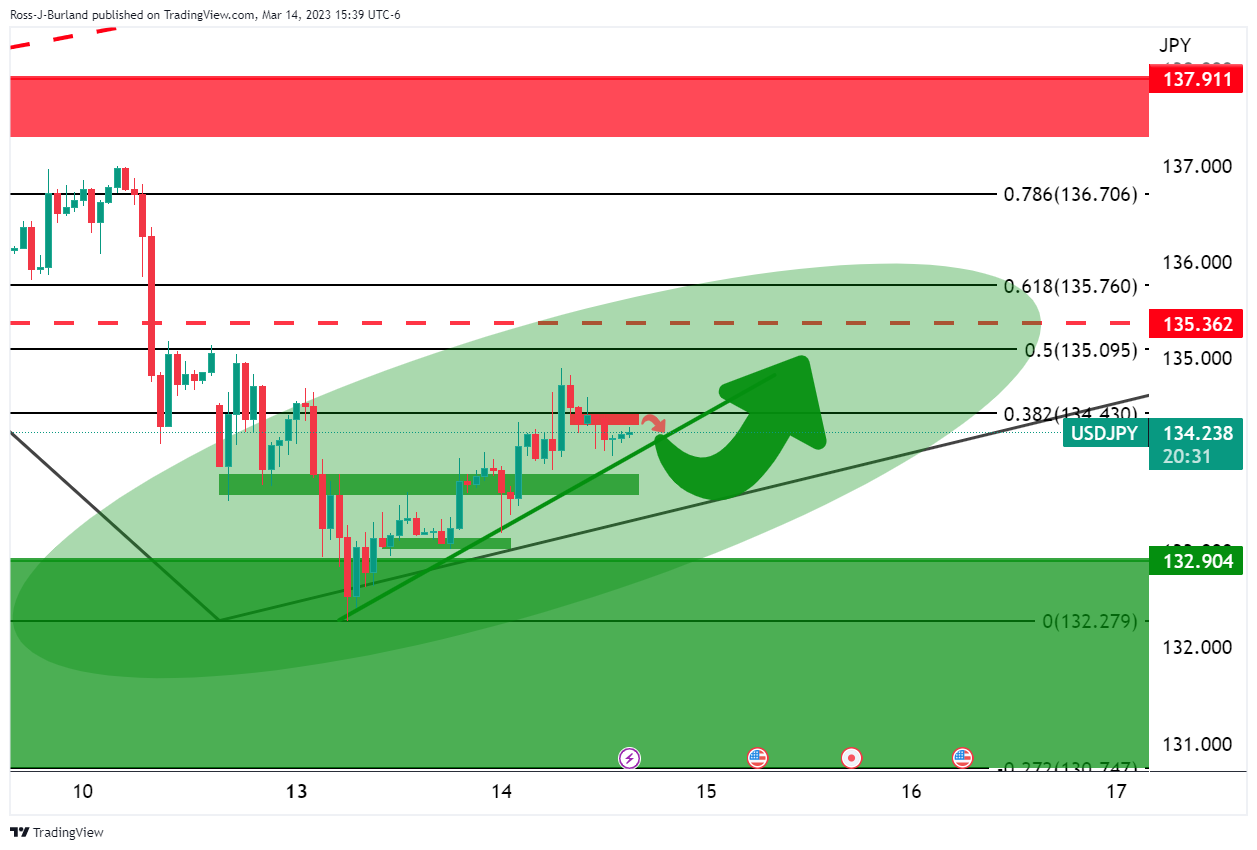

USD/JPY Update

As you can see, the bulls have moved in and the price is on its way towards 135.50. However, down the road, there are prospects for a correction and some bottoming ahead of higher demand:

Bulls will have to commit to trend line support, or thereabouts, with resistance potentially found at the M-shaped neckline in the meantime:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.