- USD/JPY bounces 0.35% from the minimum of 151.64, driven by the movements of bond yields.

- The technical analysis suggests a bullish change; Resistance near the 200 -day SMA at 152.76.

- Downward risks if the SMA is not exceeded; supports in 152.00 and 150.93 in focus.

The USD/JPY rose during the North American session. It is negotiated in 152.52 and records profits of more than 0.35% after touching a daily minimum of 151.64. The increase in 10 -year American treasure bonus yield promoted the rise of the torque, which is positively correlated with 10 -year performance.

USD/JPY Price forecast: Technical Perspective

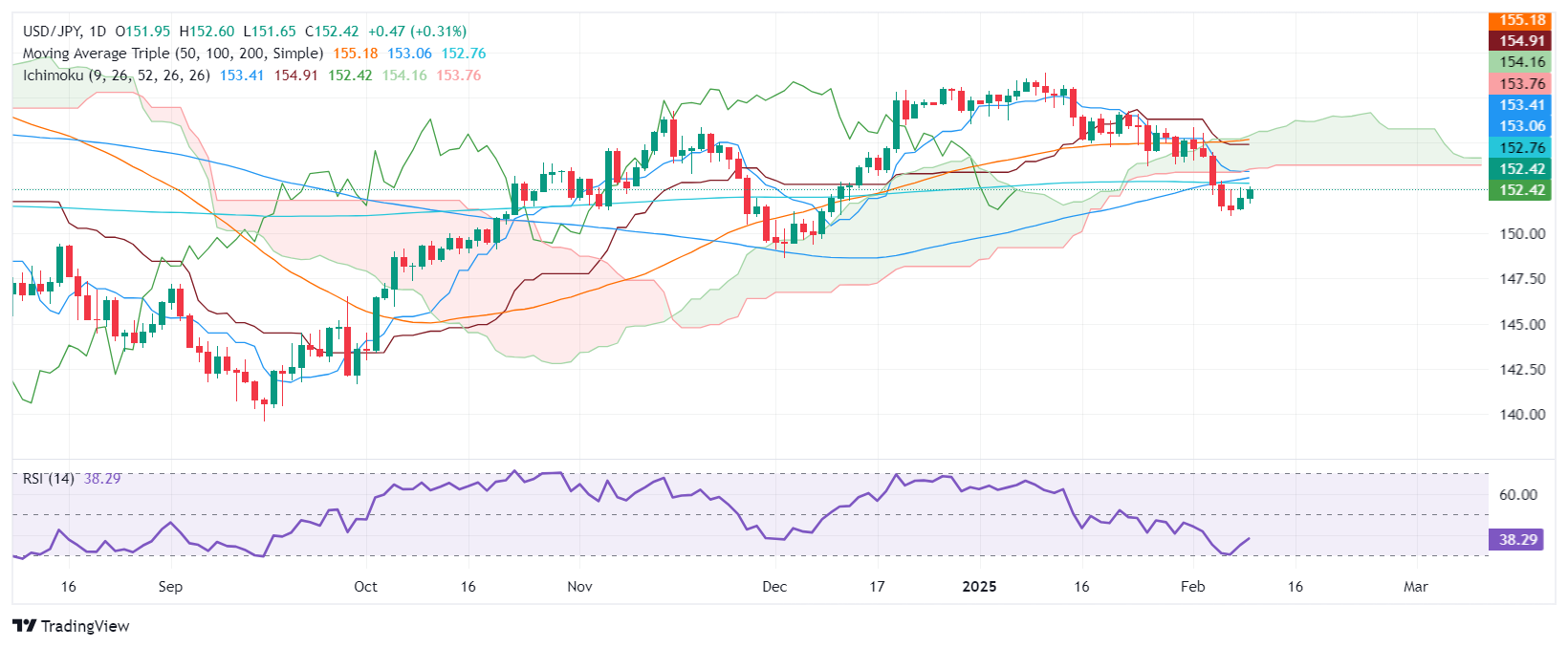

The USD/JPY is still biased, although buyers could challenge the simple mobile average (SMA) of 200 days in 152.76. The impulse changed slightly to Alcista, although the relative force index (RSI) remains bassist and the slope points up.

If buyers recover the 200 -day SMA, the following key resistance would be the level of 153.00 before trying the Senkou Span B base in 153.76.

On the other hand, if the USD/JPY remains below the 200 -day SMA, the first support would be the figure of 152.00. More losses are below the minimum daily of February 7, 150.93, followed by the minimum of December 3, 148.64.

USD/JPY Price Graph – Diario

And in Japanese price today

The lower table shows the rate of change of Japanese Yen (JPY) compared to the main currencies today. Yen Japanese was the strongest currency in front of the Japanese yen.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.53% | -0.60% | 0.30% | -0.16% | -0.28% | -0.23% | 0.16% | |

| EUR | 0.53% | -0.08% | 0.85% | 0.39% | 0.25% | 0.30% | 0.70% | |

| GBP | 0.60% | 0.08% | 0.93% | 0.46% | 0.31% | 0.36% | 0.76% | |

| JPY | -0.30% | -0.85% | -0.93% | -0.45% | -0.59% | -0.53% | -0.14% | |

| CAD | 0.16% | -0.39% | -0.46% | 0.45% | -0.13% | -0.08% | 0.31% | |

| Aud | 0.28% | -0.25% | -0.31% | 0.59% | 0.13% | 0.05% | 0.44% | |

| NZD | 0.23% | -0.30% | -0.36% | 0.53% | 0.08% | -0.05% | 0.39% | |

| CHF | -0.16% | -0.70% | -0.76% | 0.14% | -0.31% | -0.44% | -0.39% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Japanese yen from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the JPY (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.