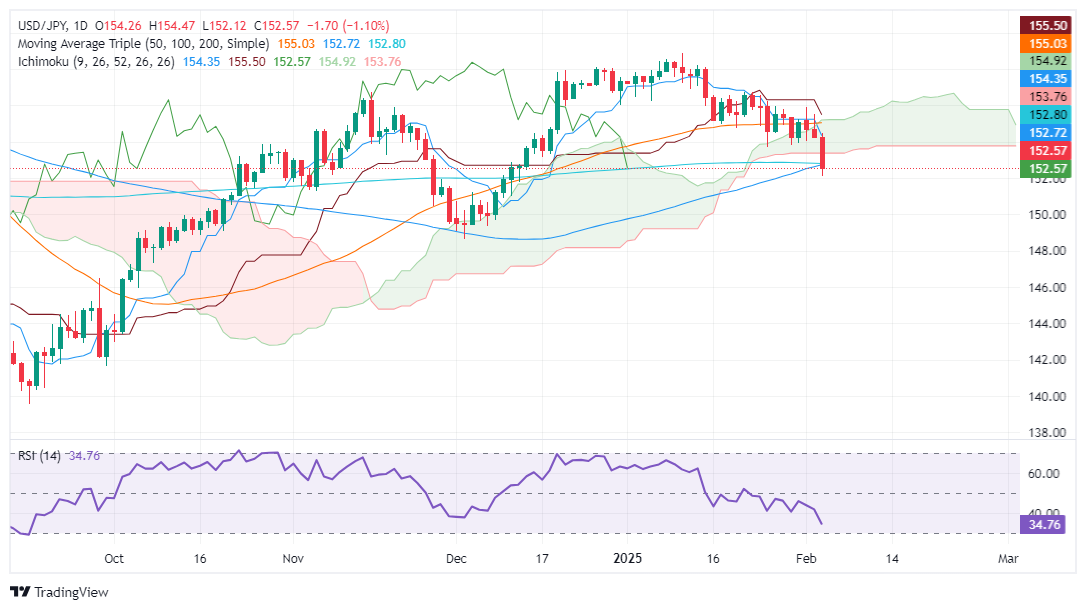

- USD/JPY sinks 1.13%, falling sharply to 152.59 while moving decisively below the 200 -day SMA and Kumo.

- The possible recovery depends on recovering the level of 153.00, with resistance near the lower edge of Kumo in 153.35/40.

- The continuous bearish trend could point to long -term supports in the minimum of December 149.36 and 148.65.

The USD/JPY collapsed 175 pips on Wednesday, registering losses of more than 1.13% while the par broke the Ichimoku cloud (Kumo). This consolidates the bearish trend of the torque, with the Japanese yen (JPY) ready to appreciate in the short term. At the time of writing, the par is quoted at 152.59.

USD/JPY Price forecast: Technical Perspective

The bassists intervened on Wednesday, pushing the USD/JPy below Kumo and breaking the Simple Mobile (SMA) of 200 days in 152.80. This has opened the door to more falls.

Despite this, a rebound is in the cards, if buyers exceed the figure of 153.00, which could pave the way to test the lower part of Kumo in 153.35/40, offering sellers a better entrance price. However, if it is exceeded, the following resistance would be the level of 154.00, followed by the maximum of February 5 in 154.46.

If the bearish trend continues, the first support of the USD/JPY would be the minimum of December 6, 149.36, followed by the minimum of December 3, 148.65.

USD/JPY Price Graph – Diario

And in Japanese price today

The lower table shows the rate of change of Japanese Yen (JPY) compared to the main currencies today. Yen Japanese was the strongest currency against the Australian dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.01% | -0.09% | -0.00% | 0.04% | 0.04% | 0.00% | |

| EUR | -0.02% | -0.03% | -0.10% | -0.02% | 0.04% | 0.03% | -0.04% | |

| GBP | 0.01% | 0.03% | -0.10% | 0.01% | 0.03% | 0.07% | 0.00% | |

| JPY | 0.09% | 0.10% | 0.10% | 0.07% | 0.12% | 0.10% | 0.11% | |

| CAD | 0.00% | 0.02% | -0.01% | -0.07% | 0.03% | 0.05% | 0.01% | |

| Aud | -0.04% | -0.04% | -0.03% | -0.12% | -0.03% | -0.01% | -0.05% | |

| NZD | -0.04% | -0.03% | -0.07% | -0.10% | -0.05% | 0.01% | -0.03% | |

| CHF | -0.01% | 0.04% | -0.01% | -0.11% | -0.01% | 0.05% | 0.03% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Japanese yen from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the JPY (base)/USD (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.