- The USD/JPY can be seen for the third consecutive day, approaching the resistance of 145.35.

- The YEN is cutting profits after a positive reaction to the Boj’s decision.

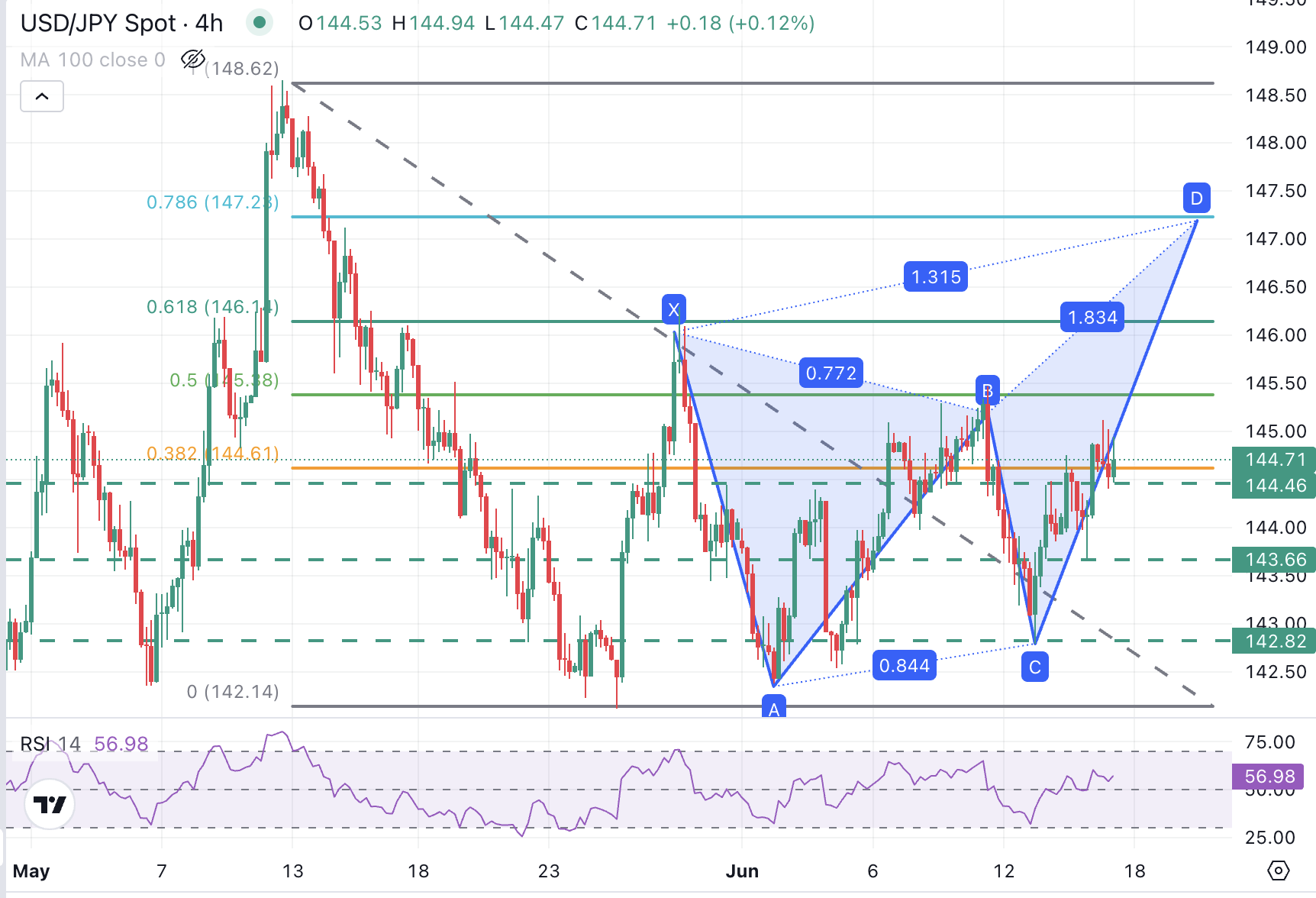

- Technical indicators suggest a trend change with a potential objective above 147.00.

The US dollar is quoting with slight profits against Japanese Yen on Tuesday, on the way to complete a three -day streak. The Intradía RSI has established itself within the upward territ

The Bank of Japan held the rates without changes after its monetary policy meeting, but warned about the growing uncertainty in global trade to avoid committing new rates. The Yen recovered immediately after the decision, but has been losing ground since then.

However, investors are cautious when making great bets in the US dollar before Wednesday’s Fed decision. It is very likely that the bank maintains the rates without changes, but could soften its hard line rhetoric in the light of the weak macroeconomic figures observed recently. This result could limit the recovery of the US dollar.

And in Japanese price today

The lower table shows the rate of change of Japanese Yen (JPY) compared to the main currencies today. Yen Japanese was the strongest currency against pound sterling.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | 0.15% | -0.06% | -0.04% | -0.16% | -0.25% | -0.20% | |

| EUR | 0.04% | 0.17% | 0.00% | -0.01% | -0.09% | -0.12% | -0.18% | |

| GBP | -0.15% | -0.17% | -0.22% | -0.18% | -0.26% | -0.34% | -0.34% | |

| JPY | 0.06% | 0.00% | 0.22% | -0.02% | -0.13% | -0.21% | -0.19% | |

| CAD | 0.04% | 0.01% | 0.18% | 0.02% | -0.19% | -0.13% | -0.17% | |

| Aud | 0.16% | 0.09% | 0.26% | 0.13% | 0.19% | -0.05% | -0.06% | |

| NZD | 0.25% | 0.12% | 0.34% | 0.21% | 0.13% | 0.05% | -0.04% | |

| CHF | 0.20% | 0.18% | 0.34% | 0.19% | 0.17% | 0.06% | 0.04% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the Japanese yen from the left column and move along the horizontal line to the US dollar, the percentage change shown in the picture will represent the JPY (base)/USD (quotation).

Technical analysis: in an upward trend around 145.35 and beyond

The reversal of the torque since the maximum of June 11 has been contained above the minimums of the end of May in 142.15, and the pair is in upward trend this week. The highest minimum suggests a possible change in trend.

The harmonic patterns suggest that the torque could be in the CD leg of a Butterfly formation directed at levels above the mentioned maximum of June 11, in 145.35, and the maximum of May 29, in 146.00. The fibonacci setback of 78.6% of the mass sale of the end of May, in 127.25, is a potential objective for corrections.

In the lower part, the immediate resistance is at the intra -level of 144.45 and the minimum of June 16, in 143.65. A rupture of 142.80 cancels this vision.

4 -hour graph of USD/JPY

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.