-

- USD/JPY faces pressure as the bullish impulse fades.

- The impulse indicators of the USD/JPY indicate a decrease in the force of the trend, since the ADX and the MACD are weakened.

- The general weakness of the US dollar adds down pressure on the USD/JPY, pushing prices around 144.00.

The USD/JPY is struggling to maintain a key support on Monday, since the bullish impulse continues to fade, with both daily and weekly graphics indicating a decrease in the force of the trend.

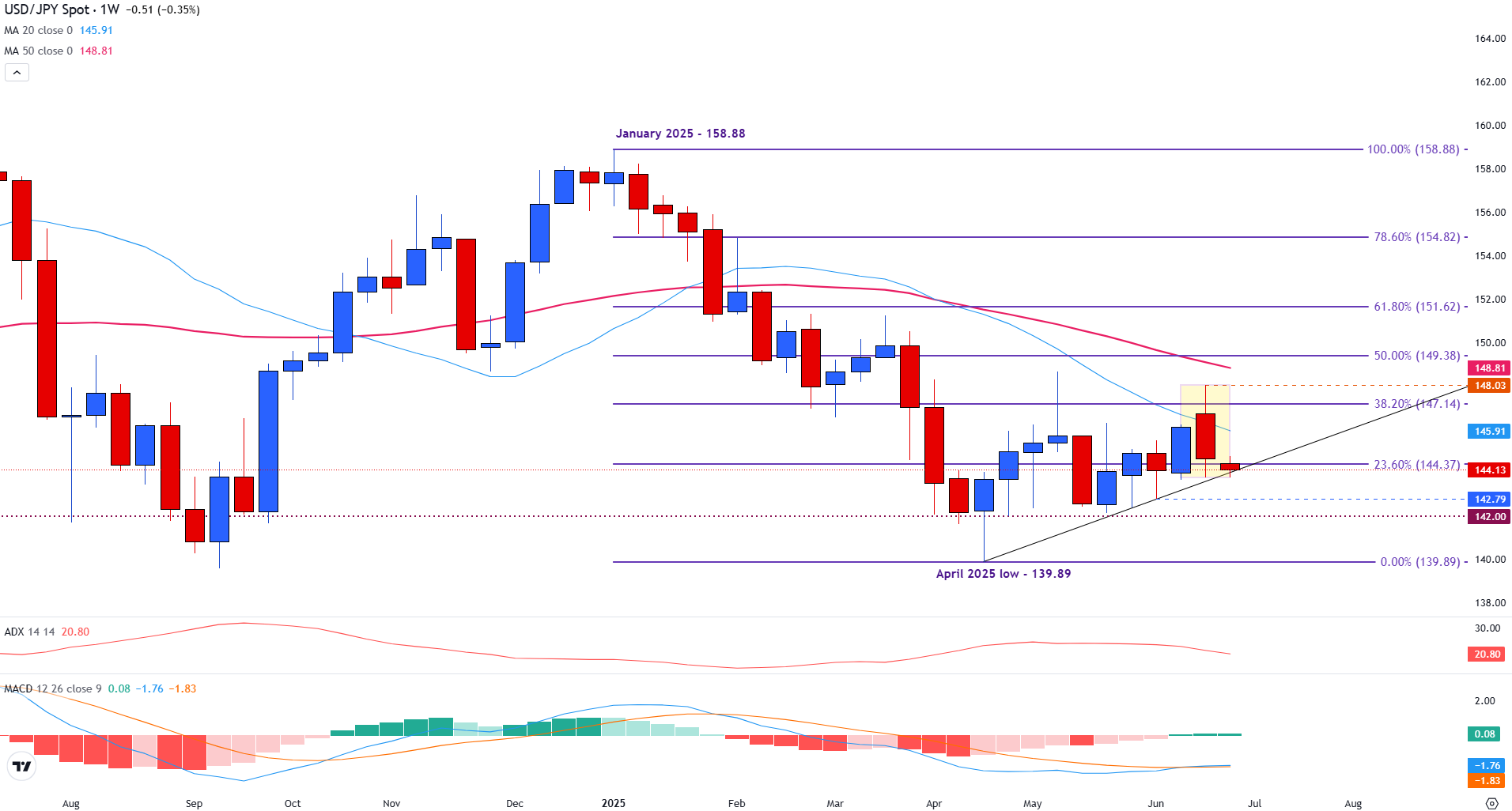

After not being able to maintain profits above the level of 148.00 last week, the torque has been falling, moving back towards the support of the ascending trend line near the level of 144.00.

This line of trend is currently aligned with the fibonacci setback of 23.6% of the fall from January to April in 144.37, an area that the torque is now trying to defend. Monday’s price action shows that the USD/JPY tries to stabilize above this support area, but impulse indicators suggest that the movement can lack conviction.

At the time of writing, the PAR quotes around 144.19. With the impulse weakening in several deadlines, the technical signals continue to indicate a market in range, increasing the risk of a break down if the support levels fail to stay.

Impulse indicators suggest a decrease in the force of the trend for the USD/JPY

The average directional index (ADX) in the daily temporal framework has fallen to 10.87, indicating an extremely weak trend, even more than weekly reading. This confirms even more than recent movements are corrective in nature instead of a sustained trend.

The convergence/divergence of mobile socks (MACD) in the daily chart is also flattening, with the histogram bars losing strength and the signal line becoming horizontal. This suggests a lack of bullish tracking after the failed break last week about 148.00.

USD/JPY DAILY GRAPH

The weekly graph then illustrates how long -term mobile means continue to act as dynamic support and resistance for the action of the USD/JPY price.

Last week, the torque shot after overcoming both the simple mobile average (SMA) and the 38.2% fibonacci setback in 147.14.

A weaker yen helped boost recovery, briefly raising the torque to re -test the psychological level of 148.00.

USD/JPY falls below the 20 -week SMA as the bullish impulse fades

However, the movement stopped as the benefits and the lack of bullish monitoring triggered a reversal. This is reflected in the thin superior wick of the weekly candle, indicating a purchase interest in decrease in about 148.00. Since then, the PAR has fallen below the 20 -week SMA, which now becomes resistance in 145.92.

The impulse signals are weakening. The ADX closed last week pointing down, indicating a decrease in the force of the trend. Meanwhile, the MACD remains below the zero line, suggesting that any increase seen so far is probably corrective instead of the beginning of a sustainable upward trend.

Weekly USD/JPY graphics

The bearish bias persists for the USD/JPy below 144.00

Looking towards this week, the action of Monday has pushed the torque towards the support of the ascending trend line, which currently remains above the psychological level of 144.00.

A rupture below 144.00 could lead to the 142.79 area to the focus, the third contact point of the ascending trend line. Below that, 142.00 is presented as another key psychological level, with a deeper movement that could expose the level of 140.00.

The April line of trend remains a short -term key support structure; However, the broader technical indicators suggest a cautious perspective. Both SMAs of 20 and 50 weeks continue to incline themselves, reinforcing the long -term bearish bias unless the price can recover and stay above the 149.00 region.

And in Japanese faqs

The Japanese Yen (JPY) is one of the most negotiated currencies in the world. Its value is determined in general by the march of the Japanese economy, but more specifically by the policy of the Bank of Japan, the differential between the yields of the Japanese and American bonds or the feeling of risk among the operators, among other factors.

One of the mandates of the Bank of Japan is the currency control, so its movements are key to the YEN. The BOJ has intervened directly in the currency markets sometimes, generally to lower the value of YEN, although it abstains often due to the political concerns of its main commercial partners. The current ultralaxy monetary policy of the BOJ, based on mass stimuli to the economy, has caused the depreciation of the Yen in front of its main monetary peers. This process has been more recently exacerbated due to a growing divergence of policies between the Bank of Japan and other main central banks, which have chosen to abruptly increase interest rates to fight against inflation levels of decades.

The position of the Bank of Japan to maintain an ultralaxa monetary policy has caused an increase in political divergence with other central banks, particularly with the US Federal Reserve. This favors the expansion of the differential between the American and Japanese bonds to 10 years, which favors the dollar against Yen.

The Japanese Yen is usually considered a safe shelter investment. This means that in times of tension in markets, investors are more likely to put their money in the Japanese currency due to their supposed reliability and stability. In turbulent times, the Yen is likely to be revalued in front of other currencies in which it is considered more risky to invest.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.