- USD/JPY hit a four-week high of 143.88 amid unscheduled BOJ bond-buying intervention.

- Initial jobless claims came in at 227,000, within estimates, and while ISM business services activity remains in expansionary territory, the reading of 52.7 indicates cooling.

- Upcoming US Nonfarm Payrolls data for July could provide additional direction for the USD/JPY pair.

The USD/JPY pair pulls back after hitting a four-week high at 143.88 after the Bank of Japan stepped in to buy Japanese Government Bonds (JGBs) following its yield curve control (YCC) change. However, buyers’ hopes were short-lived as overall Japanese Yen (JPY) strength weighed on the USD/JPY pair. The USD/JPY pair changes hands around 142.40s, down about 0.60% from its opening price in the North American mid-session.

The pair falls below its opening price by about 0.60% as unexpected bond-buying action from the Bank of Japan and mixed US economic data.

Investor sentiment remains sour, as witnessed by the fall in US stocks. US Treasury yields rise strongly, especially the benchmark 10-year note, which stands at 4.183%, gaining almost 10 basis points, but fails to support USD/JPY as the Yen holds solid. Earlier released US economic data showed jobless claims were within estimates at 227,000, the US Department of Labor reported. Although the data is encouraging the job market is easing, reports Mixed in recent months keep market participants incapable of weather when the job market cools.

The Institute for Supply Management (ISM) recently revealed that business services activity remains in expansionary territory at 52.7, below forecasts of 53, and down from 53.9 in June. Although the data is still positive, it shows that activity is cooling, putting a recessionary scenario on the table if consumers do not support the economy.

Apart from these data, the US Nonfarm Payrolls report for July on Friday is expected to offer a clear reading of the labor market. Any upward surprise could bring further rate hikes by the US Federal Reserve (Fed) on the table. Otherwise, the Fed may take a dovish stance ahead of the September policy meeting.

Meanwhile, Richmond Fed President Thomas Barkin made remarks, saying that inflation is too high, and that “last month’s inflation reading was good, and I hope that’s a sign.”

On the Japanese front, the BOJ carried out an unscheduled bond buying operation, as the 10-year JGB peaked at 0.66% as the BOJ intervened in the market to buy 400 billion yen in different maturities. Therefore, Japanese Yen traders should watch this news as volatility increases during the Asian session.

USD/JPY Price Analysis: Technical Insights

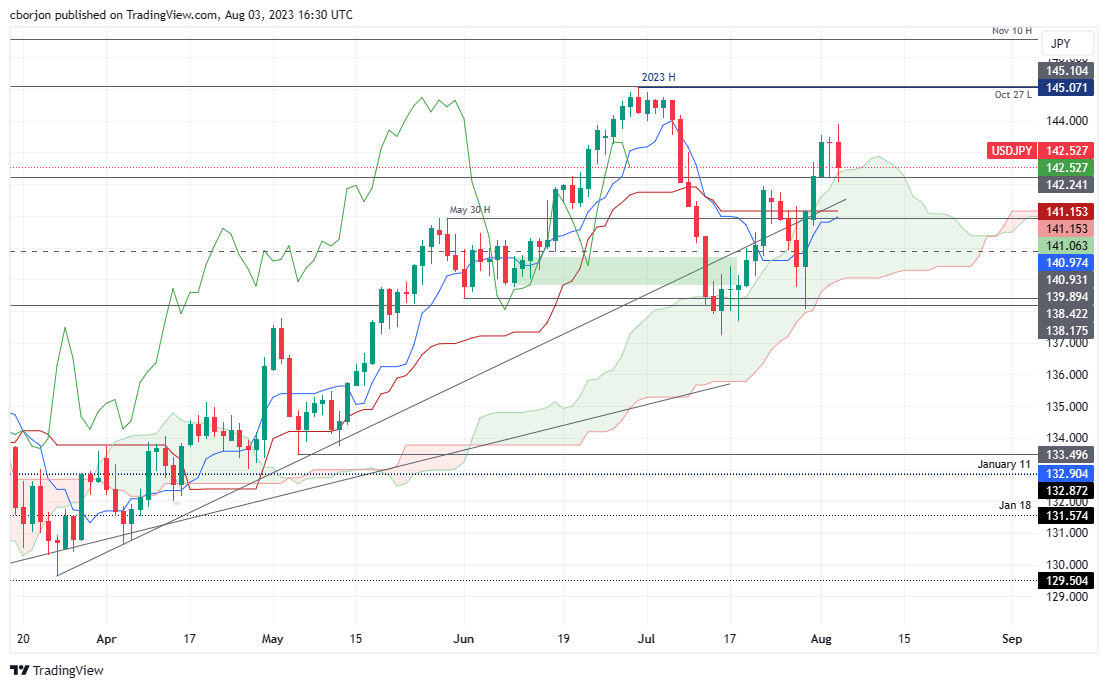

USD/JPY remains biased higher but is drifting towards the top of the Ichimoku (Kumo) Cloud, a support zone around 142.35/45. If USD/JPY falls within the Kumo, that could pave the way for further losses, with support found at the Kijun and Tenkan-Sen levels, each at 141.15 and 140.97. Conversely, if buyers recapture 143.00, the door could be opened to test the weekly high of 143.88.

USD/JPY

| Overview | |

|---|---|

| Last price today | 142.44 |

| Today Change Daily | -0.89 |

| today’s daily variation | -0.62 |

| today’s daily opening | 143.33 |

| Trends | |

|---|---|

| daily SMA20 | 140.73 |

| daily SMA50 | 141.21 |

| daily SMA100 | 137.7 |

| daily SMA200 | 136.63 |

| levels | |

|---|---|

| previous daily high | 143.48 |

| previous daily low | 142.23 |

| Previous Weekly High | 141.82 |

| previous weekly low | 138.07 |

| Previous Monthly High | 144.91 |

| Previous monthly minimum | 137.24 |

| Fibonacci daily 38.2 | 143 |

| Fibonacci 61.8% daily | 142.71 |

| Daily Pivot Point S1 | 142.55 |

| Daily Pivot Point S2 | 141.76 |

| Daily Pivot Point S3 | 141.3 |

| Daily Pivot Point R1 | 143.8 |

| Daily Pivot Point R2 | 144.26 |

| Daily Pivot Point R3 | 145.05 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.