- USD / JPY draws some buying near the 105.85 region amid widespread USD strength.

- Risk-off sentiment offers some support for the safe haven JPY and could limit any further gains.

The pair USD/JPY it has managed to bounce more than 30 pips from the lows of the Asian session on Friday, around the 105.85 region. At the time of writing, the pair remains slightly negative on the day around the 106.10-15 region.

The pair has been witness a modest intraday setback, from the 106.40-45 region in new five-month highs, amid a new wave of global risk aversion trading, which tends to prop up the safe-haven Japanese yen. Nevertheless, a global strength of the US dollar has helped limit the decline and it has helped the USD / JPY pair to attract new purchases near the 105.85 region.

As investors assimilated the pessimistic comments from Fed chairman Jerome Powell, during congressional testimony, the USD was back in demand amid a Sudden rise in US Treasury yields The US bond market has reacted strongly to the progress of a massive fiscal spending plan in the US and the impressive rate of vaccination against COVID-19 globally.

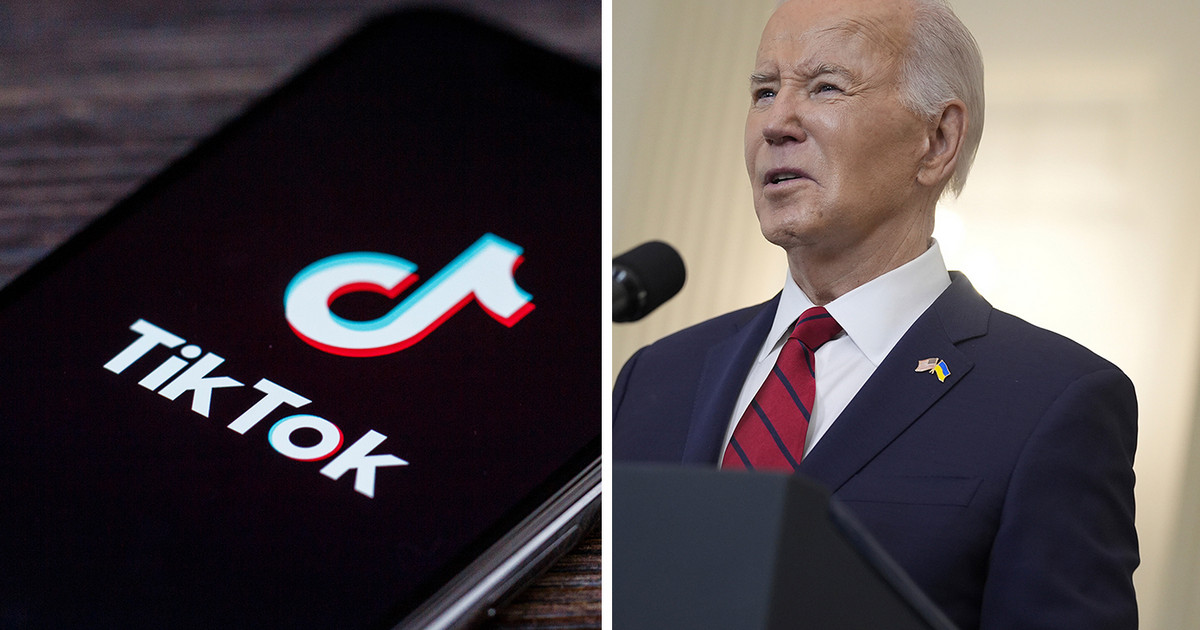

It is expected that House of Representatives vote Friday or over the weekend on the pandemic aid package of 1.9 trillion dollars proposed by the president of the United States, Joe Biden. In addition, the U.S. Food and Drug Administration has indicated that it may grant emergency use approval to the Johnson & Johnson COVID-19 vaccine by the end of this week.

Events have continued to drive the reflation trade and have pushed the 10-year US government bond yield beyond 1.50%, to highs of more than a year. This has been seen as a key factor that has provided a strong boost to the dollar. Meanwhile, the emergence of some lower level buying favors the bulls and supports the prospects for additional gains.

Market participants are now awaiting the US economic calendar, with the release of the underlying PCE price index, personal income / expense data, the goods trade balance and Chicago PMI. This, along with US bond yields, will influence the USD. Apart from this, the broader market risk sentiment could generate some trading opportunities around USD / JPY.

USD / JPY technical levels

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.