- The USD/JPY bullish trend extends driven by the stable yield of the 10-year US Treasury bond, which remains at 4.58%.

- President Trump plans new tariffs on Chinese and European goods, fueling the recovery of the US dollar.

- The Bank of Japan eyes a rate hike with wage growth and inflation improving, weakening the Yen.

USD/JPY rose in early trading during the North American session, boosted by Trump’s trade rhetoric against Canada, Mexico, the EU and China. Furthermore, a firm US dollar and a stable 10-year US Treasury bond yield pushed the pair above the 156.00 figure for a gain of 0.41%.

USD/JPY rises above 156.00, ignores BoJ rate hike speculation

On Tuesday, Trump stated that his team is discussing applying 10% tariffs on goods from China on February 1, while tariffs on European goods are also being considered. Meanwhile, the dollar rebounded after Monday’s 1.22% drop as Trump toned down his trade rhetoric in his inauguration speech.

Meanwhile, the US Dollar Index (DXY), which tracks the performance of the Dollar against a basket of six currencies, is unchanged at 108.13. The yield on the 10-year US Treasury bond is 4.58%, flat.

The Japanese Yen remains slightly weaker even though the Bank of Japan (BoJ) is expected to raise rates at its January 23-24 meeting. Governor Kazuo Ueda and his team have been given the green light as Japanese retailers are raising wages for the second year in a row amid rising inflation and difficulties hiring staff.

In terms of data, the US economic agenda remains absent. In Japan, the December Trade Balance is expected to reduce the deficit to ¥-55B from ¥-117.6B.

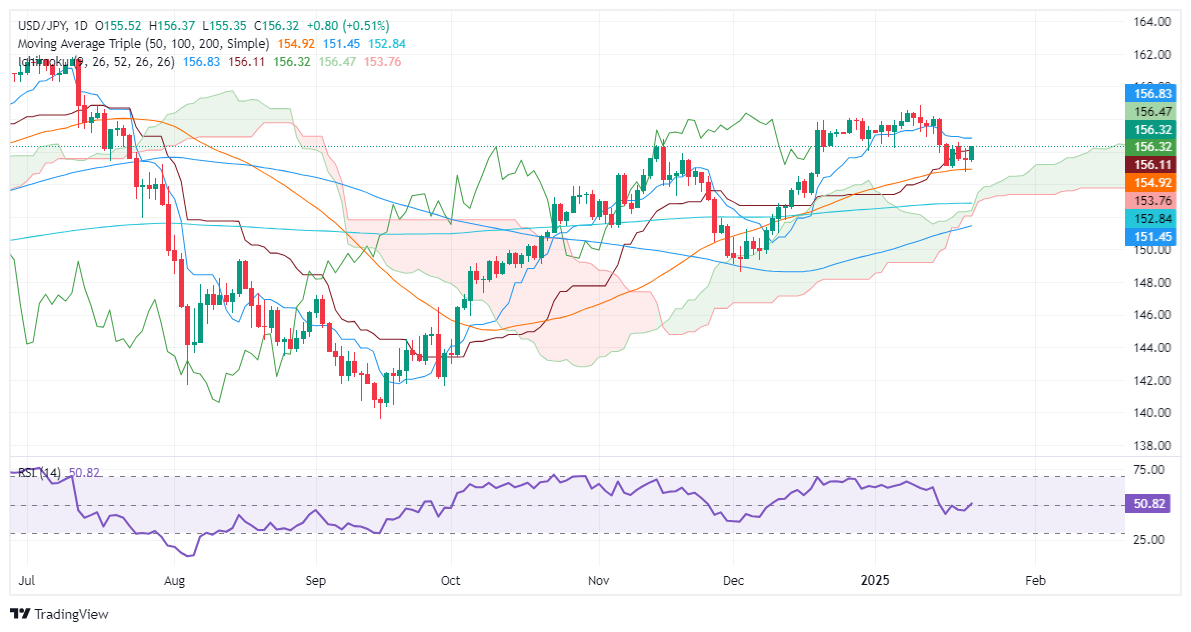

USD/JPY Price Analysis: Technical Perspective

USD/JPY rebounded after hitting a weekly low of 154.76, failing to test a four-month support trend line drawn from the October 2024 lows of 139.56.

However, buyers stepped in and pushed the exchange rate beyond the 155.00 and 156.00 figures as they target the Tenkan-sen at 156.82. A break of the latter will expose the figure of 157.00, followed by the daily high of January 14 at 158.20.

Conversely, if USD/JPY falls below 156.00, it would expose 155.00, followed by the January 21 low of 154.76.

Japanese Yen PRICE Today

The table below shows the percentage change of the Japanese Yen (JPY) against major currencies today. Japanese Yen was the strongest currency against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | 0.17% | 0.53% | 0.28% | 0.02% | 0.10% | 0.14% | |

| EUR | -0.02% | 0.15% | 0.50% | 0.25% | 0.00% | 0.08% | 0.11% | |

| GBP | -0.17% | -0.15% | 0.39% | 0.10% | -0.15% | -0.07% | -0.06% | |

| JPY | -0.53% | -0.50% | -0.39% | -0.25% | -0.50% | -0.43% | -0.41% | |

| CAD | -0.28% | -0.25% | -0.10% | 0.25% | -0.25% | -0.17% | -0.17% | |

| AUD | -0.02% | 0.00% | 0.15% | 0.50% | 0.25% | 0.08% | 0.09% | |

| NZD | -0.10% | -0.08% | 0.07% | 0.43% | 0.17% | -0.08% | 0.00% | |

| CHF | -0.14% | -0.11% | 0.06% | 0.41% | 0.17% | -0.09% | -0.00% |

The heat map shows percentage changes for major currencies. The base currency is selected from the left column, while the quote currency is selected from the top row. For example, if you choose the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change shown in the box will represent the JPY (base)/USD (quote).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.