- The USD/JPY is strengthened above 144.00 while investors weigh the US inflation data and a softer Japanese ICC.

- Commercial optimism between the US, China and the EU elevates the global feeling, pressing the flows to the Yen as a safe refuge.

- The BOJ is expected to keep the fees in July, while the Fed faces political tensions in mixed US data.

The Japanese Yen (JPY) is weakening against the US dollar (USD) on Friday, since markets weigh new inflation figures and a change in appetite for risk.

At the time of writing, the USD/JPY is quoted above 144.00, recovering the simple mobile average (SMA) of 20 days in 144.57.

Inflation in Japan cools while the U.S. Underlying PCE shows high price pressure signs

In Japan, Thursday’s consumer price index data showed that inflation slowed down a bit in May. This has increased the expectations that the Bank of Japan will not move the rates in July.

Although inflation remains above the 2% objective of the Boj, the slowest pace seems to be giving those responsible for the policy some maneuvering margin.

In the US, the numbers of personal consumption spending (PCE) on Friday came hotter than expected. May data showed that underlying inflation increased 0.2% in the month, with an annual rate of 2.7%. Both figures exceeded consensus.

This has indicated that inflation has not cooled as much as Fed would like. But at the same time, personal income and personal spending were weak, and the latest data from the University of Michigan showed that consumer inflation expectations decreased.

This combination adds to the growing signs that the US economy may be losing impulse. With President Trump continuing to pressing the Fed for feat cuts, the operators are trying to read between the lines.

In addition, the US and China ended the commercial agreement agreed in June, which increased the appetite of investors for risk. Throughout the week, the decrease in geopolitical tensions in the Middle East has reduced the demand of Yen as an active refuge.

The USD/JPY remains supported by the psychological level of 144.00

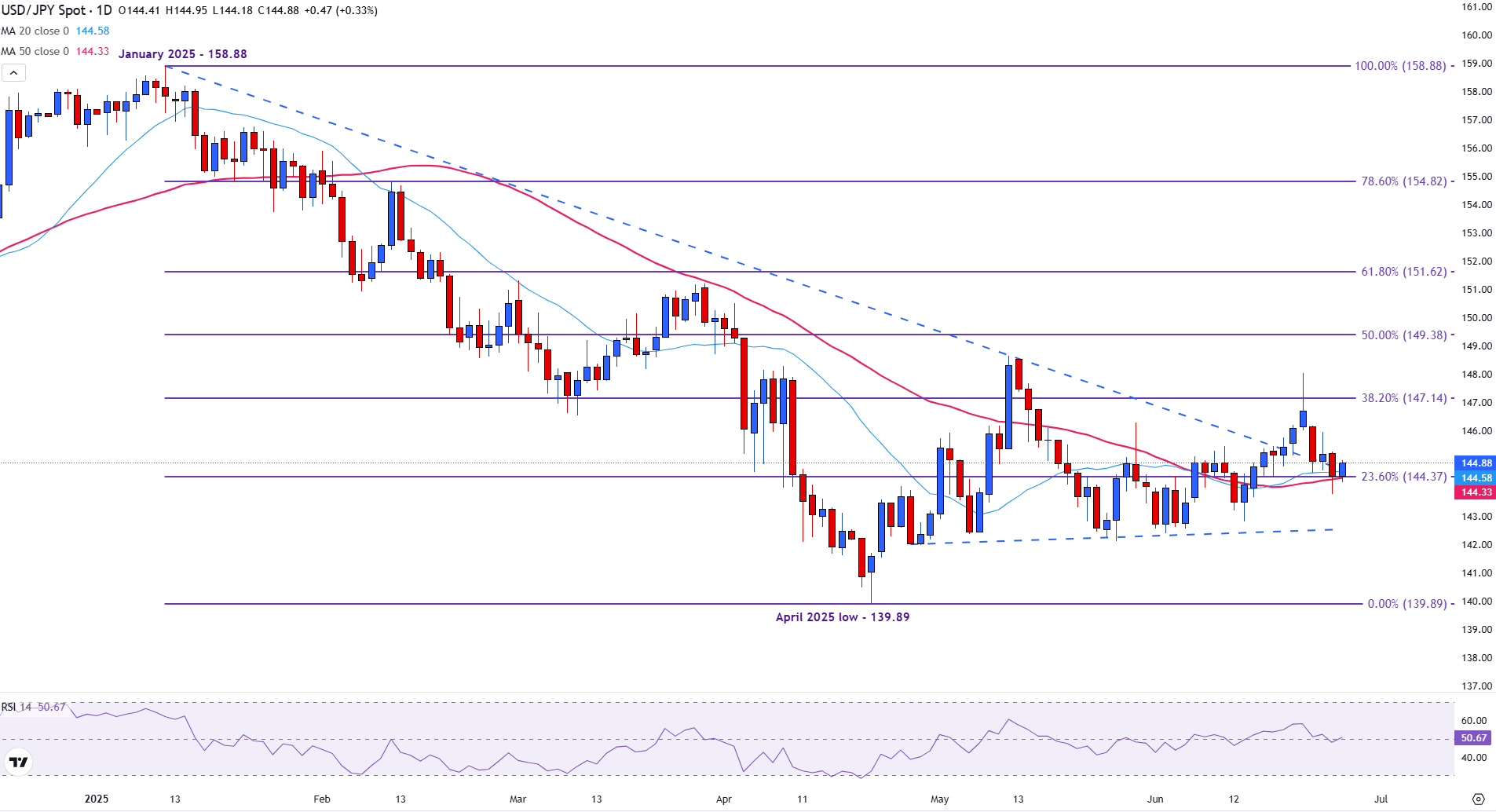

The USD/JPY is around 144.88 at the time of writing, with the pair supported by the Fibonacci recoil level of 23.6% of the fall from January to April in 144.37.

Prices are currently being negotiated near a support group. Simple mobile means (SMA) of 20 days (144.57) and 50 days (144.33) are converging in this area.

The psychological level of 145.00 provides short -term resistance in 145.00, a break from which you could see prices re -test the maximum of Tuesday of 146.19. Above that is 147.14, which marks the fibonacci setback of 38.2%. This level is also aligned with a line of descending trend that has limited the price action since February.

USD/JPY DAILY GRAPH

A rupture is needed above this region to open the road to 149.38 (50%decline). The Relative Force Index (RSI) is about 50, reflecting a neutral momentum and a strong directional lack of directional conviction. A daily closure below the area of 144.30–144.40 would probably expose the negative side around 143.00, with a stronger support seen about 141.60–142.00.

And in Japanese faqs

The Japanese Yen (JPY) is one of the most negotiated currencies in the world. Its value is determined in general by the march of the Japanese economy, but more specifically by the policy of the Bank of Japan, the differential between the yields of the Japanese and American bonds or the feeling of risk among the operators, among other factors.

One of the mandates of the Bank of Japan is the currency control, so its movements are key to the YEN. The BOJ has intervened directly in the currency markets sometimes, generally to lower the value of YEN, although it abstains often due to the political concerns of its main commercial partners. The current ultralaxy monetary policy of the BOJ, based on mass stimuli to the economy, has caused the depreciation of the Yen in front of its main monetary peers. This process has been more recently exacerbated due to a growing divergence of policies between the Bank of Japan and other main central banks, which have chosen to abruptly increase interest rates to fight against inflation levels of decades.

The position of the Bank of Japan to maintain an ultralaxa monetary policy has caused an increase in political divergence with other central banks, particularly with the US Federal Reserve. This favors the expansion of the differential between the American and Japanese bonds to 10 years, which favors the dollar against Yen.

The Japanese Yen is usually considered a safe shelter investment. This means that in times of tension in markets, investors are more likely to put their money in the Japanese currency due to their supposed reliability and stability. In turbulent times, the Yen is likely to be revalued in front of other currencies in which it is considered more risky to invest.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.