- The Mexican peso extends its recovery amid improving risk sentiment.

- USD/MXN falls for the second day in a row.l

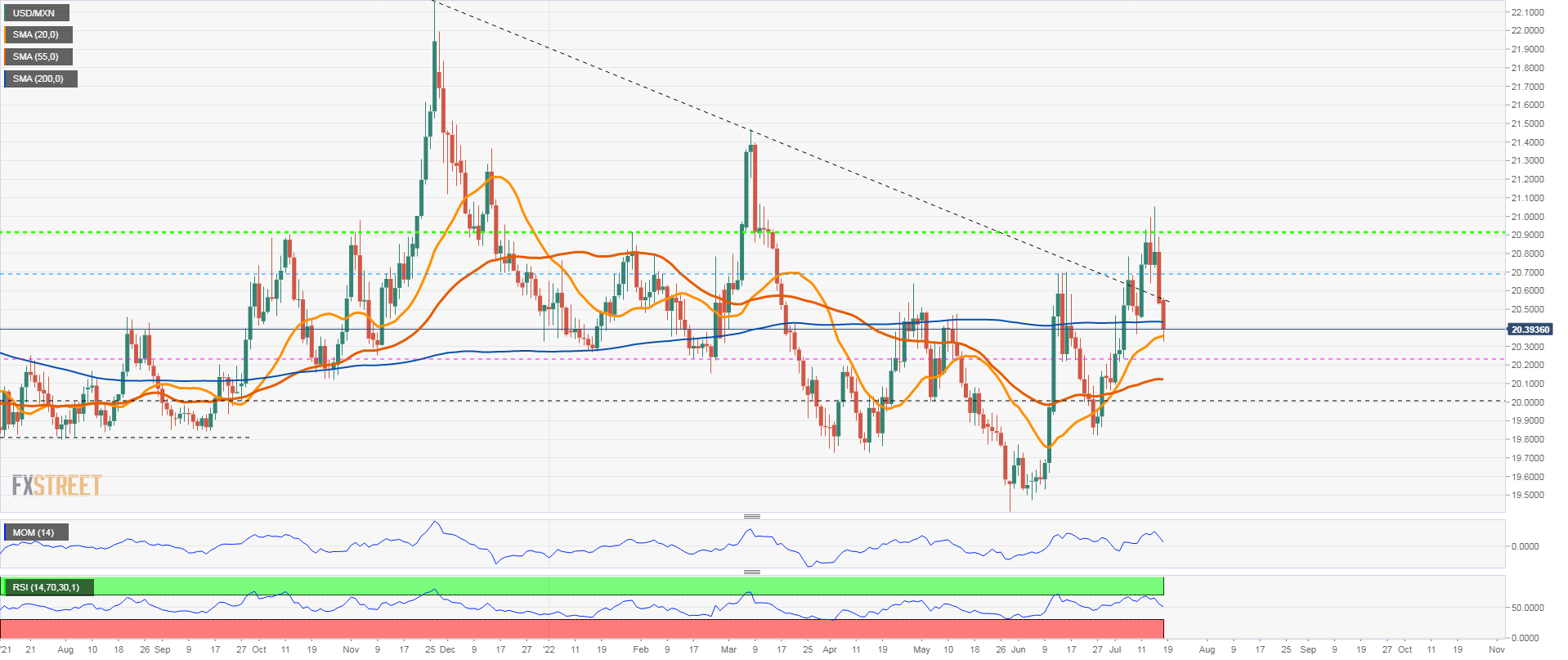

- Key support at 20.30/35, dollar strengthens above 20.45.

Emerging market currencies rose for the second day in a row on Monday, amid a global improvement in market sentiment. Stability in US yields and rising commodity prices offer relief to riskier currencies such as the Mexican peso.

USD/MXN reached a high above 21.00 last week, levels not seen since March. It failed to hold above 21.00 (nor did it post a daily close above 20.90) and initially fell back to 20.60. On Friday, it broke down and on Monday it sudoo at 20.32, close to the 20-day SMA.

During the American session, USD/MXN is bouncing off the key support zone around 20.33. If it moves above 20.45 again, the Mexican peso would lose strength, opening the doors to a test of 20.70, which is once again a critical resistance.

The pullback from the monthly highs so far represents a correction in the USD/MXN. The short-term bias remains bullish. A consolidation below 20.45 would keep the upside limited. A close below 20.22 could change the short-term trend to neutral.

USD/MXN daily chart

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.