- USD/TRY gains additional traction on the upside near 18.60.

- Turkey’s manufacturing PMI dropped to 46.90 over the past month.

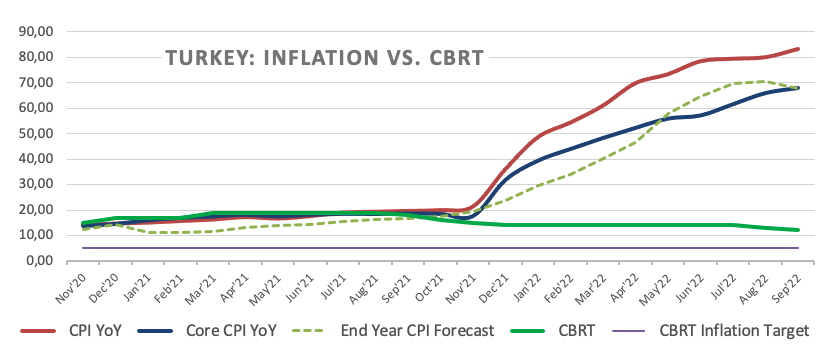

- Inflation rose to a 24-year high above 83% in September.

The Turkish lira accelerates its depreciation and raises the USD/TRY to a new all-time high above 18.57 on Monday.

USD/TRY strengthens after the IPC, and looks for the recovery of the dollar

USD/TRY resumes the upward path on Monday after the Turkish inflation figures were released again, in which the CPI hit the highest pace since July 1998, at 83.45% YoY, while prices at the consumption increased by 3.08% compared to the previous month. Also weighing on sentiment, Producer Prices rose at an annualized rate of 151.50% YoY and 4.78% YoY.

In addition, the increase in transport and food costs, together with a significant increase in housing prices, were the cause of a new rise in the national CPI in September.

Additional releases noted that the Manufacturing PMI dipped slightly to 46.90 in September (from 47.40).

Additional gains in the pair also come from the dollar’s better tone, which adds to Friday’s advance and maintains the mood in the risk complex.

The lyre, therefore, enters its Tenth consecutive month with losses and is already down more than 40% so far this year (compared to 44% in all of 2021).

What to look for around the TRY

USD/TRY continues to navigate the all-time high zone near 18.60 amid the combination of ever-present lira weakness and relentless dollar rally.

So far, price action around the Turkish lira is expected to continue to revolve around developments in energy and commodity prices – which are directly correlated to developments in the war in Ukraine – broad trends in risk appetite and the path of Fed rates in the coming months.

Additional risks facing the Turkish currency are also coming from within, as inflation shows no signs of abating (despite rising less than expected in July and August), real interest rates remain well entrenched in negative territory and political pressure for the CBTR to lean towards low interest rates remains pervasive.

Furthermore, the lira will continue to suffer against the background of Ankara’s plans to prioritize growth (through higher exports and tourism revenues) and improving the current account.

Technical levels

So far the pair is gaining 0.59% at 18.5616 and faces the next hurdle at 18.5737 (Oct 3rd all-time high), followed by 19.00 (round level). To the downside, a break below 18.0801 (55-day SMA) would expose 17.8590 (weekly low Aug 17) and finally 17.7586 (monthly low).

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.