- USD/TRY flirts with the 18.73 level, new all-time highs.

- Inflation in Turkey surprised to the downside in December.

- CBTR could prolong the stagnation in the next meetings.

The Turkish lira pared some of Tuesday’s gains and motivates the USD/TRY to continue to rise and reach new all-time highs near 18.73 on Wednesday.

USD/TRY continues to consolidate broadly

The price action in the USD/TRY maintains for the moment the erratic behavior of several months.

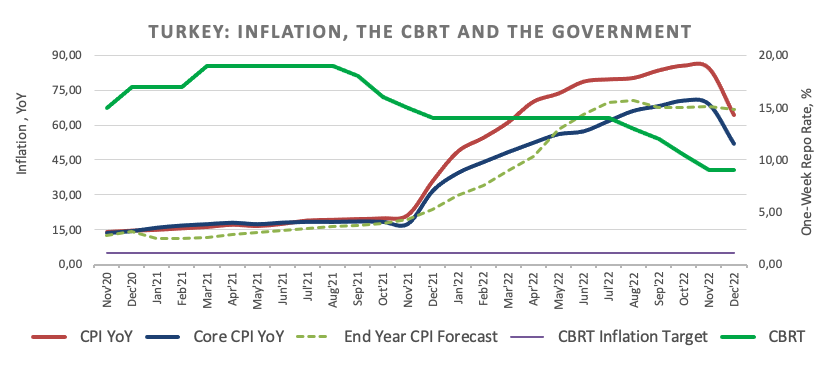

Indeed, the pair remained largely apathetic to the latest release of domestic inflation figures, where the CPI further extended the decline from 24-year highs recorded in October 2022, always on the back of strong base effects.

In the latter case, the general CPI rose 64.27% annualized in December, while the core CPI advanced 51.93% year-on-year and Producer Prices rose 97.72% year-on-year.

Looking ahead, the current disinflation appears to be in line with President Erdogan’s view that inflation should decline sharply during the first half of the new year, in the absence of strong headwinds and in a relatively stable macroeconomic environment.

In this context, the Central Bank of Turkey (CBTR) could refrain from acting on interest rates, after cutting 500 basis points last year.

What to keep in mind about the TRY

USD/TRY remains within the multi-month consolidative trend near all-time highs in the 18.70 zone.

So far, the price action around the Turkish lira is expected to continue to oscillate around the evolution of energy and raw material prices – which are directly correlated with the evolution of the war in Ukraine -, the general risk appetite trends and dollar dynamics.

Meanwhile, the lira is expected to remain under scrutiny in response to Ankara’s plans to prioritize growth by turning current account deficit into surplus and always following a recipe for lower interest rates.

technical levels

For now, the pair gains 0.25% at 18.7041 and faces the next hurdle at 18.7287 (4th Jan all-time high) followed by 19.00 (round level). To the downside, a break below 18.5992 (55-day SMA) would expose 18.5565 (weekly low Dec 26) and finally 18.4827 (monthly low Dec 13).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.