- The Turkish Lira depreciates slightly to around 32.20 against the Dollar.

- The CBTR left the one-week repo rate unchanged at 50.0%.

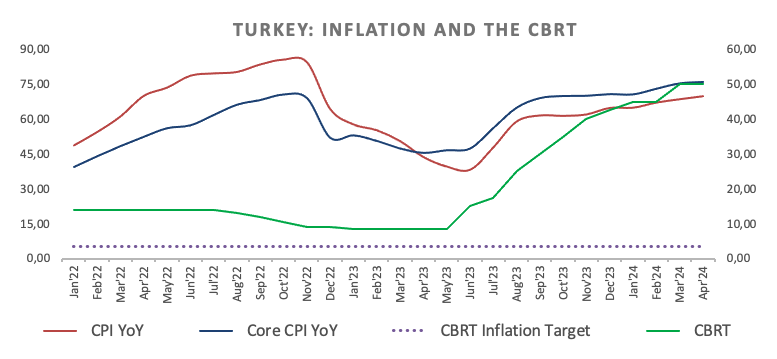

- The central bank sees a disinflationary scenario in the second half of 2024.

On Thursday, the Turkish Lira maintains its consolidation phase, hovering around the minimum of 32.00 after the CBTR decision on interest rates.

USD/TRY faces further consolidation in the near term

For now, there has been no change in the sideways theme surrounding the Turkish currency, which has remained trapped within the 32.00-32.60 range since mid-March.

On Thursday, the Central Bank of Turkey (CBTR) left its one-week double trading rate unchanged at 50.00%, as widely expected.

The CBTR stated that its rate decision came after taking into account the lagged effects of monetary tightening, adding that it is closely monitoring the effects on credit conditions and domestic demand.

In the statement, the bank emphasized its vigilance regarding inflation risks, citing a “limited decline in the underlying monthly inflation trend in April.”

In addition, the bank also indicated that it would tighten its policy if a significant and persistent rise in inflation was anticipated.

Looking ahead, market expectations point to an increase of almost 72 basis points at the bank's next meeting on June 27.

It is worth noting that headline inflation in Türkiye increased by 69.80% until April.

Key levels for USD/TRY

At the moment, the pair advances 0.10% to 32.1950 and faces the next bullish barrier at the all-time high of 32.6461 (April 19). On the other hand, a break below the weekly low of 31.9722 (Apr 29) would expose another weekly low of 31.7390 (March 21) and finally the temporary 100-day SMA of 31.4788.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.