Currently, $175 billion in BTC makes up about 15% of the total capitalization of the first cryptocurrency, which reaches about $1,125 billion. A few days ago, the figure was noticeably higher, but in recent days the Bitcoin rate has fallen from $64,000 to $57,000.

“Interest in Bitcoin among institutional investors is also growing. Hedge funds, asset management firms and endowments are increasingly recognizing Bitcoin's potential as a store of value,” VanEck analysts wrote.

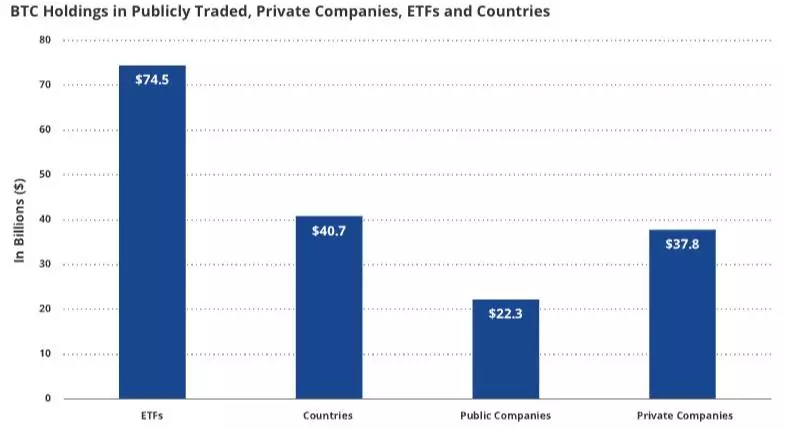

Currently, ETFs account for the largest share – $74.5 billion. In second place are wallets owned by states – $40.7 billion. Wallets of private and public companies account for, respectively, $37.8 billion and $22.3 billion in BTC.

The report also notes that Bitcoin continues to gain popularity as a means of payment and infrastructure for various projects.

Earlier, VanEck CEO Jan van Eck said that investor interest in Bitcoin is growing amid a possible financial crisis in the United States.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.