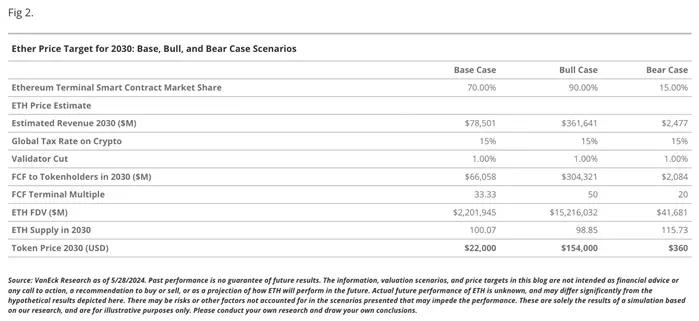

An optimistic forecast assumes an increase in the value of the second largest cryptocurrency by capitalization to $154,000, and a negative forecast – $360. VanEck experts clarified: the assumptions are based on the likely launch of spot exchange-traded funds for ether in the United States and progress in scaling the Ethereum ecosystem.

“We expect that spot Ether ETFs will soon be approved for trading on US stock exchanges. This will allow financial advisors and institutions to own a unique asset,” VanEck representatives emphasized.

The investment attractiveness of Ether is growing, and the ecosystem continues to grow thanks to the participation of large financial funds and technology corporations:

VanEck experts believe that ether should be considered as “programmable money” and as “digital oil”, which has few analogues in the non-cryptocurrency financial world.

Previously, QCP Capital experts indicated that Ether was ahead of Bitcoin in terms of volatility by 15% and the markets remain bullish on ETH.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.