Against the background of correction, large holders of bitcoin and Ethereum demonstrate conflicting strategies. Some fix profit, others buy on a drawdown.

Lookonchain analysts drew attention to the “waking up” after 12 years of Kit, who transferred 750 BTC ($ 83.3 million) to Binance.

A bitcoin og “BC1QLF” Sold Another 750 $ BTC($ 83.11m) in the pass.

12 Years Ago, He Receved 5k $ BTC($ 1.66M then) AT Only $ 332 and Only Started Selling AFTER $ BTC Broke $ 90k in December 2024.

He Has Sold 1.750 $ BTC($ 189.3m) AT $ 108,160 AVG, Leaving 3.250 $ BTC($ 360.75M). … pic.twitter.com/m3g3lhgm9c

– Lookonchain (@lookonchain) August 27, 2025

The crypto -investor acquired coins in 2013, when Bitcoin traded $ 332, and began to sell them in December last year. According to the specialists, its profit amounted to $ 510 million.

According to ARKHAM, after the last transaction on the whale balance there were still 750 BTCs, and on the wallet connected with it – 2500 BTC (~ $ 276.5 million).

The user under the nickname DOXXED suggested that the investor is preparing to buy Ethereum. Earlier, experts reported another large digital gold holder, which was activated for the first time in seven years and bought 62,914 ETH ($ 270 million) in the spot market.

Lookonchain noted that the address may be connected with another whale that performed a similar operation. On August 21, he sold 670 BTC ($ 76 million) to buy 68 130 ETH ($ 295 million).

Ethereum Chits use the moment

On August 26, Ethereum-Kit inactive since 2021 has withdrawn 6334 ETH ($ 28 million) from the Kraken exchange, the analyst said under the pseudonym Cryptogoos.

After 4 years of silence …

This Whale Just Bours $ 28m Worth of $ Eth.

He Knows Someting. pic.twitter.com/dqigdfy6ag

– Cryptogoos (@crypto_goos) August 26, 2025

According to Coingecko, over the past few days, the broadcast of the broadcast has sank by 13% – from $ 4900 to $ 4300. Experts believe that large investors regarded the correction as a suitable time to accumulate an asset.

Another unknown participant who bought Ethereum by $ 2.55 billion through Hyperlique and blocked them in stakeing conducted a larger operation.

ARKHAM specialists also said that nine addresses associated with whales bought an air of $ 456.8 million. Five of them made transactions through the BitGo platform, and the rest through the OTC platform Galaxy Digital.

9 Whale Addresses Just Bours $ 450m of Eth

9 Massive Addresses Just Bourst a Total of $ 456.8 Million Usd of Eth. 5 of these Addresses Receved from Bitgo While the Remachased Their Eth With Galaxy Digital OTC.

Whales Are Buying $ Eth.

Addresses: … pic.twitter.com/tcezqlng6w

– Arkham (@arkham) August 26, 2025

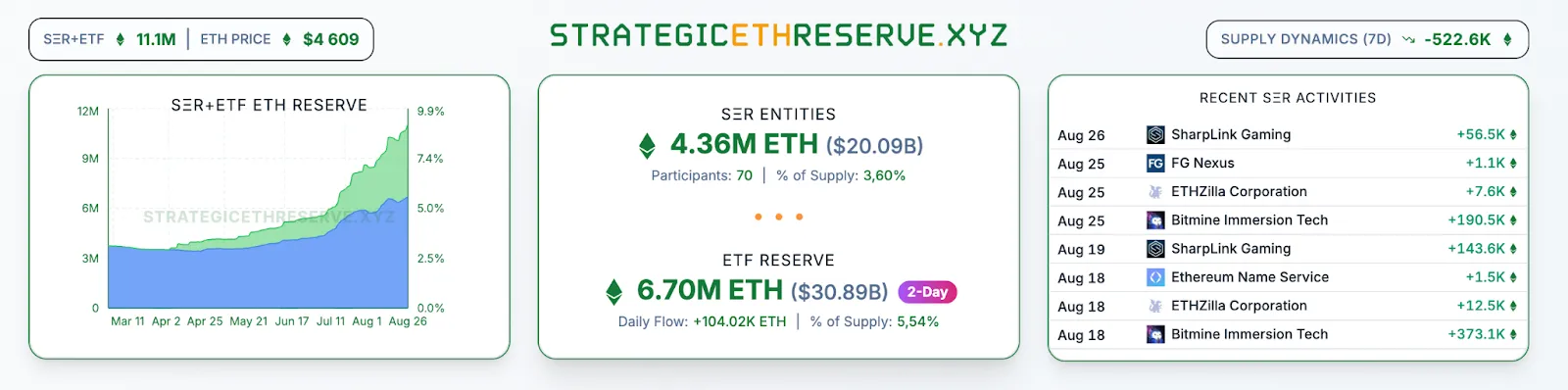

Demand for Ethereum continues to grow from the corporate sector. Over the past week, Bitmine bought a cryptocurrency for $ 2.2 billion, bringing reserves to 1.7 million ETH in the amount of $ 7.9 billion.

Meanwhile, the explosive ETF based on the air attracted more than $ 1 billion from August 21, compensating for the previous outfills.

At the time of writing under the control of exchange funds and public firms, there are more than 9% of the total offer of Ethereum.

Recall that in August, the head of the Standard Chartered digital asset research department Jeffrey Kendrick called the air and the companies that own it were underestimated.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.