This is what you need to know to trade today monday september 12:

Equity markets finished last week on a strong note as investors returned to equities after three consecutive weeks of losses. All eyes now turn to Tuesday’s CPI report and to the expectations that we have reached the peak of inflation. With oil prices down, used car prices down, and a whole host of commodities down, we should get the figure needed to sustain this petito rally because of the risk. This will keep talk of a Fed pivot going and bond yields should remain capped in the short term.

Already over the weekend, we got a consolidation of last week’s significant gains from the Bitcoin. Bitcoin ended the week at $21,300 and this morning it is at $22,300. Right now Bitcoin is probably the best barometer of risk we have so futures are pointing higher at the open and European equity indices are strong. Bond yields are already lower, so it’s all set. That always makes the contrarian in me nervous and in fact the risk-reward trade before the IPC is lower.

The market expects the CPI to have peaked, so if it doesn’t, equities will go down considerably. Otherwise, we should have a constant and measured extension. Friday sees the options expiry so the spotlight will be on that and keep things reasonably choppy.

The dollar has remained lower this morning despite the Bank of Japan pledging to defend its position on the JGB, but the dollar index is down as low as 108.19. Bitcoin, as mentioned, continues to rise to $21,300 and gold to $1,728. Oil rises to $88.27.

European markets rise:

- Eurostoxx +1.3%.

- FTSE +1%.

- Dax +1.6%.

US futures also higher:

- S&P +0.3%.

- Down +0.2%.

- Nasdaq +0.3%.

Top Wall Street News (SPY)(QQQ)

- The US is preparing to impose more restrictions on sales of semiconductors to China.

- Clovis Oncology (CLVS) rises after updating the Rubraca treatment.

- Bristol Myers Squibb (BMY) rises 7% after FDA approval for Sotyktu.

- Caravan (CVNA) enhanced by Piper Sandler.

- Tuesday Morning Corp (TUEM) down Monday morning on new strategic investment from Retail Ecommerce Ventures-Benzinga.

- The CEO of Disney (DIS) says at the D23 conference that he has big plans for ESPN.

- Microstrategy (MSTR) submits a request for the sale of shares, the second request says that it is to finance the purchases of Bitcoin-Benzinga.

- Netflix (NFLX) and UbiSoft they will release three games in 2023-Benzinga.

- Restaurant Brands International (RBI) will spend $400 million on advertising and renovation.

- Yum Brands (YUM) approves a tasty buyback of 2,000 million dollars.

- Target (TGT) says it has a multi-year agreement with FAO Schwarz for the distribution of toys.

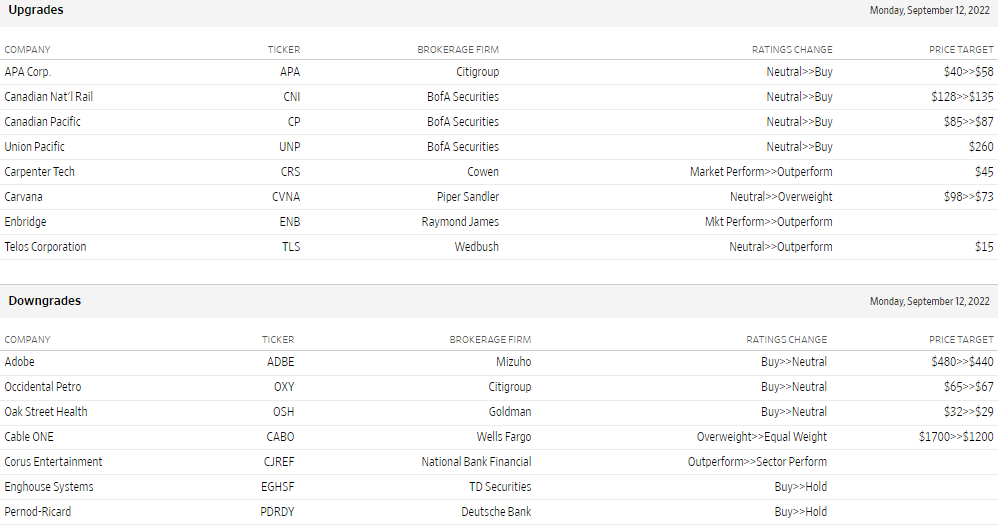

Upward and downward revisions

Source: WSJ.com

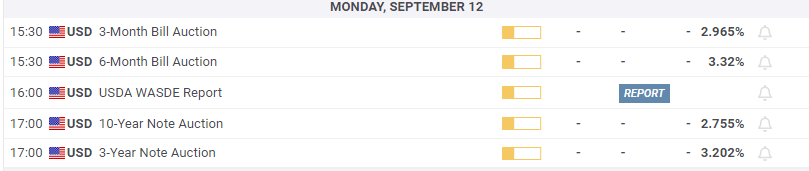

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.