This is what you need to know to operate today, Wednesday, October 19

Equity markets started the week in a bullish fashion as Monday’s strong gains were initially consolidated in the early part of the session on Tuesday. However, bond yields remained stubbornly above 4% across the curve, dampening equity enthusiasm and seeing the recovery falter as it progressed on Wednesday. However, the bulls have regained some steam after another series of solid gains across the board. Most notable of all was the strong Netflix subscriber growth, sending shares up 13% after the day.

This morning we have already seen that the trend continues with the airlineswhich now seem strong, and the food companies they appear to be in good shape, as Nestle boosts prices without destroying demand. It is becoming increasingly clear that, for many companies, demand is holding up even as inflation rages. This is the beginning of an inflationary phase, and that can often be the case. Once consumers run out of savings and interest rate hikes hit, the second half of an inflationary recession is when the damage happens. All of this means there is no hope of a Fed policy shift, and even a more aggressive stance may be needed.

The dollar is reluctant to break above 150 against the yen but continues to rise, with the Dollar Index up nearly 1% at 112.92. Oil rises despite the US saying it will draw back on strategic crude reserves. Bitcoin is down, and gold is also down at $1,633. One of the headwinds to this latest rally in equities is rising bond yields. Inflation in the UK is back above 10%, and 10-year and 30-year yields in the US are now approaching 4.1%. This will hit the high duration sector hard. Tesla needs to sustain this recovery with decent earnings after the close.

markets europeans down: Eurostoxx -0.5%, FTSE -0.7% and Dax -0.2%.

The american futures down: Nasdaq, S&P and Dow -0.4%.

Wall Street Top News (SPY) (QQQ)

British inflation exceeds 10% again in September, above forecasts.

Proctor & Gamble (PG) exceeds its profits thanks to the rise in prices.

ASML rises 5% after his good profits.

earnings fromTesla (TSLA) after closing.

Amazon (AMZN) launches into home insurance in the UK.

Netflix (NFLX) ) increases your subscribers, BPA and earnings.

Elevance Health (ELV) continues with profits and raises its prospects.

nasdaq (NDAQ): (the value, not the index!) Increase profits and income.

United Airlines (UAL) exceeds revenue and raises forecasts.

Nestle raises its forecasts for the whole year, since it has carried out a price increase without adverse effects.

Travelers (TRV) exceeds the top and bottom lines.

JB Hunt Transport (JBHT) mentions a less intense Christmas season due to a lower volume of shipments. It triumphed in EPS and profits.

Interactive Brokers (IBKR): increases the interest margin.

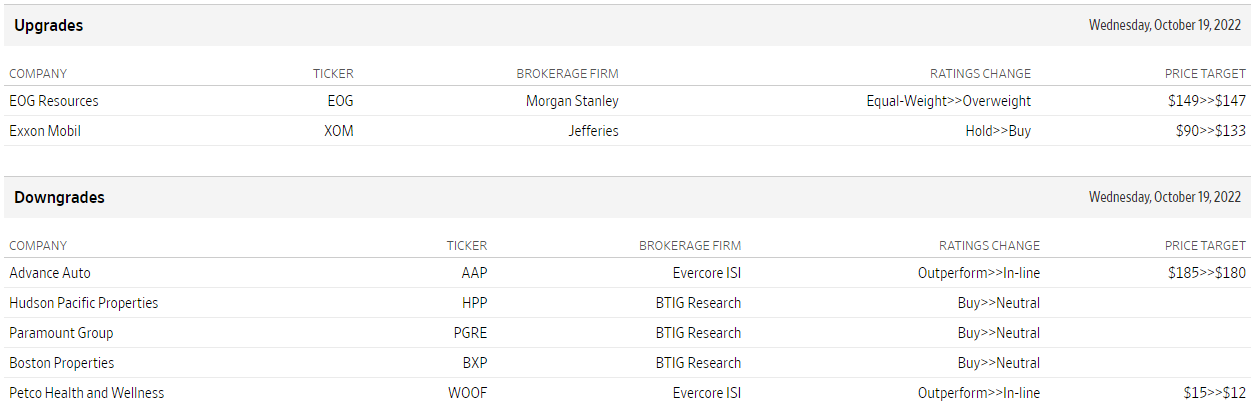

ascents and descents

Source: WSJ.com

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.