- Equities remain under pressure from rising yields.

- CPI report continues to pressure valuations, equities suffer.

- The Fed is expected to raise rates by 75 basis points on Wednesday and signal more to come.

Equity markets remain under pressure as CPI data put to rest the idea of an imminent Fed pivot. Fixed income markets immediately priced in the rate hike, which in turn caused the plunge in equities. The 2-year yield is now approaching 4% and puts an end to the so-called TINA (there is no alternative) operation.

Now there is, and investors are likely to flock to short-dated bonds to hedge against further equity market volatility. High-duration assets such as the Nasdaq stand to lose the most in such an environment, and with any Fed pivots now out of the picture, it looks like there may be more pain for this sector. Bitcoin is already showing signs of its intent by dipping back below $19,000. All eyes will now turn to the Fed on Wednesday. After the CPI, there has been talk of a 100 basis point rate hike, but I and much of the market think this is unlikely.

Rather, the Federal Reserve will opt for more of the same with another 75 basis point hike. However, Powell is unlikely to be so vague this time. Last time he surprised the markets and sparked a huge risk rally when he said the Fed would be more data reliant. Still, the data remains bullish, as last week’s CPI shows. So this will have further reinforced the need for a strong unambiguous aggressive message. It seems that the Fed is finally getting more and more concerned about how sticky inflation is getting and how this will affect consumers. In any case, I expect Powell to surprise on the aggressive side. He won’t make the same mistake as last time and, in any case, he will be a hawk. In my opinion, the risk-reward ratio is lower. Everyone expects 75 basis points and moderate speech.

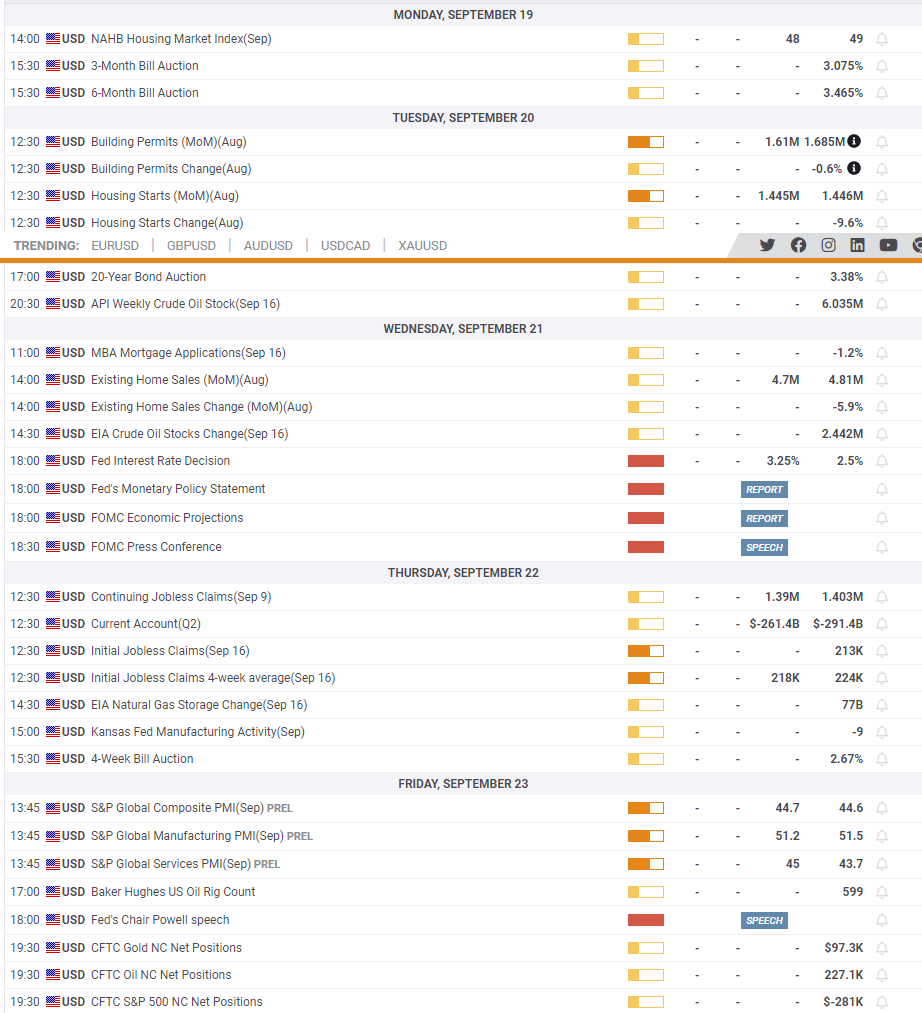

Until then, we may see a modest recovery or stabilization. We’ve already seen some high-beta names outperform, and one unusual sight was the Nasdaq outperforming the S&P 500 on a down day on Friday. A choppy closing of positions is expected on Monday and Tuesday. On Thursday, the Bank of England and the Bank of Japan will announce their decisions and central banks around the world will talk about them. Some key housing data will be released early in the week, attracting more and more attention. Rising interest rates are going to hold back US real estate, but for how long and how quickly does this carry over into the real world? This week’s data will start to show it.

For now, rates are still trading higher, which is not positive for equities. All eyes are now on Powell.

Fed re-pricing still in motion, with more priced for 2022-2023, and a slower pivot priced than before (= more sticky hawkishness becoming the central case)

Fed/Money market rates now priced above 4% by early 2024, compared to pic.twitter.com/SDmS2UUDC4

— Jens Nordvig (@jnordvig) September 19, 2022

The forward price-to-earnings ratios of the Nasdaq 100 and the Stoxx 600 Technology Index have been inversely correlated to the move in the 10-year inflation-protected Treasury yield (TIPS), which reached its highest level since 2018 – Bloomberg pic.twitter.com/oIcG59FqwO

— Christophe Barraud (@C_Barraud) September 19, 2022

Meanwhile, this has implications for investment bank profits next quarter and beyond if the drought continues.

Market downturn sparks longest US #tech IPO drought in over 20 years – FThttps://t.co/xNM7crudtd

— Christophe Barraud (@C_Barraud) September 19, 2022

We have said it before. The dollar index has broken above the 110 level again, so this bears repeating.

— JE$US (@WallStJesus) September 19, 2022

Forecast on the SPY

We remain in a bearish island formation after the post IPC sell off. We have also broken the double bottom at $389, our pivot point. This level must be recovered in order to make any upward movement. This is the first stage before reaching the $410 island. If we fail on either, then a retest of the June lows seems likely, with support at $371 on the way.

SPY daily chart

results week

#earnings for the week https://t.co/lObOE0dOhZ $COST $AZO $FDX $ACN $GIS $ACB $DRI $LEN $APOG $KBH $FDS $SFIX $AJG $FUL $MANU $RLX $TCOM $CAMP $SCS $FLUX $IBEX $AIR $VAT $DCFC $DLNG $RSSS pic.twitter.com/ezlEgXoWcW

— Earnings Whispers (@eWhispers) September 17, 2022

Economic data

All eyes on the Fed – Wednesday.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.