This is what you need to know to trade today friday september 30:

Here we go again. Inflation remains high, while the Fed’s favorite inflation gauge is not favoured. The personal consumption expenditure index PCE shows inflation remains sticky, and it will take time to bring it under control. That means there will be more rate hikes and for longer. The Bank of England’s turnaround was a moment of anti-Lehman emergency, not a turn to celebrate risky assets.

We continue with the same theme, the Fed has to have higher rates, and you will have to keep them high for longer. If it doesn’t, it means we are on the verge of another financial crisis. In my opinion, it’s that simple. Any change will really be a concern for risk assets; but, and there is always a but, that does not rule out short-term upside opportunities.

We already see that risk assets ignore this data. We are nearing the end of the quarter, and it is always a hectic time. Risk assets and stocks are already ignoring the PCE data. Sentiment is terrible, and positioning is bearish, so a bearish rally is usually set up. Let’s see.

The dollar, however, is on the upside as some easing noises from China and the British pound move lower again and the dollar index rises to 112.53. Oil falls to $80.70 and Bitcoin to $19,200. Gold remains flat at $1,662.

European markets are mixed:

- Eurostoxx flat

- FTSE: -0.25%

- Dax: +0.7%

US futures are flat:

- S&P 500, Nasdaq and Dow Jones they are flat.

wall street news

The US PCE is higher than expected. Equities fall but quickly return to flat.

The EU inflation reaches 10%.

Apple (AAPL) it falls almost 5% on Thursday.

Nike (NKE) beat results of highs and lows, but the dollar and inventories affect the action.

Micron (MU) cut spending and prospects are lower than expected.

Meta Platforms (META) will freeze hiring.

Palantir (PLTR) gets a 59 million dollar contract with the US Army.

Pepsi (PEP) could consider cost-cutting measures, according to FOX Business.

Aterian (ATER) exceeds estimates.

Rent a Center (RCII) Cut your forecasts.

Amylyx Pharma (AMLX) rises after FDA approval.

Carnival (CCL) lose benefits.

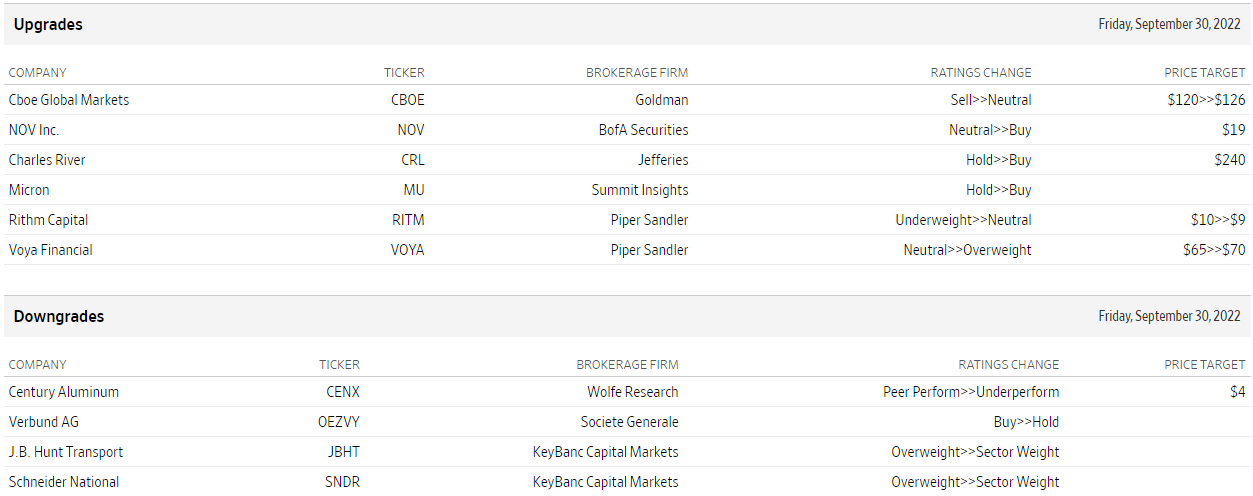

Upgrades and rebates

Source: WSJ.com

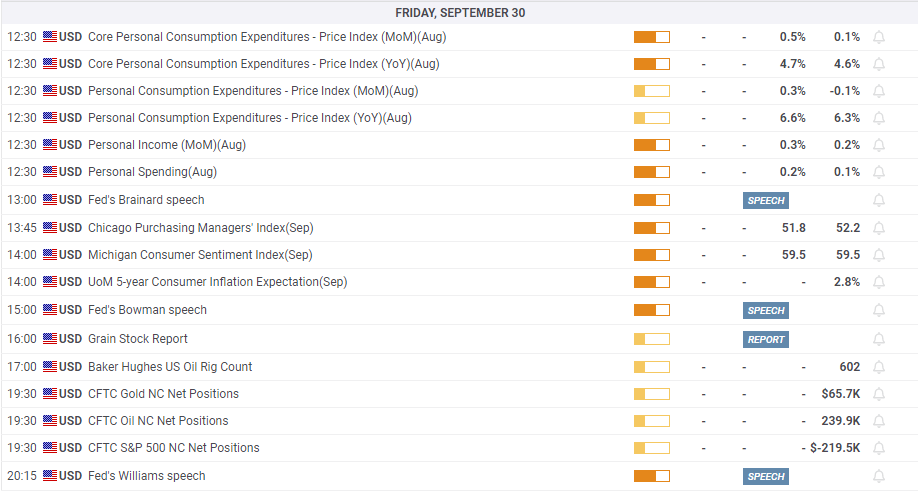

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.