This is what you need to know to trade today Thursday September 22:

Wow, things are moving around here. It’s central bank week, and so far there are hikes as far as the eye can see. First of all, the Fed raised interest rates by 75 basis points last night and surprised markets with the futures rate dot chart. The dot plot shows no cuts in 2023 and perhaps a modest increase. This rise was at least 50 basis points higher than interest rate markets had expected and caused an immediate fall in risk assets. However, once the press conference started, equities became more bullish as speeches moderated, before selling off again until the close.

The Bank of Japan then did nothing on interest rates, but did step in to stem the yen’s inexorable decline. This is likely to be only a short-term relief as no other central bank has joined the initiative. The Bank of England was delighted to raise interest rates by 50 basis points as the expected restraint in energy prices will curb inflation. The Swiss National Bank has also risen 75 basis points.

Equities are likely to move lower from here, but in the short term we may have a positioning rally as everyone was a bit bearish. Overall, things are getting tougher for equity valuations as TINA is dead and rates head for 5%. However, Bitcoin is up 3% this morning, reinforcing our short-term rebound thesis. I mean very short term, like the rest of this week. Attention will now start to turn to the third quarter results. Since the last time, the dollar has continued to rise and economic conditions have worsened, so this is likely to be a difficult season.

Oil rises to $85, and Bitcoin stands at $19,200, up 4% on the day. Gold is trading at $1,681, while the dollar index falls to 110.68.

European markets are mixed: Eurostoxx +1%, FTSE +0.6% and DAX -0.6%.

US futures rise: S&P flat, Dow +0.1% and Nasdaq flat.

Wall Street Top News (SPY) (QQQ)

The fed raise interest rates by 75 basis points and see higher rates for longer.

The Bank of Japan intervenes in the foreign exchange market to support the yen, selling dollars.

The Bank of England raise rates by 50 basis points.

The Swiss National Bank raise rates by 50 basis points.

Royal Caribbean (RCL) announces a bond offer.

Target (TGT) will hire 100,000 workers for the holiday season, the same as in 2021.

results of Costco (COST) after closing.

income from Darden Restaurants (DRI) they fail, but they reaffirm their forecasts.

American Tower (AMT) increases the dividend to $1.47 per share.

Ideanomics (IDEX) Submit a secondary offer.

LiAuto (LI) will host an early launch event for the L8 premium car on September 30.

Tilray (TLRY) obtains Italian approval for the distribution of THC25.

Accenture (ACN): Earnings per share is better, earnings are in line.

Honda Motors to cut car production by 40% at two Japanese plants in October due to supply chain problems-Reuters.

Toyota plans to produce 100,000 fewer vehicles in October due to shortage of semiconductor chips-Reuters.

Salesforce (CRM) announces plans to operate more efficiently.

Eli Lilly (LLY): The FDA approves Retevmo for new uses.

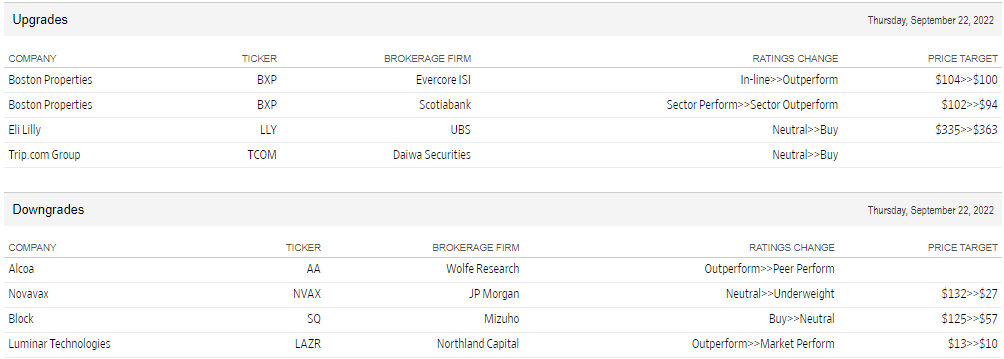

Upward and downward revisions

Source: WSJ.com

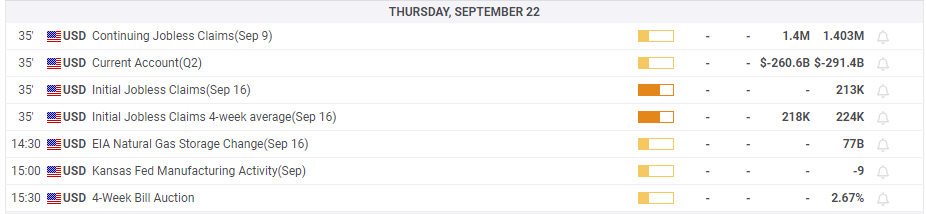

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.