This is what you need to know to trade today Wednesday November 30:

The last day of the month usually sees some movements against the grain, but more so when it comes to the end of the quarter. However, this month the dollar is down and equities are up, so keep that in mind as we get closer to closing. All eyes will be on Powell, as not much is happening previously. China continues to reopen, but the expected follow-up from yesterday has not materialized. Equities are practically flat, with the exception of the technology sector, which falls, and the energy sector, which rises. Today we already have contradictory data in the United States. ADP reports weak job growth while US GDP is strong. Actually, we’ll have to wait for Powell. I hope he’s aggressive.

The dollar index is down to 106.50, while gold rises to $1,757 on falling yields. Oil continues to recover to $81, and Bitcoin has risen to $16,800.

European markets rise:

- Eurostoxx: +0.35

- FTSE: +0.7%

- Dax: +0.1%

US futures are slightly positive.

Wall Street News

The US GDP it is better than expected.

The figures of use of ADP in the US they were worse than expected.

Powell will speak at 18:30 GMT.

Hormel (HRL) down by results. Sales did not meet forecasts.

Petco (WOOF) goes up thanks to positive results.

Crowdstrike (CRWD) down due to forecasts for the fourth quarter.

NetApp (NTAP) down due to weak forecasts.

Workday (WDAY) rises due to good prospects and the repurchase of shares.

Top Reuters headlines

Royal Bank of Canada (RBC): Canada’s largest lender posted a modest drop in fourth-quarter profit as higher loan-default provisions and slower underwriting activity dwarfed gains from rising interest rates.

Brookfield Asset Management: The Canadian asset manager will buy a 49% stake in Sweden’s SBB’s education portfolio for SEK 9.2 billion in cash.

Foot Locker Inc (FL): The shoe retailer said Tuesday that chief financial officer Andrew Page will step down to pursue other opportunities after the company’s fourth-quarter 2022 earnings.

Horizon (HZNP)with a market capitalization of about $18 billion, is in talks with Amgen, Sanofi and the Johnson & Johnson unit Janssen Global Services.

Boeing (BA): A leading US lawmaker is proposing to extend the certification deadline for two new versions of Boeing’s 737 MAX.

Coterra Energy (CTRA): The US shale producer has pleaded not guilty to contaminating water from wells in Dimock, Pennsylvania, and will pay $16.29 million to build a new means of supplying water to its residents, the state’s attorney general said Tuesday.

Walt Disney Co (DIS) It said it anticipates organizational and operational changes at the company that could result in impairment charges, according to a regulatory filing.

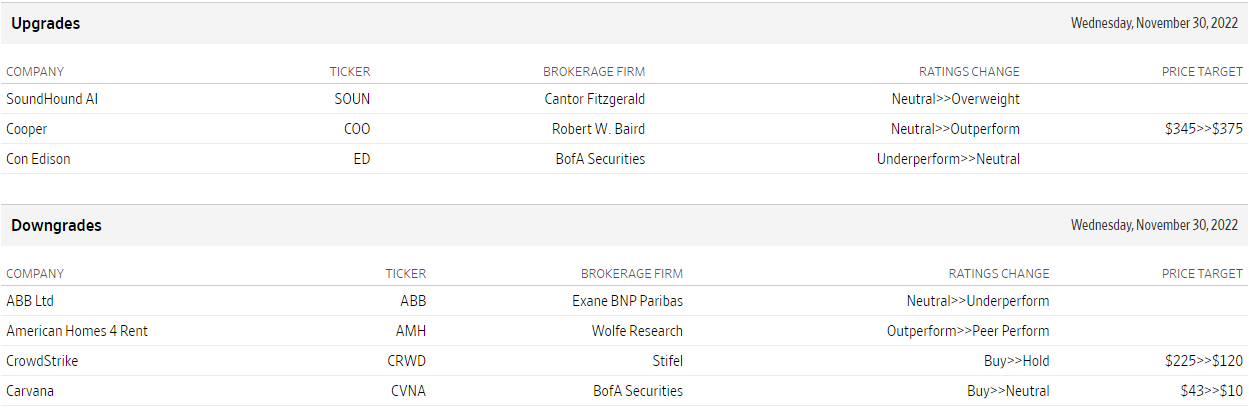

upgrades and downgrades

Source: WSJ.com

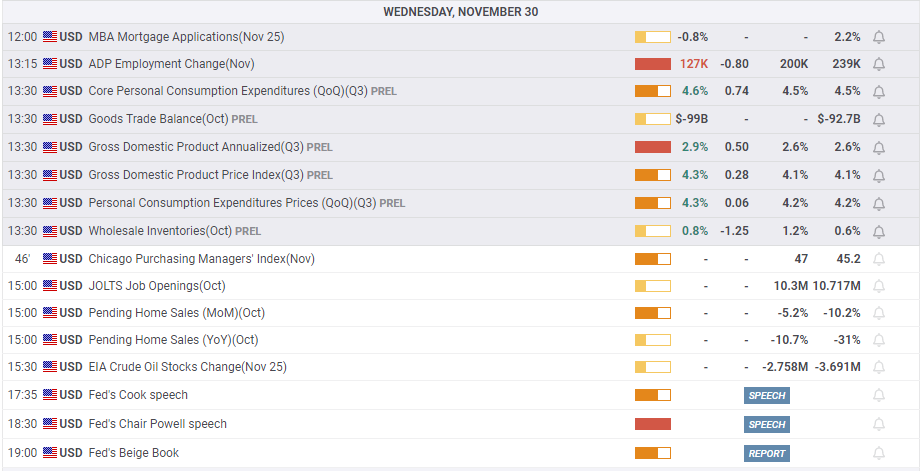

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.