This is what you need to know to trade today Monday October 17:

This morning, the UK has taken a new turn, as the new chancellor has backed down on almost all of the tax cut plans announced by his predecessor. So far, the British pound has taken the news well, with GBP/USD up 1% on the day. Naturally, this will be transmitted to the equity market, since we are all protagonists of the decline in the dollar and the rise in risk these days. The latest omens in Europe are good, as most markets have risen strongly.

However, earnings season gets underway this week with Bank of America (BAC) and Bank of New York Mellon (BK), both with strong rises in the market. The eyes will focus precisely on Tesla (TSLA) At the end of the week. Has the bad news been shaken with the weak delivery numbers at the beginning of the month?

There seems to be a bit of risk appetite this morning, with gold, oil and equities higher, while returns of bonuses are lower. The Prayed it is at $1,665. The Petroleum is at $86, and the Bitcoin it also goes up to $19,500. For his part, the dollar index it is back at 112.75.

European markets rise:

- Eurostoxx: +2%

- FTSE: +1.3%

- Dax: +1.2%

US futures also higher:

- S&P 500: +1.2%

- Nasdaq: +1.6%

- Dow-Jones: +1.3%

Wall Street News (SPY) (QQQ)

The UK Foreign Minister, Jeremy Huntnullifies almost all previously announced tax cut plans.

Bank of America (BAC) exceeds expected results, stocks rise ahead of market open.

Bank of New York Mellon (BK) exceeds expected results, shares rise.

Continental Resources (CLR) it goes up because Chairman Hamm and his family are going to buy the outstanding shares.

Goldman Sachs (GS) plans the restructuring of the investment banking and trading units.

Splunk (SPLK) rises after the WSJ news about the involvement of an activist investor.

Archea Energy (LFG) agrees to be acquired by BP for $26/share. Shares rise more than 50% in pre-market.

Credit Suisse (CS) rises after information from the FT that it plans to sell parts of the Swiss bank.

Job offers from Tesla (TSLA) suggest that hiring is accelerating.

Alphabet (GOOGL): 40 companies are urging EU antitrust regulators to allow more competition on the search page to comply with the 2017 EU order.

Apple (AAPL) it is putting on hold its plans to use chips from Yangtze Memro Technologies.

Honeywell (HON) raises prospects for commercial aircraft deliveries.

Modern (MRNA) agrees to provide its new adapted vaccine to the GAVI Alliance so that the poorest have access to the coronavirus vaccine.

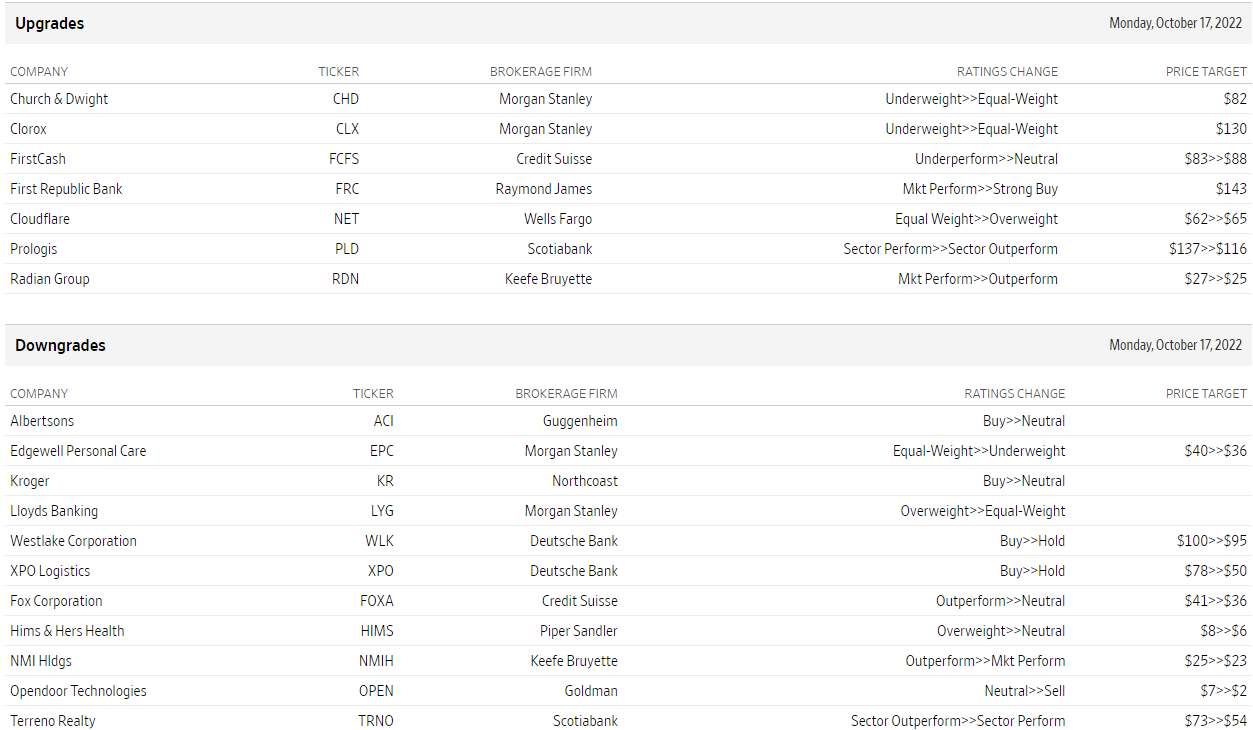

Upgrades and rebates

Source: WSJ.com

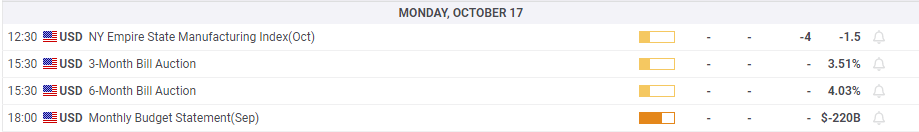

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.