This is what you need to know to trade today monday november 14:

Welcome to a new week waiting to see if this one is as dramatic as the previous one. So far all is calm in the financial markets as a sense of serenity reigns. Last week was a great episode of short hedging that started with the US CPI coming in lower than expected. Not even the crypto debacle was able to curb the bulls as there was a small rally on Friday after Thursday’s rally.

On Monday, the economic picture is a bit calmer. At the end of the week, retailers will present their results to complete the season. Until now, results have been slightly better than feared in all sectors except technology. This makes the latest rally look challenging, given the weight of big tech companies in the major indices. However, seasonality is on our side and some unknowns are now known. Midterm elections are out of the question, Russia is talking more dovish, and China is still talking about at least reopening despite rising coronavirus cases.

The dollar strengthens, with the dollar index rising to 106.88. The Prayedmeanwhile, falls to $1,761, while the Petroleum stands at $88.11, with a small loss. The Bitcoin recovers to $17,100.

European markets are mixed:

- Eurostoxx: -0.2%

- FTSE: +0.3%

- Dax: +0.5%

US futures lower:

- S&P 500: -0.3%

- Nasdaq: -0.5%

- Dow-Jones: -0.2%

wall street news

The eurozone industrial production it is better than expected.

The president of ukraine he says he is ready for peace.

Reuters top headlines:

Tesla (TSLA): Elon Musk’s trial opens to decide the fate of his $56 billion Tesla paycheck.

United Rentals Inc (URI): The company is to acquire the assets of its smaller rival Ahern Rentals for about $2 billion.

Alibaba Group Holding Ltd (BABA): “The e-commerce platform has opted not to disclose the final sales tally for its annual Singles Day shopping spree for the first time since the event began in 2009.”

Amazon.com Inc (AMZN): “Germany’s antitrust watchdog said it had expanded two investigations into the US e-commerce giant by making use of new regulation that allows it to ban any anti-competitive behavior at an earlier stage.”

BioNTech SE (BNTX) and Pfizer Inc: “The German biotech company that developed a widely used COVID-19 vaccine with Pfizer has acquired a manufacturing facility in Singapore, its first in Asia, the company said.”

Meta Platforms Inc (META): “The owner of Facebook told her employees on Friday that she would stop developing smart displays and smartwatches and that nearly half of the 11,000 jobs she cut this week in an unprecedented cost-cutting move were technology functions.”

Walt Disney Co. (DIS): “The company is planning to freeze hiring and cut some jobs as it works to bring the Disney+ streaming service to profitability amid economic uncertainty, according to a memo seen by Reuters on Friday.”

CNBC headlines:

Oatly (OTLY): The oat-based beverage maker saw shares plunge 11.8% in premarket after it reported a larger-than-expected quarterly loss.

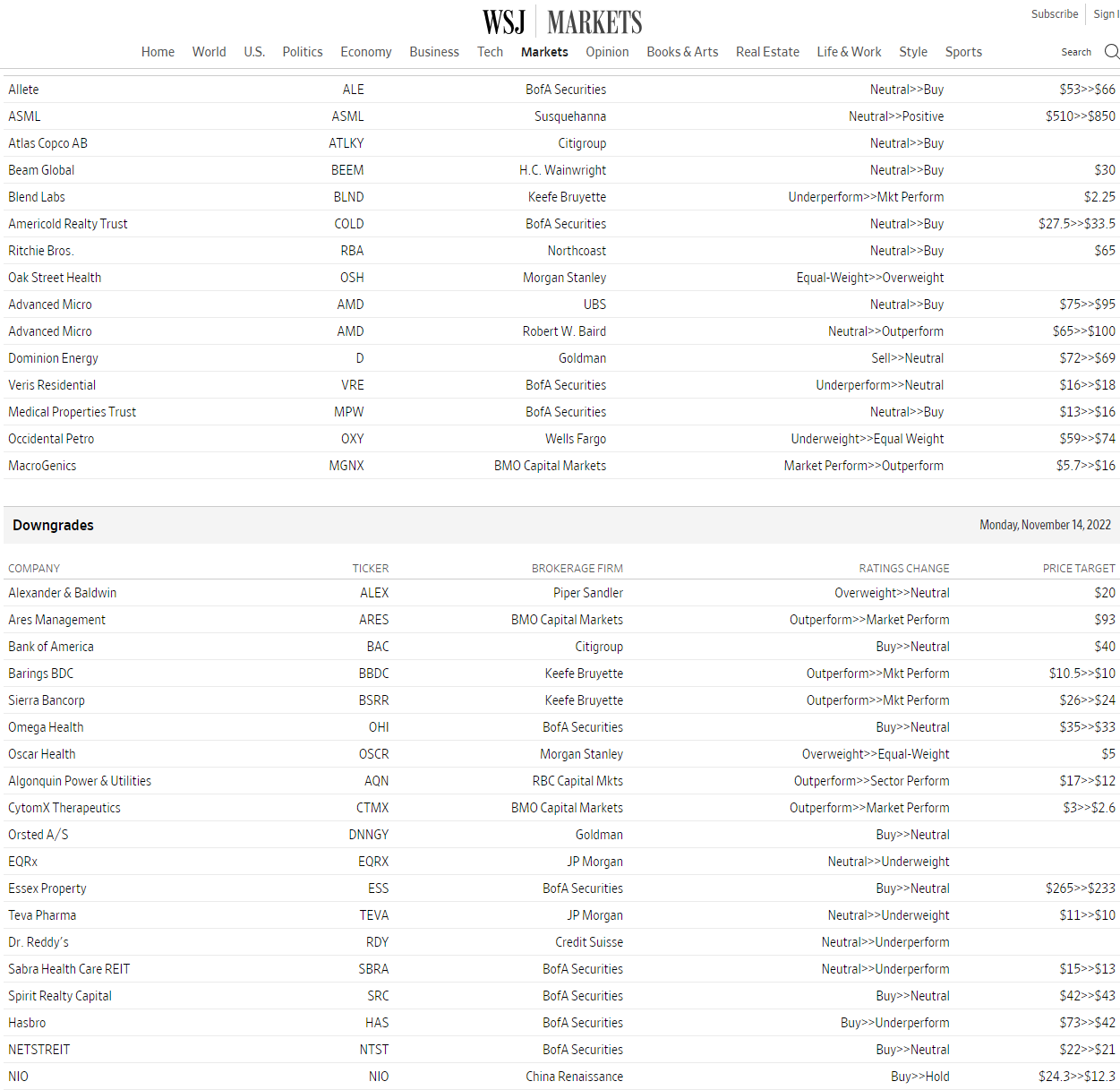

Advanced Micro Devices (AMD): “Shares of the chipmaker rose 3.2% in pre-market after receiving upgrades from both Baird and UBS.”

Hasbro (HAS): “Shares of the toymaker fell 5.2% in pre-market after a double downgrade from ‘buy’ to ‘insufficient’ at Bank of America.”

Tyson Foods (TSN): “The beef and poultry producer posted quarterly earnings of $1.63 per share, which is 10 cents per share from consensus estimates.”

Upgrades and rebates

WSJ.com

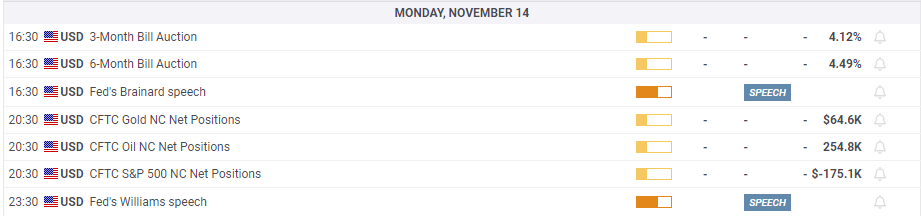

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.