This is what you need to know to trade today Monday January 30:

The markets are pretty quiet this morning, while we have a lot to do this week. Overnight Asian stocks were weak as risk aversion was the main theme. The Hang Seng closed down close to 3%, while the Nikkei remained flat. It is not surprising, since we have the decisions of the Fed, the ECB and the BoE on interest rates, as well as the results of Apple (AAPL), Amazon (AMZN), Ford (F), McDonald’s (MCD) and Caterpillar (CAT), to name a few. only some. So, a huge week awaits us.

The Deitherlar benefited from risk aversion sentiment, but strong Spanish inflation data boosted the Euro. The DXY Dollar Index is holding steady at 101.90. The Petroleum dropped to $79.54 and the Prayed it held steady at $1,925.

European markets fall: with the FTSE gaining +0.12%, but with the DAXthe ACC and the eurostoxx falling -0.6%.

US futures move lower: with the S&P 500 -1%, the NASDAQ -1.3% and the Dow Jones -0.7%.

Featured Wall Street News

The Spanish inflation exceeds forecasts.

The German GDP below forecasts.

Reuters Top News

Koninklijke Philips NV PHG: The Dutch healthcare technology company cuts another 6,000 jobs worldwide.

Xpeng Inc XPEV: The Chinese company announces the appointment of Wang Fengying, former vice president of Great Wall Motor, as president of the new electric vehicle company.

Baidu Inc BIDU: The Chinese internet search company plans to launch an artificial intelligence (AI) chatbot service similar to OpenAI’s ChatGPT in March, a person familiar with the matter told Reuters.

Chevron Corp CVX: The White House launched a new attack on U.S. oil companies on Friday, accusing them of using profits to pay shareholders instead of boosting supply, after Chevron said its annual profit had doubled by 2022.

Rio Tinto Plc RIO: The company has apologized for the loss of a small radioactive capsule that has triggered a radiation alert in parts of the vast state of Western Australia.

Shell Plc SHEL: The oil company will combine its oil and gas and liquefied natural gas (LNG) production divisions as part of broader changes under new chief executive Wael Sawan, which the company said could result in some job cuts.

Toyota Motor CorpTM: The Japanese automaker sold 10.5 million vehicles in 2022, defending its title as the world’s best-selling automaker for the third consecutive year.

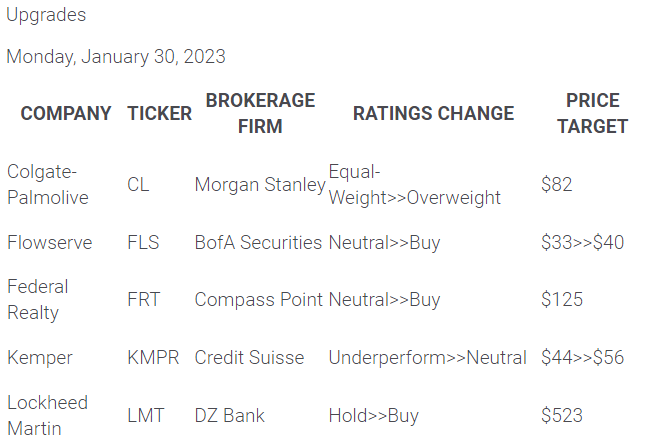

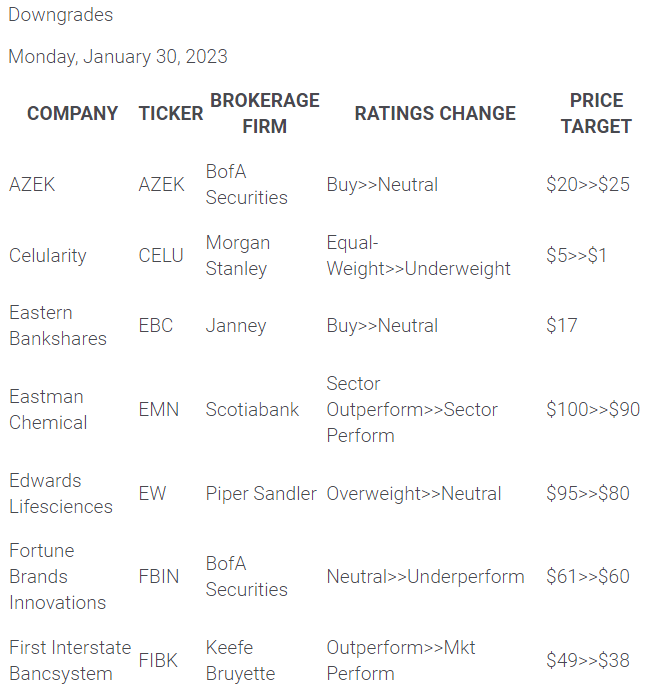

upgrades and downgrades

Source: WSJ.com

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.