This is what you need to know to trade today Thursday September 29:

Up, down, repeat. Wednesday’s optimism was quickly reversed on Thursday as investors realized that the next turn will be for very bad news. It’s a turnaround that will only happen if the economy is a total mess or if we’re close to another Lehman moment. The Bank of England averted a Lehman moment in its pension sector and rushed to bail out Gilt positions. If the Federal Reserve changes, it will be for a similar, almost disastrous reason. That doesn’t sound so good to me for risk assets, even though they pivoted on Wednesday. On Thursday, reality resumes and risk assets slide back down while the dollar rises again.

There is talk of intervention again with news that China has told local banks to be prepared. These are really interesting times: first the Bank of Japan, then the Bank of England, and now China. Who will be next? Thursday’s data is not exactly comforting. The final readings are nothing more than revisions to previous data, but the general theme is that the labor market is strong, US inflation is sticky. However, the latter is high in the services sector, not in the goods sector. Services inflation usually lasts much longer.

Dollar rises back to 113. Oil also holds at $82.60 as Nordstream talks keep energy higher, and gold dips to $1,655. Bitcoin drops to $19,300.

European markets down:

- Eurostoxx: -1.7%

- FTSE: -1.7%

- Dax: -1.8%

US futures also down:

- S&P 500: -1.1%

- DowJones: -1.2%

- Nasdaq: -1.5%

Wall Street News (SPY) (QQQ)

The members of the ECB They talk about more rate hikes.

Spain seeks to blame Russia for the pipeline Nordstream.

Chinese electric vehicle shares are under pressure after a cut in the delivery of LiAuto (LI).

Platoon (PTON) for sale at Dick’s Sporting Goods (DKS).

Rivian (RIVN): Truist sees an 85% upside for Rivian.

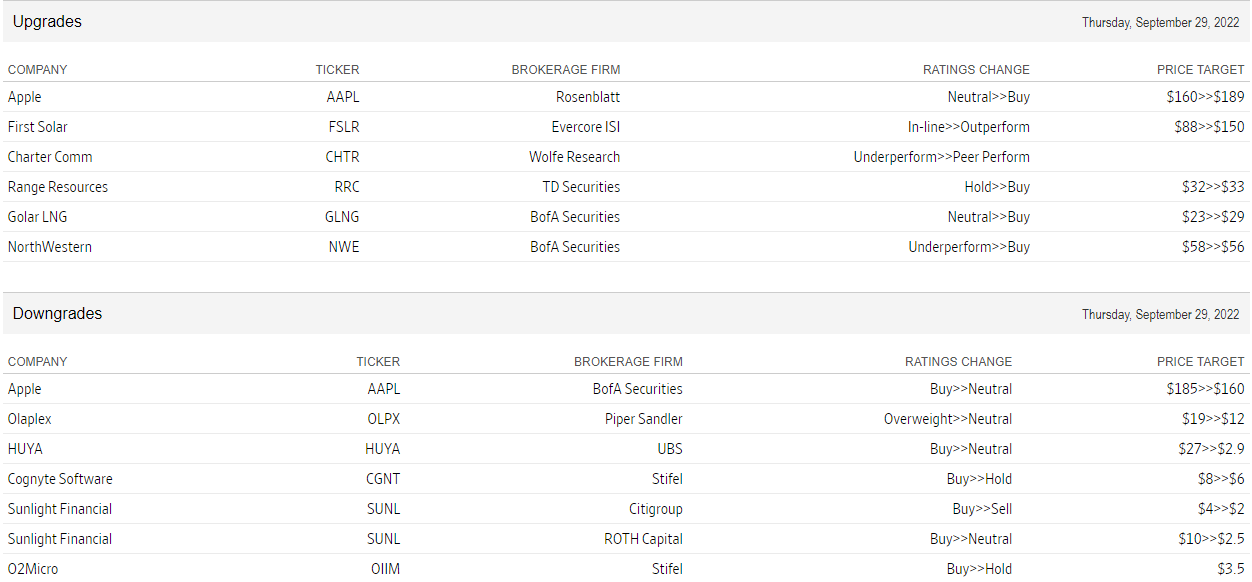

the valuation Apple (AAPL) it was downgraded by Bank of America, but upgraded by Rosenblatt.

CarMax (KMX) falls hard by not making a profit.

Bed Bath & Beyond (BBBY) also fails.

Occidental Petroleum (OXY): Berkshire buys the fall.

Vail Resorts (VAIL) sees strong demand for skiing helping revenue.

Rite Aid (RAD) lower due to the cut in perspectives after the results.

Ups and downs

Source: WSJ.com

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.