This is what you need to know to trade today friday october 21:

Equity markets remain nervous, as earnings season is overshadowed by the ever-growing specter of rate hikes. This has made technology and growth stocks continue to sufferand the earnings of Snap (SNAP) posted overnight will not have helped. Prospects for ad spending look dim and Meta Platforms (META) and Alphabet (GOOGL), among others, are being dragged down. It appears consumers are still spending on travel and food but have not yet turned to lower-priced alternatives, but businesses are increasingly bracing for a slowdown and making cutbacks. Bond yields, however, continue to react to tougher rhetoric from Fed members, and equities may be relieved that today is the last chance to speak before the “quiet period.” ” Of the next week.

The dollar has broken above 150 against the yen with no signs of intervention. The dollar index is up more than 0.5% to 113.50, and Bitcoin is down to $18,900. Gold has dipped slightly to $1,623, while oil is holding steady at $84.30.

European markets down:

- Eurostoxx: -0.6%

- FTSE: -0.4%

- Dax: -1.1%

US futures lower:

- S&P 500: -0.4%

- Dow-Jones: -0.4%

- Nasdaq: -0.7%

Wall Street News (SPY) (QQQ)

American Express (AXP) beat in EPS and revenue.

Verizon (VZ) beat in EPS and revenue.

Twitter (TWTR) lower in the pre-market after a Bloomberg news about the possibility that the Biden administration will review Musk’s companies.

SNAP drops 25% after your winnings.

META and GOOGL they’re also down due to the digital ad revenue concerns mentioned above.

Pfizer (PFE) it hopes to quadruple the price of the coronavirus vaccine once the deal with the US government ends.

Twitter (TWTR) said he has no plans to lay off staff after a Washington Post article said Musk was considering layoffs.

Apple (AAPL): Foxconn says production remains normal at the iPhone plant in China despite Covid restrictions.

Revlon (REV): Trading in its shares is suspended by the New York Stock Exchange.

Autoliv (ALV) rises despite the negative results.

Regions Financial (RF) lose high and low profits.

Simply Good Foods (SMPL) thanks to its good results.

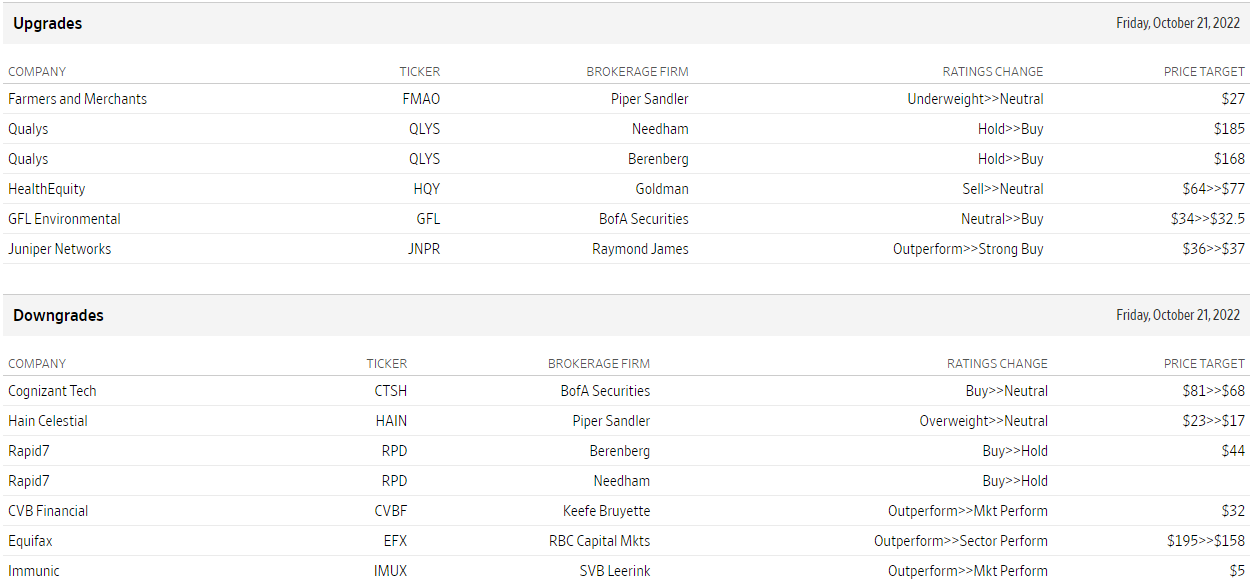

Upgrades and rebates

Source: WSJ.com

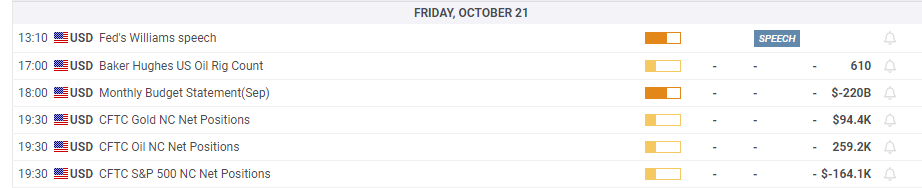

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.