This is what you need to know to trade today Tuesday January 24:

The NASDAQ rose again by more than 2% and the other leading indices closed higher. Credit is being given to a Wall Street Journal article pointing to a 25 basis point hike by the Federal Reserve at its next meeting, but in reality markets have already priced the 25 basis point hike as a certainty for some time now. some time. No, it’s all about enthusiasm and money on the side that wants to get in on the action. Hopes are high for earnings season, and Microsoft (MSFT) will kick-start the tech sector this afternoon. However, CTA money remains on the sidelines, and a break of 4,100 for the S&P 500 could kick-start this rally.

The dollar is still under pressure, but this morning it recovers and reaches 102.00 on the DXY dollar index. Oil rises to $82 and gold to $1,941. The most impressive thing about yesterday’s rise was that it came at the same time that bond yields were rising, which is unusual.

European markets down:

- The CAC, the DAX, the FTSE and the Eurostoxx fell -0.3%.

US futures are also down:

- Dow Jones and S&P 500 fall -0.2%

- The NASDAQ loses -0.4%.

Featured Wall Street News

The German manufacturing PMI it is worse than expected.

The UK PMI it is weaker than expected.

General Electric (GE) bat in EPS, revenue fails.

Microsoft (MSFT) publishes results after closing.

Verizon (VZ) Lower forecasts for 2023.

Tesla (TSLA) plans to build a semi-trailer plant in Nevada.

Johnson & Johnson (JNJ) improves its forecasts for 2023.

3M (MMM) will cut 2,500 jobs.

Lockheed Martin (LMT) exceeds revenue and earnings per share.

Eli Lilly (LLY) will invest 450 million dollars to expand the production of drugs against diabetes.

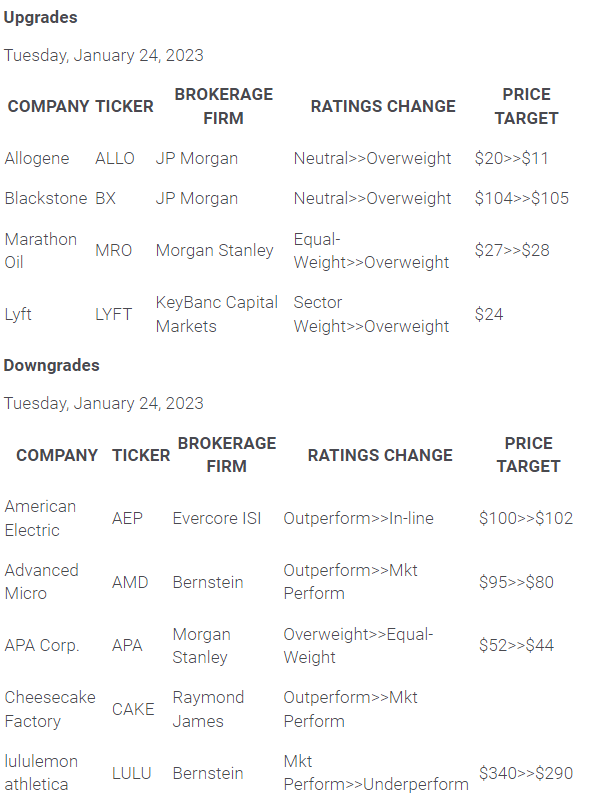

upgrades and downgrades

Source: WSJ.com

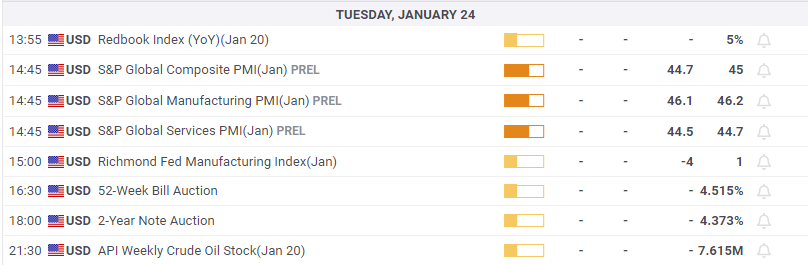

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.