This is what you need to know to trade today tuesday november 22:

Equity markets continue to fall as news flow is thin in a holiday-shortened week. At least The Wall Street Journal provided some volatility, as a report it published made oil plummets 5% before Saudi Arabia denied any increase planned by OPEC. This sent oil stocks lower on Monday, but they are up today in Europe and should follow suit in the US as the price of oil stabilizes. Last night’s results were mixed, as retailers again performed well, but disappointing forecasts for Dell Technologies (DELL) They created another cloud. The highlight this week will be the FOMC minutes, and given how aggressive Powell was at the press conference, it seems like a good bet that those minutes will go hawkish.

The dollar index DXY has dropped this morning to 107.43, while the Bitcoin it continues to suffer and is now at $15,700. The Petroleum rises back to $81, and the Prayed rises due to the fall of the dollar to $1,747.

European markets:

- Eurostoxx: -0.35%

- FTSE: +0.2%

- Dax: flat

US futures:

- Nasdaq: flat

- Dow Jones: flat

- S&P 500: flat

Wall Street News

Holzman of the ECB supports a 75 basis point rise.

Dell Technologies (DELL) exceeds expectations, but forecasts are weak.

Best Buy (BBY) exceed the results.

Dollar Tree (DLTR) publishes its results before the opening.

GameStop (GME): Carl Icahn is rumored to be on bass.

Rumors circulate that Tesla (TSLA) will lower the price in China.

Burlington Stores (BURL) exceed your results.

Reuters News

The UK launches an investigation into the domain of mobile browsers from Apple (AAPL) and Google (GOOGL).

The China Baidu (BIDU) beat third-quarter revenue estimates thanks to recovery in ad sales.

Medtronic (MDT): The company lowers its earnings outlook for the full year due to the strength of the dollar.

Zoom Video Communications (ZM) lowered its annual revenue forecast.

Kroger Co (KR): The International Brotherhood of Teamsters union said Monday that a new national contract at the US supermarket chain has been ratified with overwhelming support.

Novavax (NVAX): The drugmaker said on Monday it had given written notice to GAVI, the Vaccine Alliance, ending with immediate effect an agreement for the sale of the company’s COVID-19 vaccine to low- and middle-income countries.

Walt Disney Co (DIS): A day after his return to the company, CEO Bob Iger moved to undo a corporate structure set up by his handpicked successor.

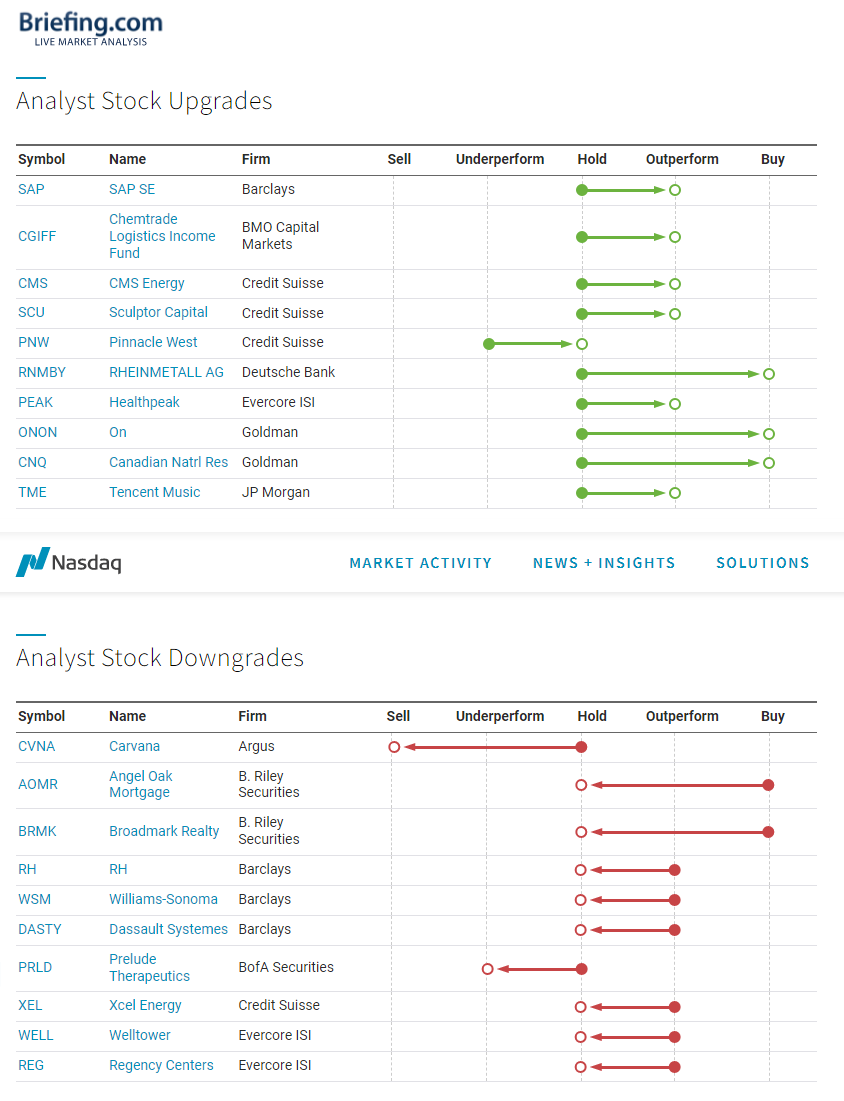

upgrades and downgrades

Source: Nasdaq.com

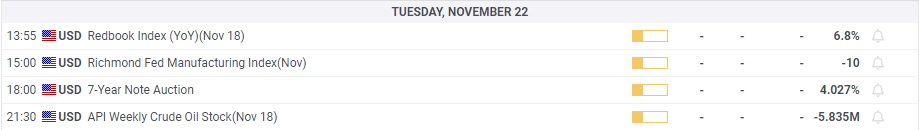

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.