This is what you need to know to trade today, Thursday, November 17:

The main event today is not the US data, but the UK mini-budget and Bullard’s comments from the Fed. The UK is in a tough spot, as they would say there. The economy is in trouble and the government needs to cut spending. It doesn’t look good. The British pound weakened, and that momentum was added when St. Louis Fed President James Bullard took the pulpit. He surprisingly spoke of rates between 5% and 7%, which spooked risky assets. Retail earnings remained mixed, with Kohls restating its forecasts and Macy’s outperforming. In general, the recovery, as we have been commenting on, is long and the risks are to the downside.

The dollar has strengthened on Bullard’s comments, rising to 107 on the Dollar Index. The Prayed drops to $1,760, while the Petroleum (WTI) also drops to $83.96 as covid cases in China continue to rise. Bitcoin drops to $16,400.

markets europeans to the downside: Eurostoxx -0.8%, FTSE -0.3%, and Dax -0.4%.

markets Americans to the downside: Nasdaq -1.3%, S&P -1.2% and Dow -1%.

Top Wall Street News

The UK budget is as expected, but the OBR anticipates a reality check.

Fed member James Bullard has talked very aggressively, so yields go up, the dollar goes up, and stocks go down.

Republicans have won a majority in the US House of Representatives.

Elon Musk says he will find a new leader for Twitter.

The quarterly income of alibaba ) fail to meet expectations due to the slowdown in spending.

The China NetEase (NTES) falls after ending a 14-year deal with Activision Blizzard.

Cisco Systems (CSCO): The company raised its full-year revenue and profit forecast amid easing bottlenecks in the supply chain.

Nvidia (NVDA): The computer and chip design company beat expectations for third-quarter earnings on Wednesday.

Sonos (SONO): The company, facing weak demand for its high-end loudspeakers, is relying on reduced supply chain bottlenecks and a series of infrequent promotions to boost sales in the holiday quarter.

Diamondback Energy (FANG): The oil and gas producer said on Wednesday that it has agreed to purchase all of Lario Permian’s leasing interests and related assets.

Starbucks (SBUX): Workers at more than 100 Starbucks locations, owned by the US company, plan to strike for one day.

Tesla (TSLA): James Murdoch, a Tesla official, testified in court on Wednesday that CEO Elon Musk has identified someone in recent months as a possible successor to lead the electric car maker.

Macy’s (M) exceed your earnings.

Kohls (KSS) Reposition your guidelines while you search for a new CEO.

BJ Wholesale (BJ) goes up thanks to his good earnings.

Bath & Body Works (BBWI) rises strongly after raising its forecasts.

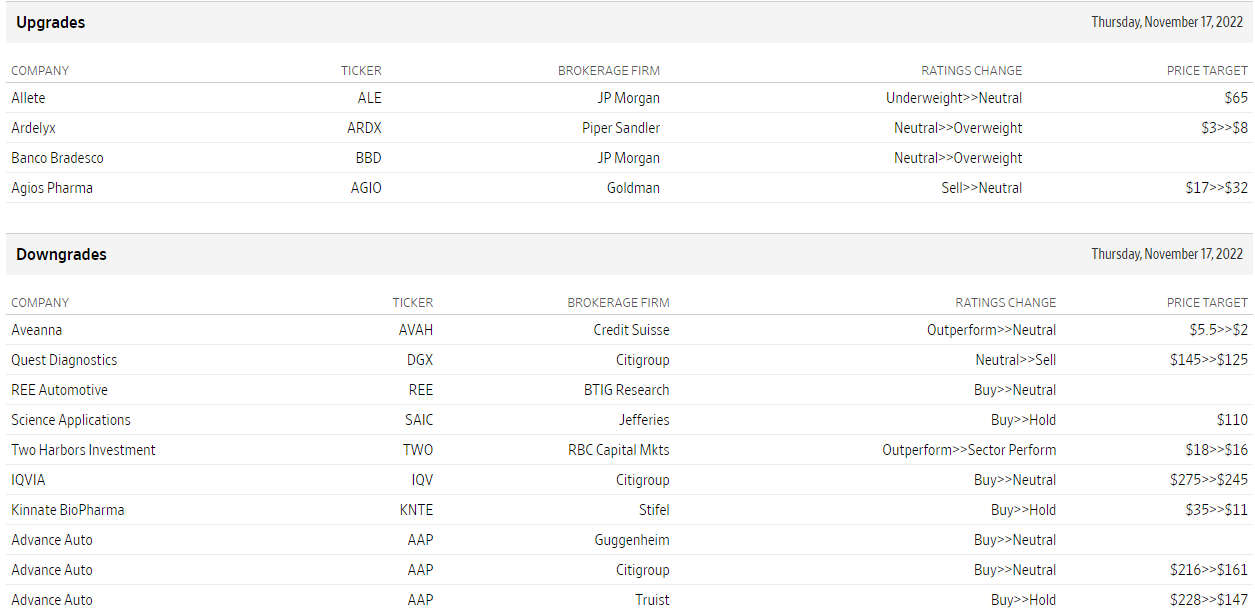

Ups and downs

Source: WSJ.com

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.