This is what you need to know to trade today Thursday October 20:

Tesla missed revenue expectations according to yesterday’s publication after the market closed, which has disappointed investors and while TSLA shares are down nearly 6% this morning. Otherwise, the earnings season seems to confirm the strong resistance shown so far by consumers in the face of rising inflation. All consumer companies look promising. The airlines are experiencing strong demandwe already discussed last week about Pepsi Y Domino’sand now IBM Y AT&T optimism has increased. The fly in the ear is, of course, the rate hike as yields top 4% and the CME Fed watch predicts a 5% Fed terminal interest rate by the end of next year. This is causing headaches at higher valuations. The Biden administration seems to have put a support under oil, as it says it will reset the SPR to $70. Oil has done what could be expected and has risen. The bulls now have the “Biden put” in terms of oil.

The Petroleum rises again to $86, while the dollar advances above 150.00 against the and in. The dollar index has dropped slightly to 112.45, thanks to the recovery of the euro and the pound sterling the prime minister Liz Truss has resigned from her position in the United Kingdom. The Prayed remains stable at $1,634 while the returns go up, and the Bitcoin stands at $19,200.

The Prime Minister of the United Kingdom, Liz Truss has announced her resignation. Things move fast in the UK. British Pound Strengthens, Never a Good Sign of a Leaving Prime Minister!

European markets are mixed:

- Eurostoxx: +0.2%

- FTSE: -0.1%

- Dax: it’s flat

US futures rise:

- Dow-Jones: +0.6%

- S&P 500: +0.4%

- Nasdaq: +0.3%

Wall Street News (SPY) (QQQ)

Resignation of the British Prime Minister Truss.

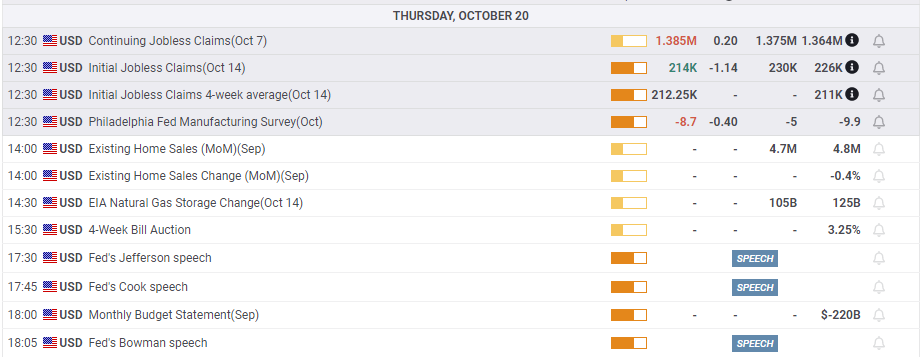

The unemployment benefit applications in the US are lower than forecasts.

AT&T (T) It exceeds maximum and minimum forecasts.

Tesla (TSLA) revenue fails, exceeds EPS.

American Airlines (AAL) It exceeds maximum and minimum forecasts.

Dow (DOW) it outperforms, but pressure on margins sends its shares down.

Las Vegas Sands (LVS) exceeds income, but losses are greater than anticipated.

Allstate (ALL) down 10% by saying it will suffer losses from Hurricane Ian.

IBM exceeds earnings and revenue forecasts.

WD-40 (WDFC) falls because it says that inflation will affect margins.

Nokia (NOK) drops 5% after improving your results.

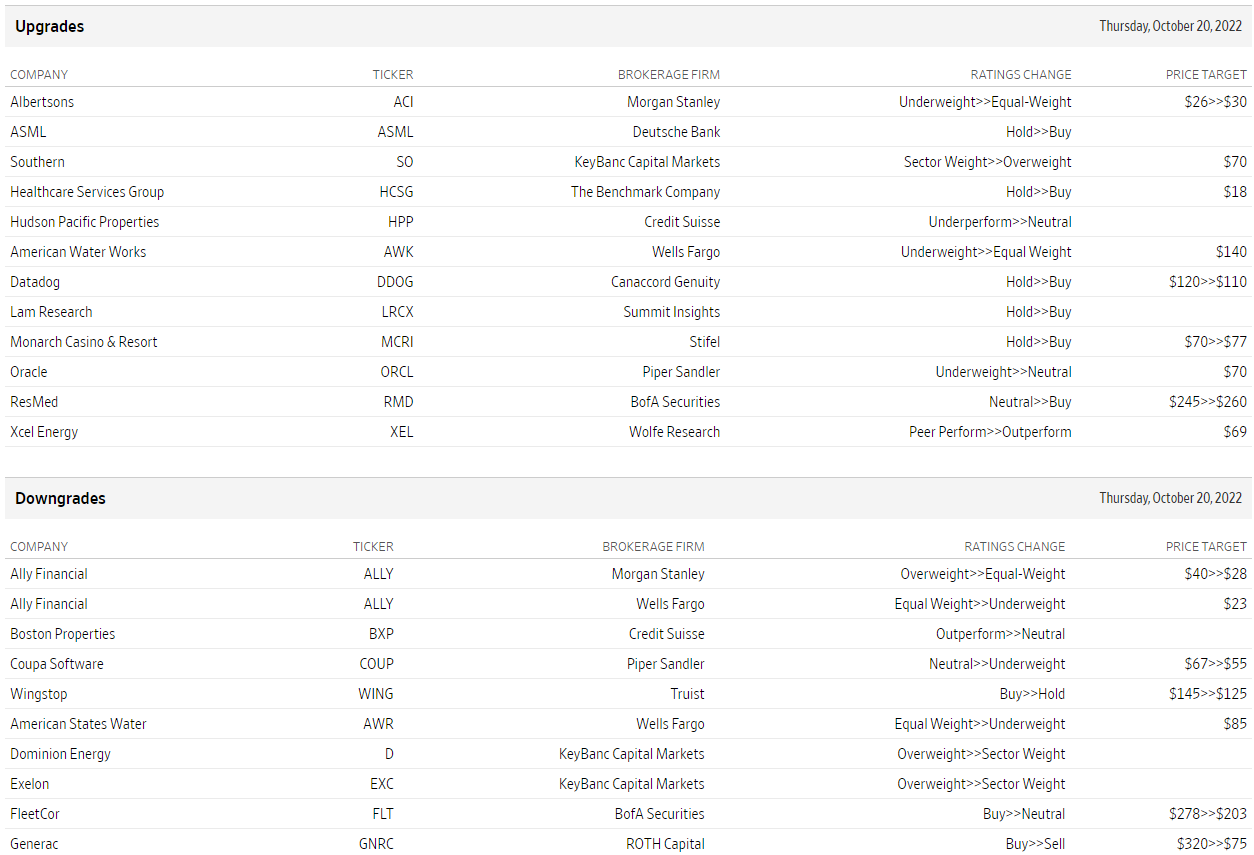

Upgrades and rebates

Source: WSJ.com

Economic data

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.